This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

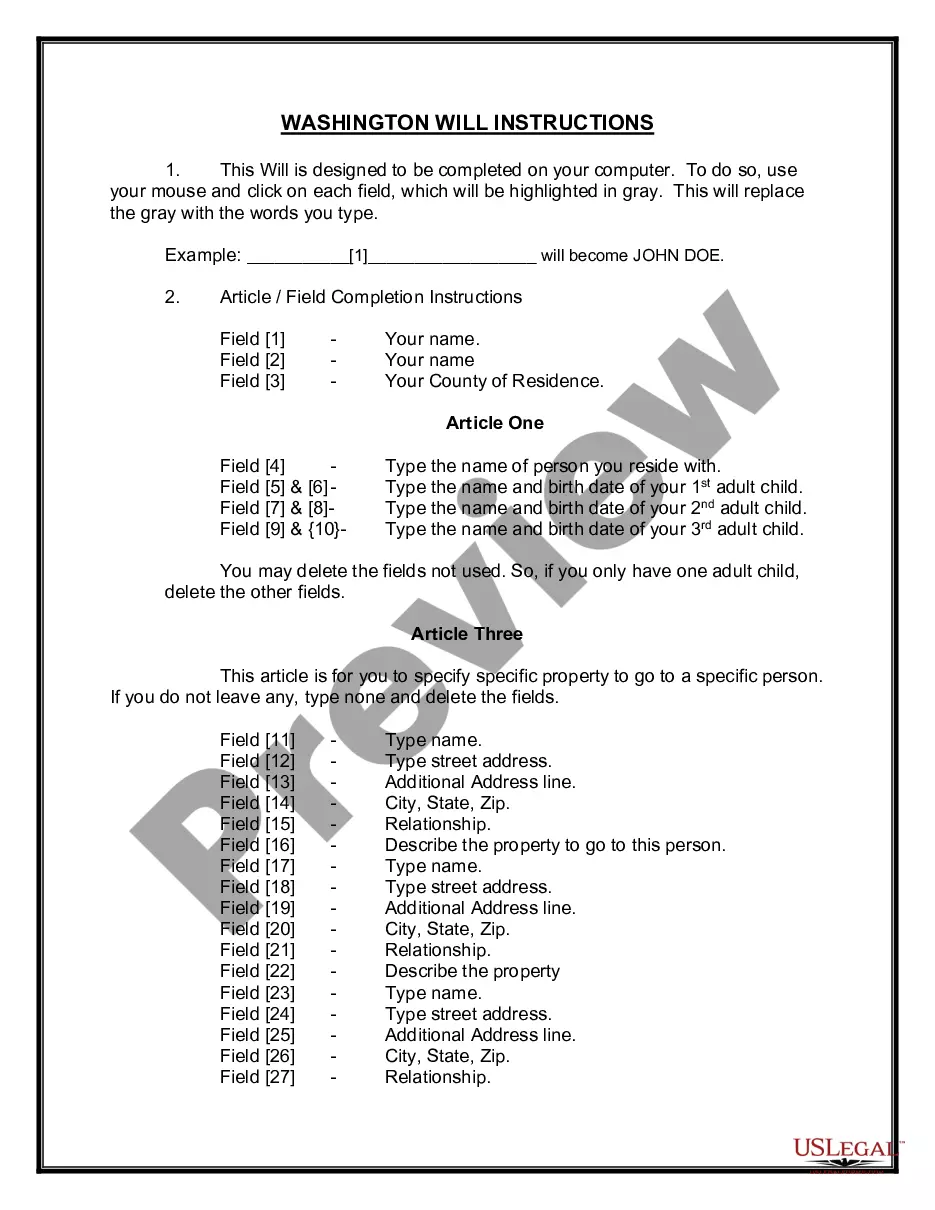

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Selecting the correct authorized document template can be a challenge.

Clearly, there are numerous web templates accessible online, but how can you acquire the authorized form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have picked the right form for your city/county. You can review the form using the Review button and check the form outline to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are certain that the form is appropriate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or Visa or Mastercard. Select the file format and download the authorized document template to your device. Complete, edit, print, and sign the acquired New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust. US Legal Forms is the largest collection of authorized forms where you can find a variety of document templates. Utilize the service to download properly crafted documents that adhere to state requirements.

- The service provides a vast selection of templates, such as the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which you can employ for both business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to locate the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

- Use your account to search through the authorized forms you have previously acquired.

- Go to the My documents section of your account and obtain another copy of the document you require.

Form popularity

FAQ

In New York, beneficiaries generally have the right to view the trust documents. This access ensures that beneficiaries understand their rights and the trust's terms, reinforcing transparency. If a beneficiary feels uncertain about their rights, they may issue a New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust to formally request access. For help with navigating these rights, uslegalforms can provide the necessary forms and support.

Yes, a beneficiary can assign their interest in a trust under New York law. However, the process requires a formal agreement, commonly known as a New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which must be communicated to the trustee. This notice ensures that the trustee is aware of the assignment and can adjust the trust's management accordingly. If you need assistance, consider using platforms like uslegalforms to obtain the necessary documents and guidance.

One significant mistake parents often make is failing to clearly communicate their intentions with the trust. Lack of clarity may lead to confusion among beneficiaries about the trust's purpose and terms. Utilizing a New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust can simplify the process and ensure that all parties understand their roles. For those looking for guidance, the US Legal Forms platform provides essential resources to help navigate trust setup and avoid common pitfalls.

Yes, a beneficiary of a trust can also serve as a trustee. This dual role can simplify management and oversight since the trustee is directly motivated by their interest in the trust's assets. However, it's essential to maintain a fair balance and avoid conflicts of interest. To understand the implications of this arrangement fully, you might explore resources on the US Legal Forms platform, which can provide key documents and guidelines.

Section 10 6.6 of the New York Estates Powers and Trusts Law outlines the process regarding a Notice to Trustee of Assignment by Beneficiary of Interest in Trust. This section ensures that trustees are properly informed when a beneficiary assigns their interest, providing clarity and preserving the rights of all parties involved. Utilizing this section can protect beneficiaries' interests and aid in the smooth administration of the trust. When navigating this law, consider relying on US Legal Forms to access templates that simplify the notice preparation process.

When writing a letter to a trustee, start with a clear subject line stating the purpose of your communication. Be concise and respectful, outlining your request or concern regarding the trust or its management. Understanding relevant regulations, such as the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust, can guide you in crafting a more effective letter.

In New York, a trustee has a duty to inform beneficiaries about the trust's administration and any significant changes. This includes providing necessary disclosures related to assets and distributions, ensuring transparency. Learning about the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help beneficiaries know what information they are entitled to receive.

Yes, a beneficiary can sue a trustee in New York if they believe the trustee is not fulfilling their duties. This may occur due to breaches of trust, including mismanagement of trust assets. If you find yourself in such a situation, understanding the implications of the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust can empower you to take appropriate action.

In New York, beneficiaries have the right to request a copy of the trust document. This access ensures that beneficiaries are informed about their rights and the terms of the trust. Knowing this can help beneficiaries understand the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust more thoroughly and their respective interests.

You should mail the NY Form IT-205 to the New York State Department of Taxation and Finance. The address varies based on whether you are submitting the form with a payment or seeking a refund. It’s crucial to check the most recent guidelines on the New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which may provide specific address details to ensure your submission is processed quickly.