New York Sample Letter for General and Absolute Release for Settlement Offer

Description

How to fill out Sample Letter For General And Absolute Release For Settlement Offer?

Selecting the appropriate sanctioned document format can be a challenge. Obviously, there are numerous online templates accessible, but how will you acquire the authorized version you need? Utilize the US Legal Forms website.

The service offers a plethora of templates, such as the New York Sample Letter for General and Absolute Release for Settlement Offer, that you can employ for both business and personal needs. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the New York Sample Letter for General and Absolute Release for Settlement Offer. Use your account to review the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

Fill out, modify, print, and sign the received New York Sample Letter for General and Absolute Release for Settlement Offer. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted paperwork that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

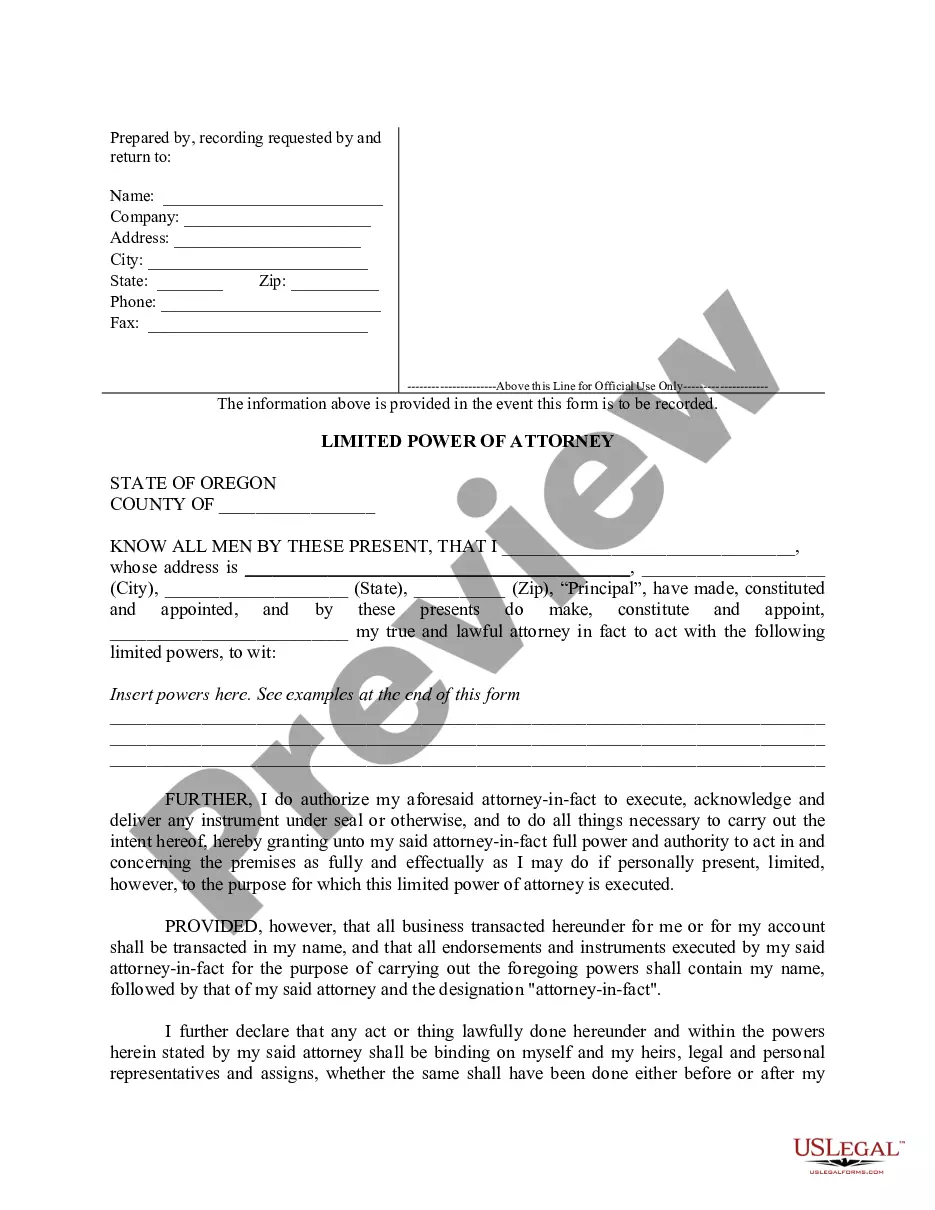

- First, ensure you have selected the correct form for your city/state. You can browse the form using the Review button and read the form details to confirm it suits your needs.

- If the form does not satisfy your requirements, use the Search box to find the appropriate form.

- Once you are certain that the form is suitable, click the Get now button to obtain the form.

- Choose the payment method you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document format to your device.

Form popularity

FAQ

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster.

Include a paragraph explaining your circumstances and details of your financial situation that you want the creditor to take into account. Enter the amount which you can afford to pay. and I want to offer this as full and final settlement of the account.

Respond in Writing why the Settlement Offer Is Too Low. Medical bills and pay stubs are two ways to show damages from your injury. However, you and your lawyer should also describe, in writing, your non-economic damages because of the injury.

If you choose to reject the low settlement offer, you must communicate your decision to the claims adjuster. Your legal representative can help you write a letter that states your intentions. Within the letter, you can indicate that you reject the offer and highlight why you deserve a higher settlement amount.

Rejecting the insurance company's first settlement offer will likely lead to negotiations. While negotiating may be a lot of work, it can pay off in the end. You can continue negotiating until a deal is reached or the insurance company refuses to continue negotiating.

Did you know that you don't have to accept a settlement offer from an insurer? If you disagree with the offer, you can decline it. However, rejecting a settlement offer isn't as simple as saying, ?Sorry, I won't accept it.? Instead, before rejecting a settlement offer, it's important to think through this decision.

In response to your letter dated [Date of Insurer's Letter], I am unable to accept your offer of $[Offer Amount] to settle my demand for compensation in Claim Number [Claim Number from Above]. The figure you offered is insufficient in light of the facts of the case.

If you choose to reject the low settlement offer, you must communicate your decision to the claims adjuster. Your legal representative can help you write a letter that states your intentions. Within the letter, you can indicate that you reject the offer and highlight why you deserve a higher settlement amount.