New York Automated City Register Tax Information Sheet (ACRIS)

Description

Definition and meaning

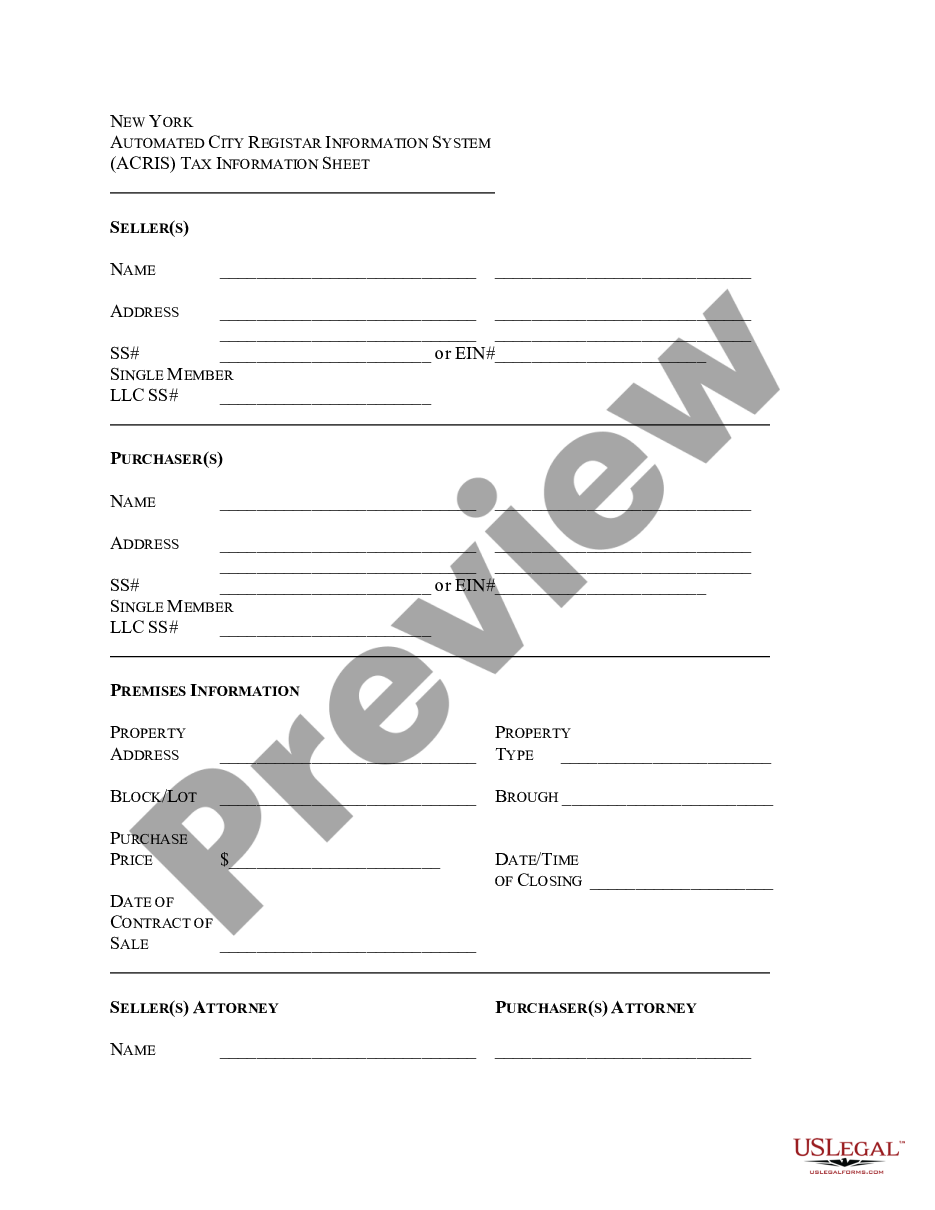

The New York Automated City Register Tax Information Sheet (ACRIS) is a legal form used in real estate transactions within New York City. This document gathers essential tax-related details pertinent to the transfer of property. It is required to ensure compliance with city regulations and to facilitate accurate tax assessments associated with property transfers.

How to complete a form

Completing the New York Automated City Register Tax Information Sheet involves several key steps:

- Begin by providing both seller and purchaser information, including names, addresses, and Social Security numbers or EINs.

- Fill in the premises information, specifying the property address, block and lot numbers, purchase price, and date of closing.

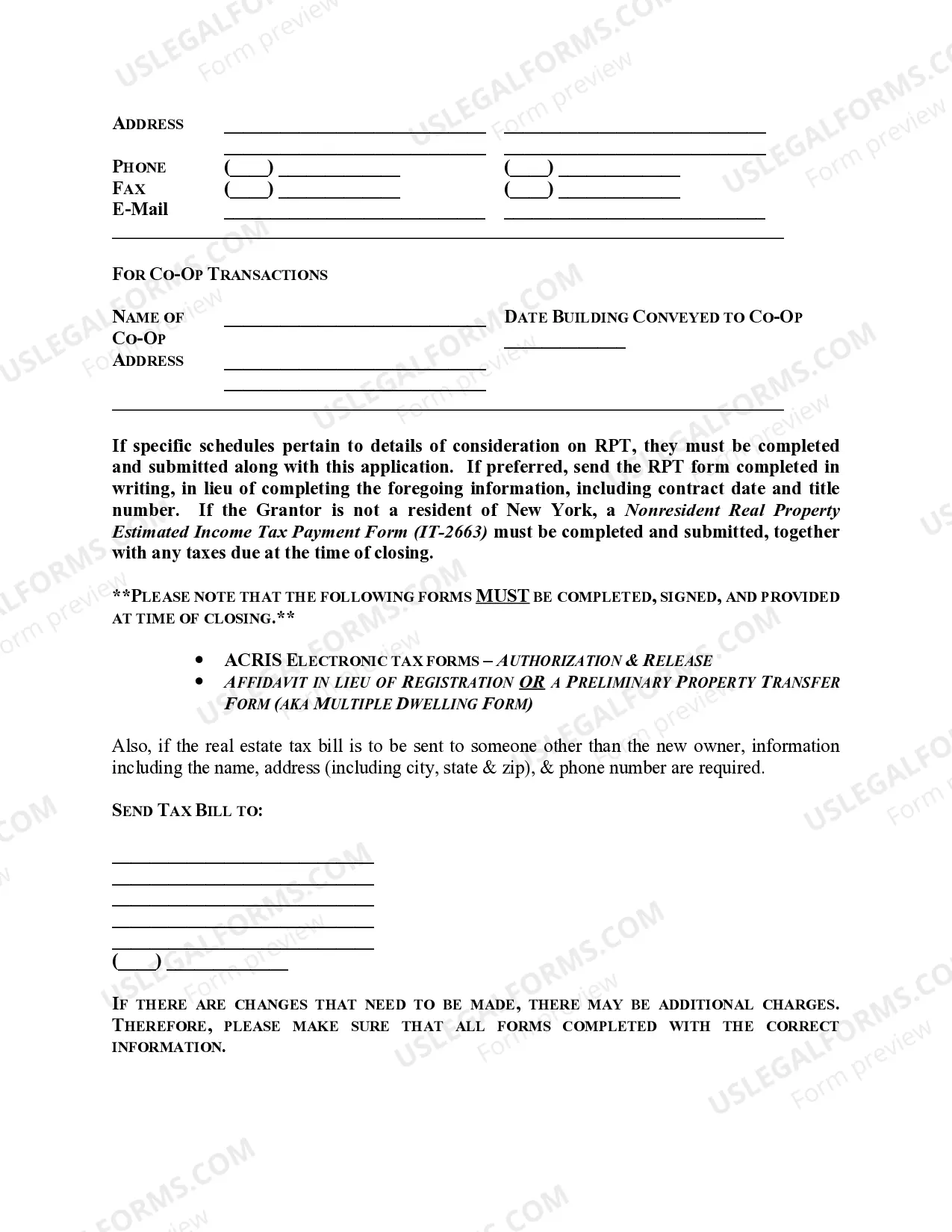

- Ensure both parties' attorneys' details are filled in correctly, including their names, addresses, phone numbers, and email addresses.

Finally, review the form thoroughly to verify all information is accurate and complete before submission.

Who should use this form

The New York Automated City Register Tax Information Sheet should be used by individuals or entities involved in the transfer of real property in New York City. This includes sellers, purchasers, and their respective legal representatives. It's essential for anyone participating in a real estate transaction to understand the requirements outlined in this form to ensure compliance with local tax regulations.

Key components of the form

The form includes several critical sections that must be completed:

- Seller Information: Details about the property seller.

- Purchaser Information: Information about the buyer of the property.

- Premises Information: The address, block/lot numbers, purchase price, and closing date.

- Attorneys Information: Contact details for both the seller's and purchaser's attorneys.

- Co-Op Transactions: Specific information if the purchase involves a co-op.

Each section must be filled out accurately to prevent delays in the property transfer process.

What documents you may need alongside this one

When submitting the New York Automated City Register Tax Information Sheet, you may also need the following documents:

- ACRIS Electronic Tax Forms - Authorization & Release

- Affidavit in lieu of Registration or a Preliminary Property Transfer Form (aka Multiple Dwelling Form)

- If applicable, a Nonresident Real Property Estimated Income Tax Payment Form (IT-2663) for non-residents

Ensuring that these documents are prepared and submitted concurrently will help streamline the closing process.

Common mistakes to avoid when using this form

When completing the New York Automated City Register Tax Information Sheet, it’s vital to avoid the following common mistakes:

- Incorrectly filling out the seller or purchaser information, including misspellings of names and addresses.

- Failing to provide required attorney details.

- Omitting critical property information, such as block and lot numbers or purchase price.

- Submitting incomplete forms or neglecting to sign where required.

Double-checking all entries before submission can prevent issues that may arise during the property transfer process.