Alaska Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

Are you presently in a location where you require documents for both professional and specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms offers a vast array of form templates, including the Alaska Guaranty of Payment of Open Account, which can be tailored to meet federal and state regulations.

Choose the pricing plan you desire, fill in the necessary information to create your account, and place your order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess a free account, simply Log In.

- Then, you can download the Alaska Guaranty of Payment of Open Account template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

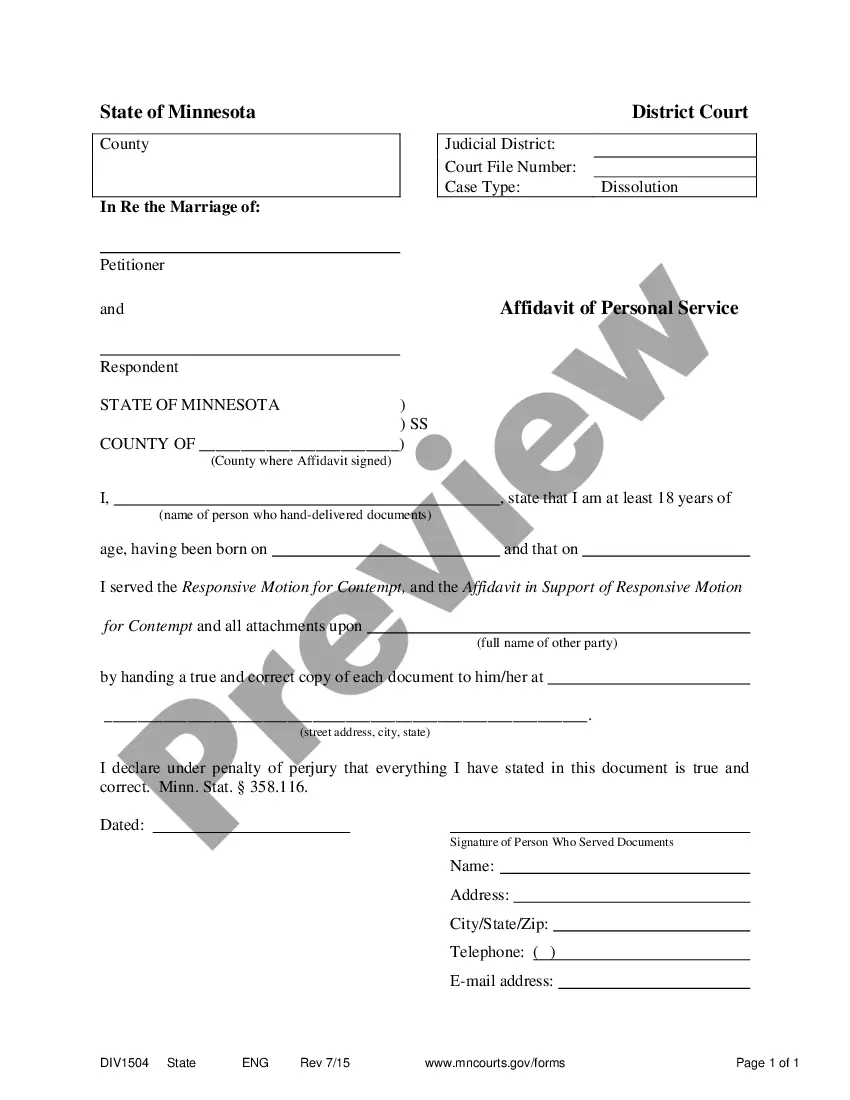

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you’re searching for, use the Search box to find the form that meets your needs.

- Once you have located the appropriate form, click on Get now.

Form popularity

FAQ

The maximum coverage for Group Term Life (GTL) insurance can vary, but typically it offers a substantial death benefit to the beneficiaries. Within the framework of the Alaska Guaranty of Payment of Open Account, it's vital to know your coverage options for GTL to ensure financial protection for your loved ones. Checking with your provider or through our platform can help clarify what limits apply in your situation.

The Life and Disability Insurance Guaranty Association serves to protect policyholders by ensuring that they receive benefits even if an insurance company becomes insolvent. This association operates under the Alaska Guaranty of Payment of Open Account, providing financial security for individuals relying on insurance for their well-being. By offering a safety net, the association helps maintain trust in the insurance system, giving you peace of mind.

The National Organization of Life and Health Insurance Guaranty Associations (NOLHGA) is a U.S. trade group made up of guaranty associationsorganizations that protect policyholders and claimants in the event of an insurance company's impairment or insolvencyin all 50 states and the District of Columbia.

What Is a State Guaranty Fund? A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

Individual and group life insurance policies as well as annuities, long-term care and disability income insurance policies are covered by life and health guaranty associations.

When an insurance company fails, a guaranty association is an entity which steps into the shoes of the failed insurer for the purpose of providing certain continued benefits and/or resolution of covered claims. However, not all types of insurance policies or claims are covered by guaranty associations.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

Insurance guaranty associations are given their powers by the state insurance commissioner. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

A guaranteed fund is a type of collective investment scheme that guarantees to pay back a pre-determined percentage of the invested capital, subject to satisfaction of certain pre-determined conditions. A guaranteed fund doesn't work exactly like a savings deposit.

Alaska Life and Health Insurance Guaranty Association The purpose of this association is to assure that a policyholder will be protected within statutory limits if a member insurer becomes financially unable to meet its obligations.