This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Nevada Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

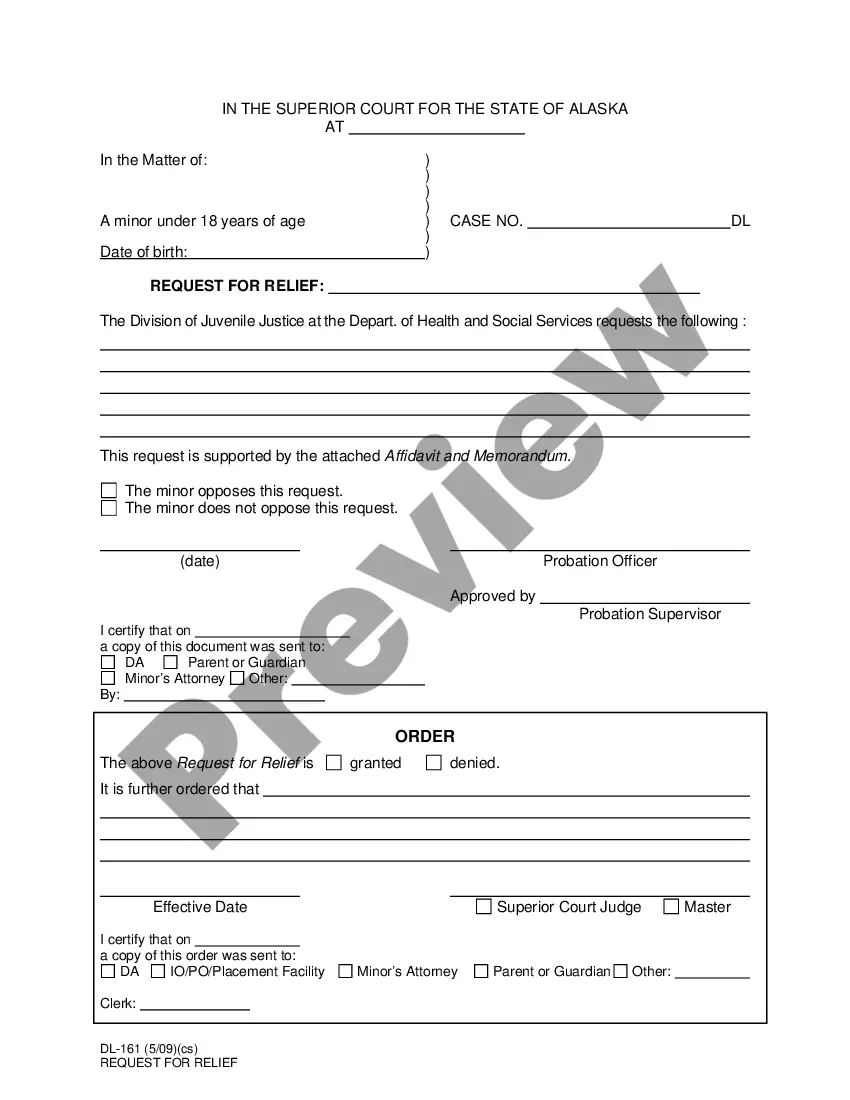

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

You can commit time on the web looking for the lawful papers template that meets the federal and state demands you want. US Legal Forms supplies 1000s of lawful types that are evaluated by pros. It is possible to acquire or print the Nevada Option to Renew that Updates the Tenant Operating Expense and Tax Basis from my assistance.

If you currently have a US Legal Forms account, you may log in and click on the Down load switch. Next, you may comprehensive, edit, print, or indication the Nevada Option to Renew that Updates the Tenant Operating Expense and Tax Basis. Each lawful papers template you acquire is the one you have eternally. To acquire another duplicate of the purchased form, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms site the first time, follow the straightforward recommendations listed below:

- First, ensure that you have chosen the correct papers template for that county/city of your choice. Read the form outline to ensure you have selected the appropriate form. If readily available, make use of the Review switch to appear with the papers template as well.

- If you would like get another edition from the form, make use of the Search field to obtain the template that meets your requirements and demands.

- When you have identified the template you desire, click on Buy now to carry on.

- Select the prices program you desire, key in your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal account to pay for the lawful form.

- Select the format from the papers and acquire it in your gadget.

- Make changes in your papers if necessary. You can comprehensive, edit and indication and print Nevada Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Down load and print 1000s of papers templates utilizing the US Legal Forms website, which provides the largest assortment of lawful types. Use specialist and express-distinct templates to deal with your business or personal needs.

Form popularity

FAQ

Renewing a tenancy means the tenant simply signs a new tenancy agreement for a new fixed term. Your letting agent can help with this however if you don't have one present then presenting your tenant with a new assured shorthold tenancy agreement would do the trick.

No, a landlord cannot evict a tenant for no reason in Nevada. As mentioned above a landlord is allowed to terminate a rental agreement if a tenant intentionally damages the property and/or doesn't comply with the rental agreement.

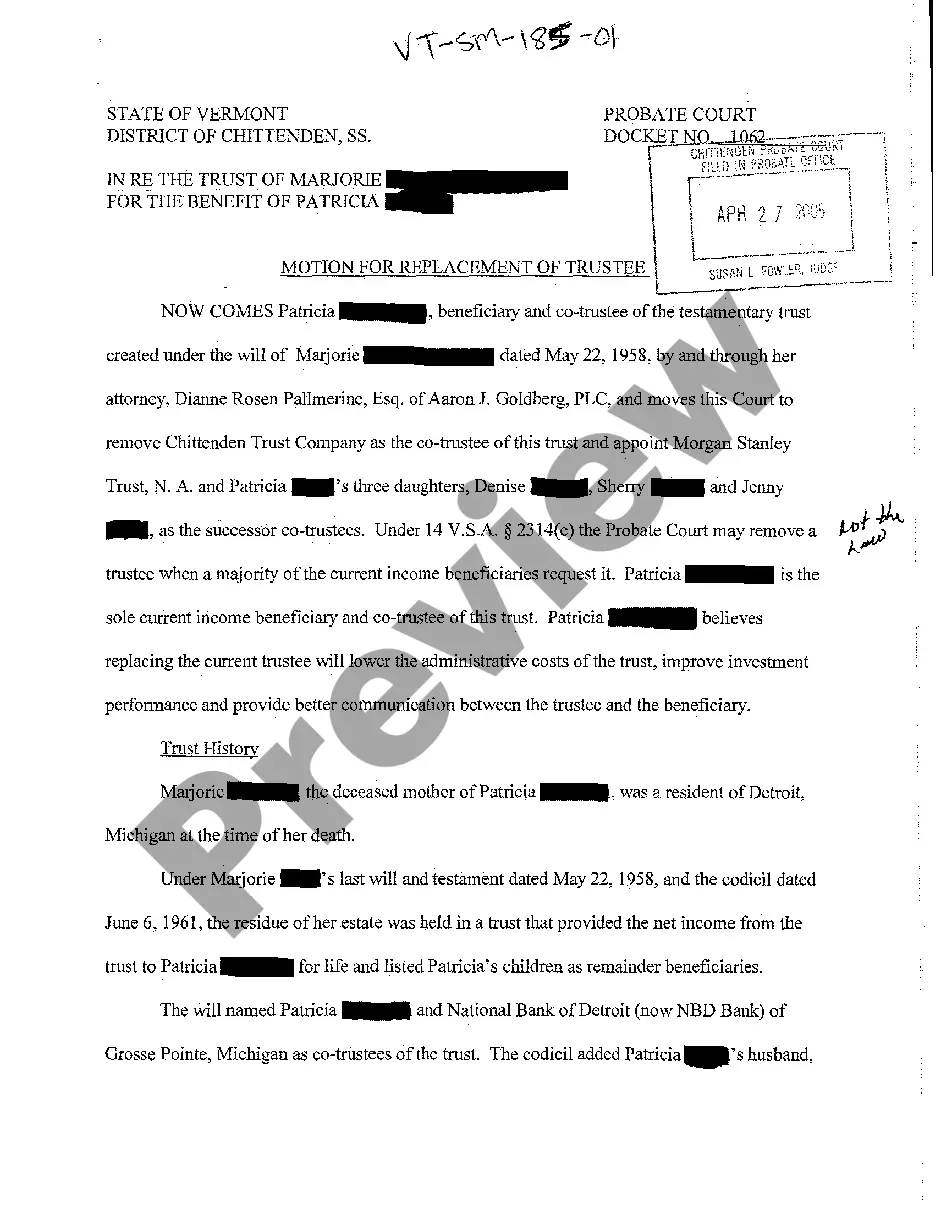

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

What is a Tenancy Renewal Fee? A tenancy renewal fee is when you are charged by the letting agent to renew a fixed term tenancy agreement. Previously, some letting agents were charging both the property owner and the tenants a tenancy renewal fee.

Can You Withhold Rent in Nevada? Yes, tenants may withhold rent under the repair and deduct statute. This statute states that if a landlord does not make repairs within 48-hours of being notified, the tenant may pay to have the repairs done and deduct the cost from their next rent payment.

A tenancy agreement can normally only be changed if both you and your landlord agree. If you both agree, the change should be recorded in writing, either by drawing up a new written document setting out the terms of the tenancy or by amending the existing written tenancy agreement.

An option to renew or extend the lease means that upon the tenant's exercise of the option (choice), the provisions of the agreed-upon option are adopted for another defined term. The terms of the option can include the length of the new term, a change in rent, and other modifications.