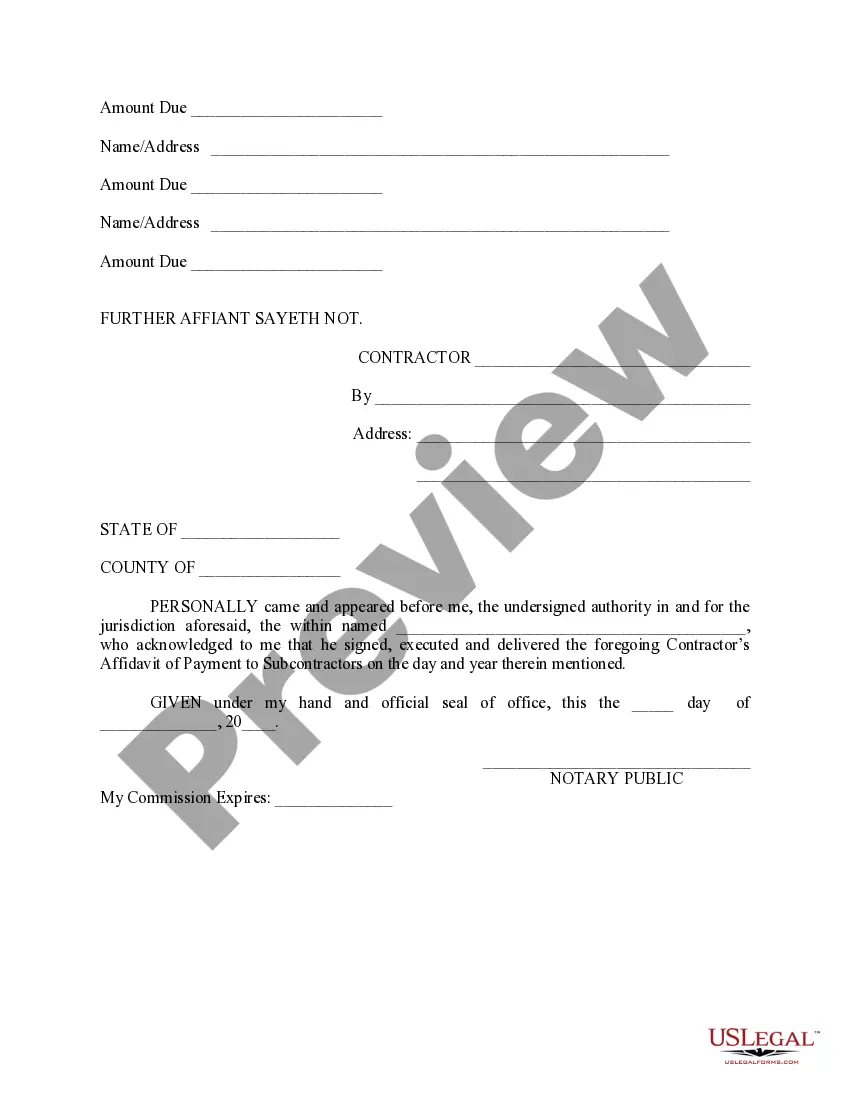

New York Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Are you currently in a situation where you require documents for either business or personal reasons on a regular basis.

There are numerous legitimate document templates available online, but finding the ones you can rely on is not easy.

US Legal Forms offers thousands of form templates, including the New York Contractor's Affidavit of Payment to Subs, designed to meet federal and state requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the New York Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

Certificate. The document that you send to the subcontractor, usually with the payments, as an acknowledgement of the payment.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

Related Definitions Certificate for Payment means a written certificate executed by the Authority indicating the amount that the Trade Contractor is entitled to be paid in connection with each Trade Contractor Application for Payment. Sample 2.

Subcontractor example For example, a building contractor may hire a subcontractor to complete the electrical wiring part of the contractor's building job. The contractor is responsible to the client for the building job including the part performed by the subcontractor.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

Notwithstanding any other provision of law, a prime contractor or subcontractor shall pay to any subcontractor, not later than 10 days of receipt of each progress payment, the respective amounts allowed the contractor on account of the work performed by the subcontractors, to the extent of each subcontractor's interest