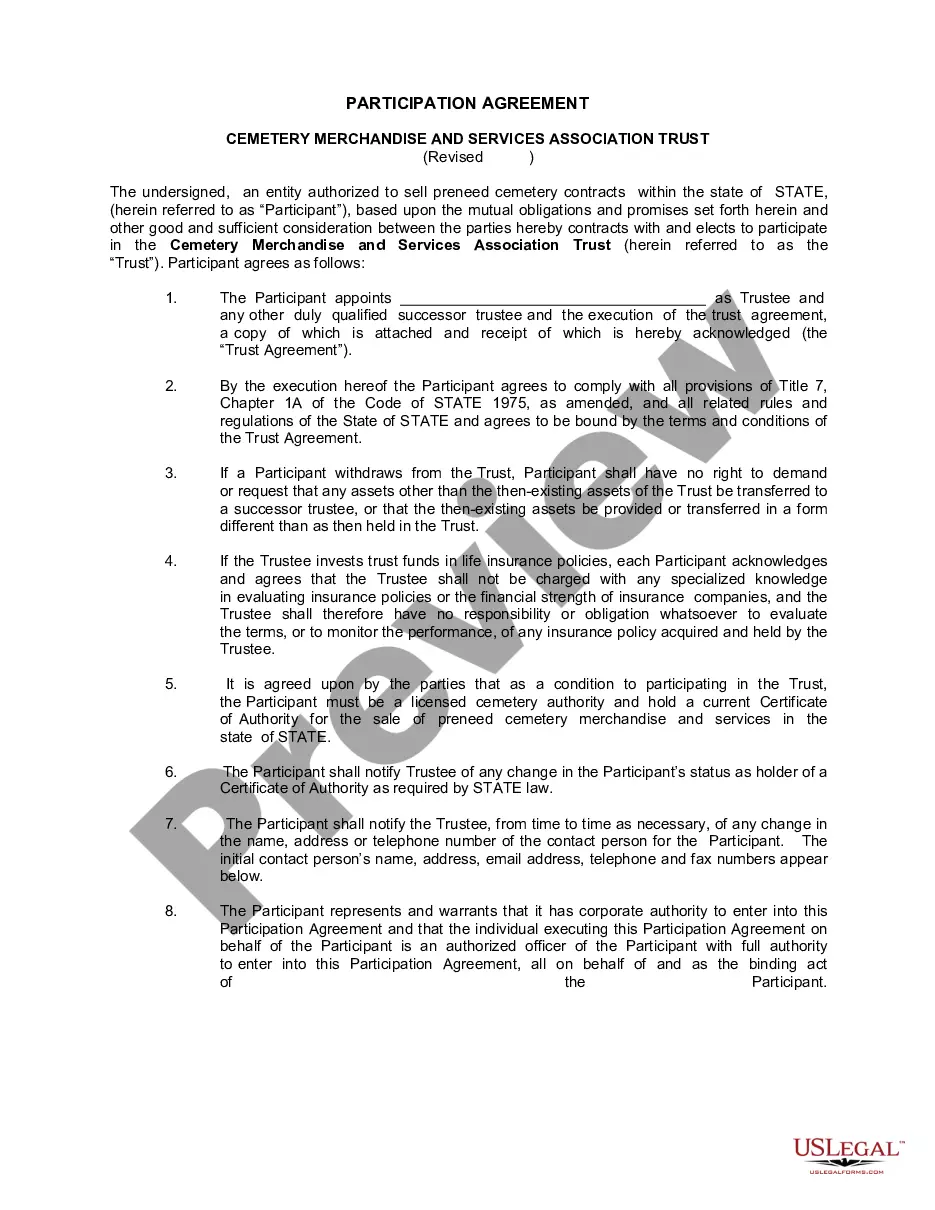

Nevada Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

Choosing the right legitimate document template might be a have difficulties. Needless to say, there are a variety of templates accessible on the Internet, but how would you discover the legitimate type you need? Utilize the US Legal Forms internet site. The services gives a large number of templates, like the Nevada Form of Parent Guaranty, which you can use for business and personal requires. All the varieties are checked by professionals and meet federal and state requirements.

In case you are presently registered, log in for your account and click the Obtain button to have the Nevada Form of Parent Guaranty. Use your account to check from the legitimate varieties you might have ordered in the past. Proceed to the My Forms tab of your respective account and have another duplicate of your document you need.

In case you are a new consumer of US Legal Forms, here are easy guidelines for you to follow:

- Very first, make certain you have chosen the right type for your personal area/state. You can look over the form making use of the Review button and look at the form information to guarantee it will be the right one for you.

- In the event the type does not meet your preferences, utilize the Seach area to get the correct type.

- Once you are positive that the form would work, go through the Acquire now button to have the type.

- Choose the pricing strategy you would like and enter in the essential information and facts. Create your account and pay money for your order making use of your PayPal account or bank card.

- Pick the data file formatting and obtain the legitimate document template for your gadget.

- Complete, edit and print out and sign the obtained Nevada Form of Parent Guaranty.

US Legal Forms may be the most significant local library of legitimate varieties where you can find numerous document templates. Utilize the service to obtain skillfully-produced paperwork that follow status requirements.

Form popularity

FAQ

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

How to fill out a guarantor letter: Start by including your full name, contact information, and the date at the top of the letter. Address the letter to the individual or organization that requires a guarantor. Clearly state your intention to act as a guarantor for the person or entity in question.

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

Your guarantor will have to sign a contract with the letting agent or landlord. This will set out the terms of the guarantor and their responsibilities to the property. Most contracts will state that a guarantor is liable to cover any unpaid rent for the length of the tenancy.