New York Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

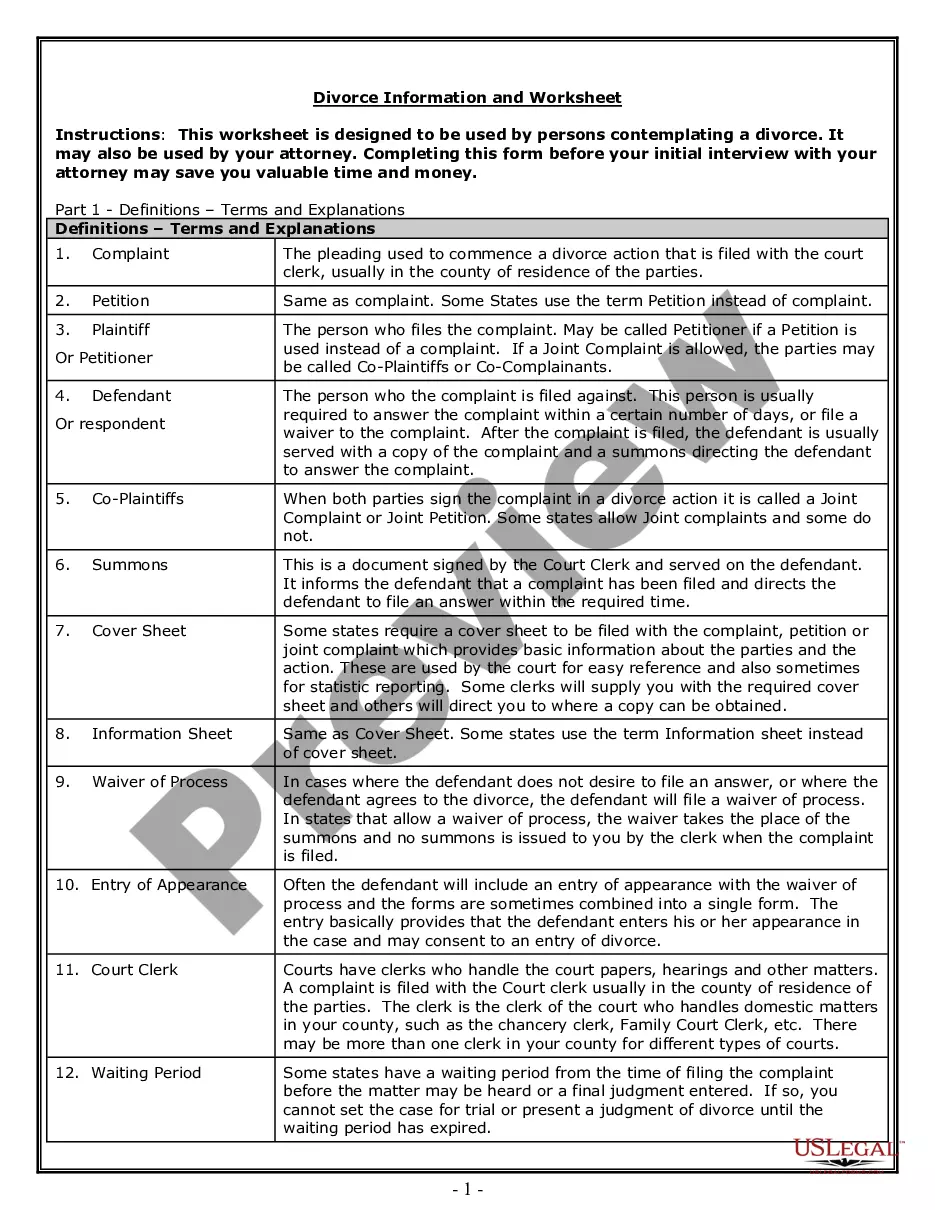

Choosing the right legitimate papers format might be a have a problem. Needless to say, there are tons of themes available on the net, but how will you find the legitimate develop you need? Utilize the US Legal Forms web site. The assistance delivers a huge number of themes, like the New York Transfer under the Uniform Transfers to Minors Act - Multistate Form, that you can use for enterprise and private requires. All of the types are inspected by specialists and fulfill state and federal needs.

If you are presently signed up, log in to the profile and then click the Down load key to have the New York Transfer under the Uniform Transfers to Minors Act - Multistate Form. Make use of profile to check through the legitimate types you may have ordered earlier. Proceed to the My Forms tab of your respective profile and obtain another backup in the papers you need.

If you are a fresh customer of US Legal Forms, listed below are basic recommendations that you can stick to:

- Very first, be sure you have selected the appropriate develop for the area/county. It is possible to look through the form making use of the Review key and browse the form information to guarantee this is basically the best for you.

- If the develop will not fulfill your expectations, use the Seach field to obtain the proper develop.

- When you are sure that the form is proper, select the Acquire now key to have the develop.

- Pick the rates prepare you desire and enter the essential information and facts. Create your profile and pay for the transaction with your PayPal profile or charge card.

- Choose the file structure and down load the legitimate papers format to the product.

- Full, edit and print and indicator the obtained New York Transfer under the Uniform Transfers to Minors Act - Multistate Form.

US Legal Forms may be the biggest library of legitimate types in which you can discover numerous papers themes. Utilize the service to down load skillfully-made paperwork that stick to state needs.

Form popularity

FAQ

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Understanding the Uniform Transfers to Minors Act (UTMA) The minor's Social Security number (SSN) is used for tax reporting purposes on UTMA accounts. Because assets held in a UTMA account are owned by the minor, this may have a negative impact when the minor applies for financial aid or scholarships.

Once the minor reaches the legal age of adulthood in their state, control of the account officially transfers from the custodian to the named beneficiary, at which point they claim full control and use of the funds.

As the custodian, you can withdraw money from a custodial account if you need to use it to pay for something that will benefit the minor. You can't take the money back yourself, or give it to someone else.

In the United States, a child's money does not belong to the child's parents or guardians. Once the paperwork is in order, as a custodian of a UTMA you become a fiduciary or you owe a fiduciary duty to the beneficiary of that account. "Fiduciary duty" means you can only use the money in their best interest.

Anyone can contribute to a UTMA account, but their contribution is considered an irrevocable gift. This means only the custodian has the right to withdraw funds, and it has to be for the child's benefit. The custodian has a fiduciary duty to act in the child's best interest.

For UTMA accounts, unearned income is the primary focus. If the UTMA account produces more than $1,250 but less than $2,500 of unearned income in 2023, the child's tax can be included on the parent's tax return using IRS Form 8814. This way, the parent can avoid having to file a separate return for the child.

The UTMA generally requires the custodian to transfer the custodial property to the minor when the minor reaches the age of 21 (unless the person creating the account, in designating the custodian, elects the age of 18 instead).