This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Mortgage Securing Guaranty of Performance of Lease

Description

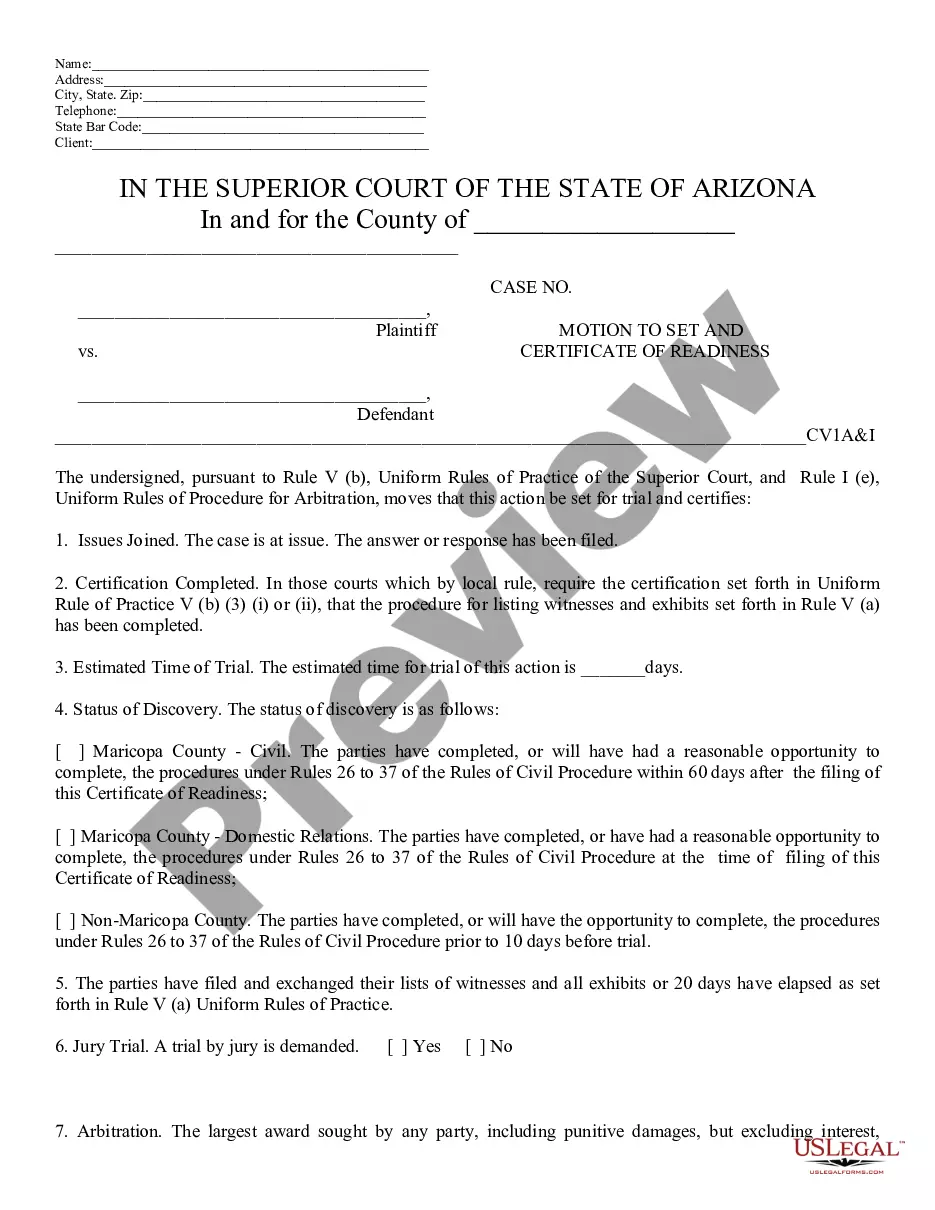

How to fill out Mortgage Securing Guaranty Of Performance Of Lease?

Are you presently inside a place that you require papers for both company or person reasons nearly every time? There are a lot of legal document layouts available on the Internet, but finding ones you can depend on isn`t simple. US Legal Forms offers a huge number of kind layouts, like the New York Mortgage Securing Guaranty of Performance of Lease, which can be created to fulfill state and federal requirements.

If you are presently familiar with US Legal Forms site and possess an account, just log in. After that, it is possible to download the New York Mortgage Securing Guaranty of Performance of Lease template.

Should you not provide an profile and would like to start using US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is for the proper town/county.

- Use the Preview button to analyze the form.

- Read the information to actually have selected the right kind.

- In the event the kind isn`t what you are trying to find, use the Research discipline to get the kind that suits you and requirements.

- When you obtain the proper kind, simply click Acquire now.

- Select the rates strategy you would like, fill out the desired information and facts to create your money, and buy your order using your PayPal or bank card.

- Pick a handy paper formatting and download your copy.

Discover every one of the document layouts you may have bought in the My Forms menus. You may get a further copy of New York Mortgage Securing Guaranty of Performance of Lease at any time, if possible. Just select the needed kind to download or produce the document template.

Use US Legal Forms, by far the most extensive selection of legal kinds, to conserve time and prevent errors. The service offers appropriately produced legal document layouts that you can use for an array of reasons. Generate an account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

How much is the Mortgage Recording Tax in NYC? The NYC Mortgage Recording Tax (MRT) is 1.8% for loans below $500k and 1.925% for loans of $500k or more. The MRT is the largest buyer closing cost in NYC.

In a refinance situation, the mortgage recording tax can be greatly reduced or avoided when the original lender agrees to assign the existing mortgage to the new lender and the new lender agrees. The mortgage recording tax will only be calculated based on the difference between the old loan and the new money.

In NYC, the buyer pays a mortgage recording tax rate of 1.8% if the loan is less than $500,000 and 1.925% if more than $500,000 or more. Buyers of commercial property pay 2.55%. These rates are what the buyer is responsible for. Your mortgage lender will also contribute 0.25%.

For borrowers in New York who are refinancing their mortgage, the mortgage tax may be reduced if the original lender and the new lender cooperate. The process is called a Consolidation Extension and Modification Agreement (CEMA).

The guarantor unconditionally guarantees the payment obligations of the obligor (the borrower or debtor) for the benefit of the beneficiary (the lender or creditor). This Standard Clause has integrated notes with important explanations and drafting and negotiating tips.

Taxpayers can deduct the interest paid on qualified residences for up to $750,000 in total mortgage debt (the limit is $375,000 if married and filing separately). Any interest paid on first, second or home equity mortgages over this amount is not tax-deductible.

If this happens and additional funds are advanced or re-advanced, the guarantee secures the additional funds up to the fixed amount. When a mortgage secures a guarantee, it secures the guarantor's obligation to repay the funds advanced related to the other party's debt, up to the guarantee amount.

This Guaranty is an absolute, unconditional, present and continuing guaranty of payment and performance and not of collection and is in no way conditioned or contingent upon any attempt to enforce Lender's rights against Borrowers or to collect from the Borrowers or upon any other condition or contingency; ingly, ...