New York Sample Letter for Agreement to Compromise Debt

Description

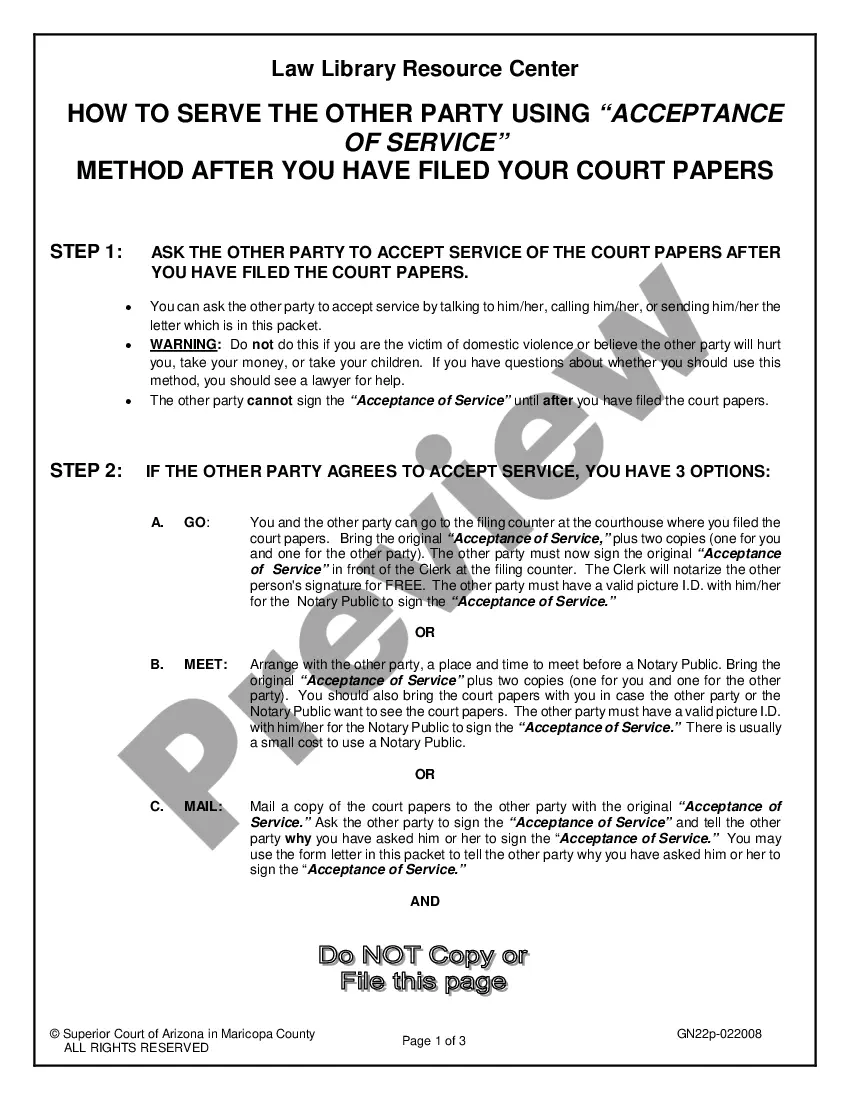

How to fill out Sample Letter For Agreement To Compromise Debt?

Have you ever found yourself in a situation where you need documents for either business or personal reasons nearly every day.

There are many legitimate document templates available online, but finding ones you can trust can be challenging.

US Legal Forms offers a vast array of document templates, including the New York Sample Letter for Agreement to Compromise Debt, designed to comply with state and federal regulations.

Once you find the appropriate form, click Acquire now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the New York Sample Letter for Agreement to Compromise Debt template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/state.

- Click the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that fits your needs.

Form popularity

FAQ

To write a letter to a debt collection agency, start with your contact information and a clear statement regarding the debt in question. Include appropriate request or dispute language based on your situation. Utilizing a New York Sample Letter for Agreement to Compromise Debt can help ensure you approach this communication with authority and clarity.

Writing a debt agreement requires a clear format, defining the parties involved, the amount owed, and payment terms. Make sure to articulate any consequences of non-payment and include spaces for both parties to sign. A New York Sample Letter for Agreement to Compromise Debt can guide you in creating an effective and comprehensive agreement.

When crafting a letter for debt collection, state the purpose clearly, including the amount owed and the debtor's information. Be sure to specify how payment can be made and any relevant deadlines. Using a New York Sample Letter for Agreement to Compromise Debt can provide a structured approach that enhances clarity and professionalism.

A compelling settlement offer should include a realistic payment plan that you can afford, along with a clear rationale for why you are requesting specific terms. You want to present your offer professionally, highlighting any hardships you face. Incorporating a New York Sample Letter for Agreement to Compromise Debt can elevate your offer and help ensure it adheres to standard practices.

When speaking with a debt collector, avoid admitting to owing the debt or providing personal information without verification. It is also wise not to agree to a payment plan without understanding its terms. Instead, you can refer to a New York Sample Letter for Agreement to Compromise Debt to negotiate more favorable terms in writing.

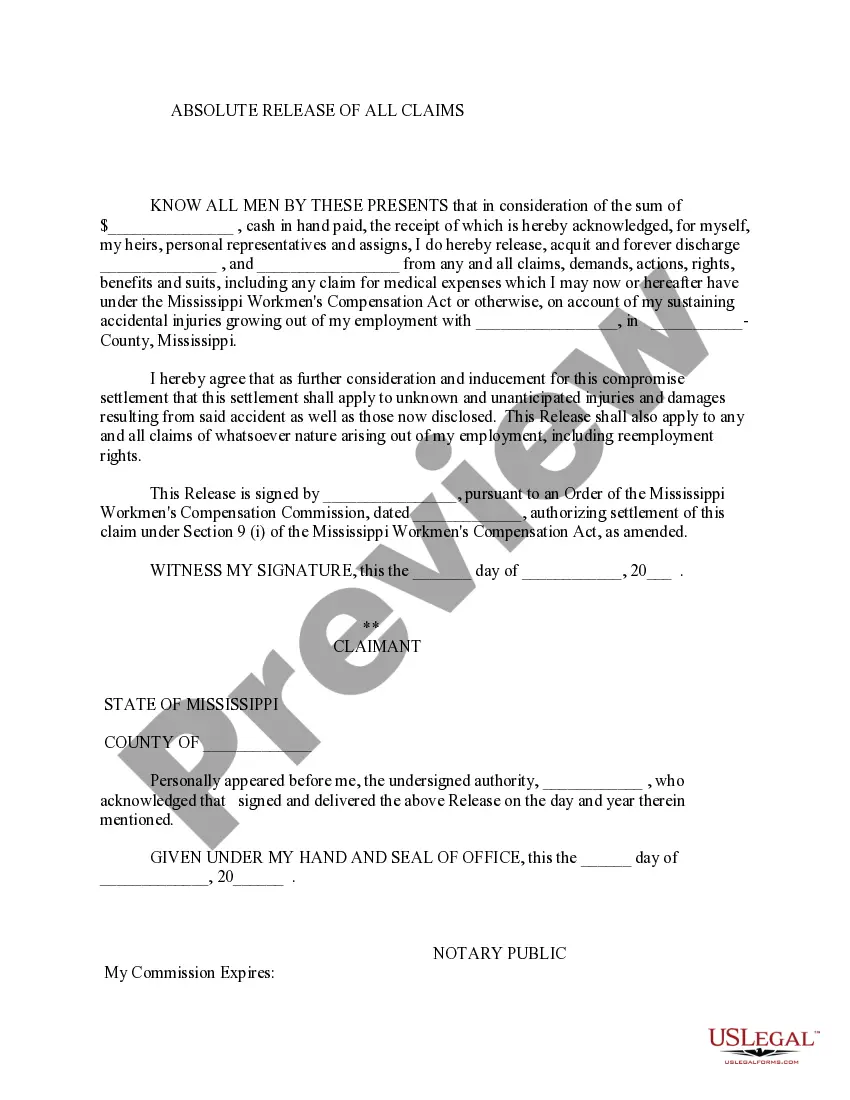

To create a debt settlement agreement, start by clearly outlining the debt amount and the proposed settlement sum. Include terms regarding payment schedules, conditions for settlement approval, and what happens if the borrower fails to comply. Utilize a New York Sample Letter for Agreement to Compromise Debt to ensure you cover essential elements and format correctly.

When negotiating a debt settlement, it's common to offer around 30% to 50% of the total debt amount. This percentage may vary based on your financial situation and the creditor's policies. To ensure you present a formal agreement, consider using a New York Sample Letter for Agreement to Compromise Debt. This letter can help articulate your offer and demonstrate your willingness to settle.

The 777 rule refers to a guideline that encourages debt collectors to validate outstanding debts within a specific period. It typically requires that they provide documentation to you upon request, ensuring transparency in collections. Understanding this rule can empower you when dealing with debt, and using a New York Sample Letter for Agreement to Compromise Debt can help initiate this process. Always keep in mind that knowledge is power when facing debt collectors.

You can obtain a debt validation letter by directly contacting the debt collector that you owe. Request this letter in writing, and they are required to provide it to you. This letter should include the details of the debt, along with your rights as a consumer. For ease, consider using a New York Sample Letter for Agreement to Compromise Debt from US Legal Forms, which can guide you in drafting your request effectively.

To fill out a debt validation letter, start with a formal greeting followed by your details and the creditor's contact information. In the body, reference the specific debt you are inquiring about and state that you request validation using the New York Sample Letter for Agreement to Compromise Debt format. Be clear about what information you need, like account details and proof of the debt, and conclude with your contact information for their response. This organized approach helps facilitate a structured dialogue with the creditor.