New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Take advantage of the website's straightforward and convenient search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to get the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors in just a few clicks.

Each legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to locate the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/country.

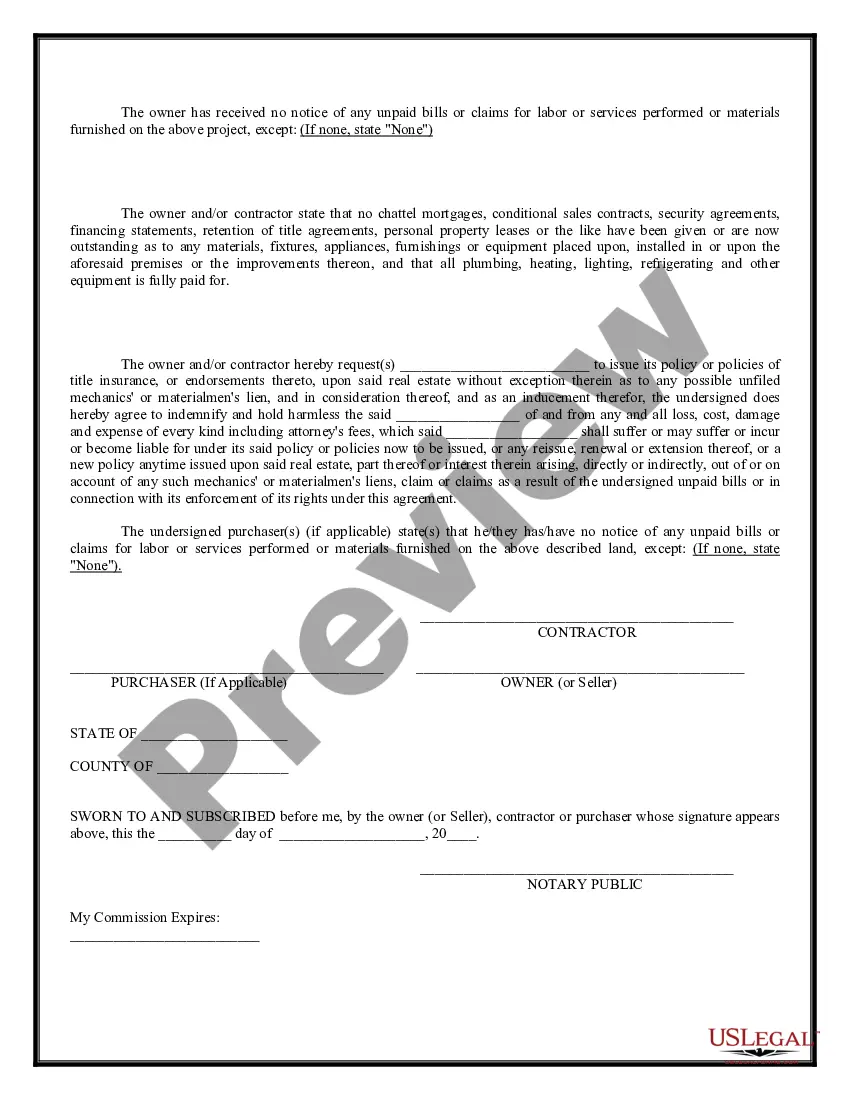

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you need, select the Download now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

Form popularity

FAQ

An affidavit form is a written statement confirmed by the oath or affirmation of the signer, used as evidence in legal proceedings. The New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors serves this purpose by providing a sworn declaration about project completion and payments. This enhances transparency and builds trust between contractors, subcontractors, and property owners.

The G706 form is a document used in construction projects to report contractor payments and verify completion statuses. It acts as a certification for project owners that all conditions necessary for final payment have been met. In contexts involving the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, the G706 can complement the affidavit by demonstrating adherence to financial commitments.

In New York, both the general contractor and the subcontractor share accountability for the work performed. While the subcontractor is responsible for the quality and safety of their specific tasks, the general contractor retains overall responsibility for the project. Thus, the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors is vital in clarifying these responsibilities and ensuring all parties are on the same page, potentially avoiding disputes.

Subcontractors in New York must fulfill their obligations as outlined in their contracts, which includes performing work to specifications and ensuring quality standards. They too can face liability if their work results in negligence or damages. The New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can serve to protect subcontractors by providing documentation of completed work and payments made, helping to establish clear accountability.

Contractors in New York have several liabilities, including ensuring that the work complies with local building codes and safety regulations. They are also responsible for payments to subcontractors, as stipulated in the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Failing to meet these obligations can lead to legal repercussions and financial losses.

In New York, a general contractor can be held liable for the negligence of a subcontractor under certain conditions. If the general contractor exercised control over the subcontractor's work or if the contractor was responsible for ensuring a safe work environment, liability may arise. This highlights the importance of understanding the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, as it outlines responsibilities and can affect liability.

A subcontractor contract is a legally binding document that details the agreement between a contractor and a subcontractor. It specifies the scope of work, payment terms, and timelines for the project. For those working in New York, incorporating a New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors helps clarify payment obligations. This contract protects both parties and promotes successful project completion.

Absolutely, a subcontractor needs a contract to clearly define their responsibilities and protect their rights. A contract outlines the project specifications, payment details, and timelines, which helps in managing expectations. Including the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors in this agreement enhances the payment process. A well-drafted contract empowers both parties.

Yes, having a contract for an independent contractor is essential to define the scope of work and payment terms. A written contract protects you and the contractor by clearly outlining roles and expectations. Additionally, integrating the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can simplify the payment process and ensure everyone is on the same page. A solid contract minimizes misunderstandings.

A Memorandum of Understanding (MOU) is an informal agreement that outlines the expectations and responsibilities of both the contractor and subcontractor. While not legally binding like a contract, an MOU establishes a mutual understanding of project goals. It's beneficial to include references to the New York Owner's and Contractor Affidavit of Completion and Payment to Subcontractors for payment acknowledgment. An MOU can pave the way for a smoother formal contract later.