New York Direct Deposit Form for Employer

Description

How to fill out Direct Deposit Form For Employer?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every single day.

There are many legal document templates accessible online, yet locating ones you can trust is challenging.

US Legal Forms provides a vast array of document templates, including the New York Direct Deposit Form for Employer, designed to meet federal and state regulations.

Once you have found the appropriate form, simply click Buy now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and complete the transaction using your PayPal or Visa/Mastercard.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- Subsequently, you can download the New York Direct Deposit Form for Employer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it corresponds to your specific city/region.

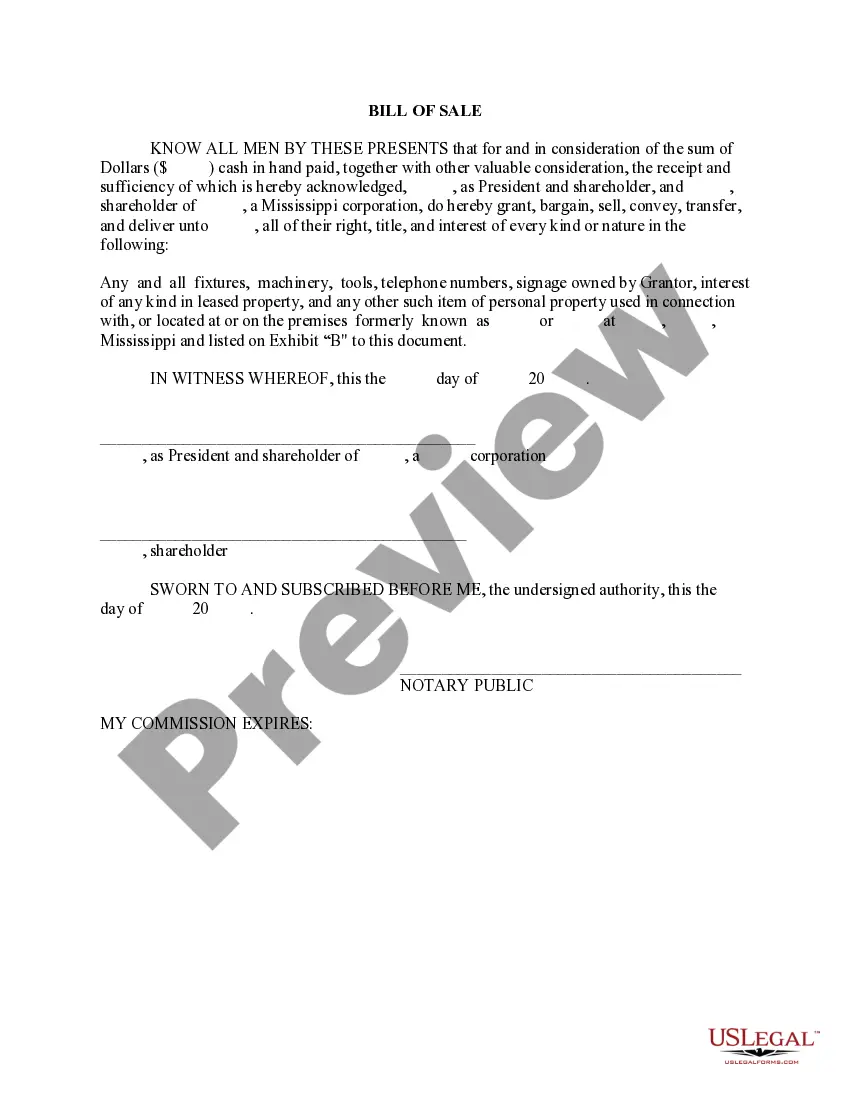

- Utilize the Review option to evaluate the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are seeking, use the Search area to find the document that meets your requirements.

Form popularity

FAQ

How to Set Up Direct DepositFill out the direct deposit form.Include your account information.Deposit amount.Attach a voided check or deposit slip.Submit the form.

New York: New York employers can't require direct deposit but can pay by this method with an employee's advance written consent. However, this doesn't apply to employees in exempt executive, administrative, or professional capacities who earn over $900 a week or those working on a farm.

Federal Law The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into.

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Commonly, an employer requesting authorization will require a voided check to ensure that the account is valid.

Complete a direct deposit form yourselfDownload the form (PDF)Locate your 9-digit routing and account number - here's how to find them.Fill in your other personal information.Give the completed form to your employer.

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

How to set up direct deposit for your paycheckAsk for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF).Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.More items...

States that Allow Required Direct DepositIndiana, Kansas, Minnesota, Missouri, South Carolina, Texas, Virginia, Washington, and West Virginia allow employers to require direct deposit.

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.