Nevada Metal Works Services Contract - Self-Employed

Description

How to fill out Metal Works Services Contract - Self-Employed?

Have you found yourself in a scenario where you require documents for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms provides a vast selection of form templates, including the Nevada Metal Works Services Contract - Self-Employed, which are designed to meet state and federal regulations.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nevada Metal Works Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

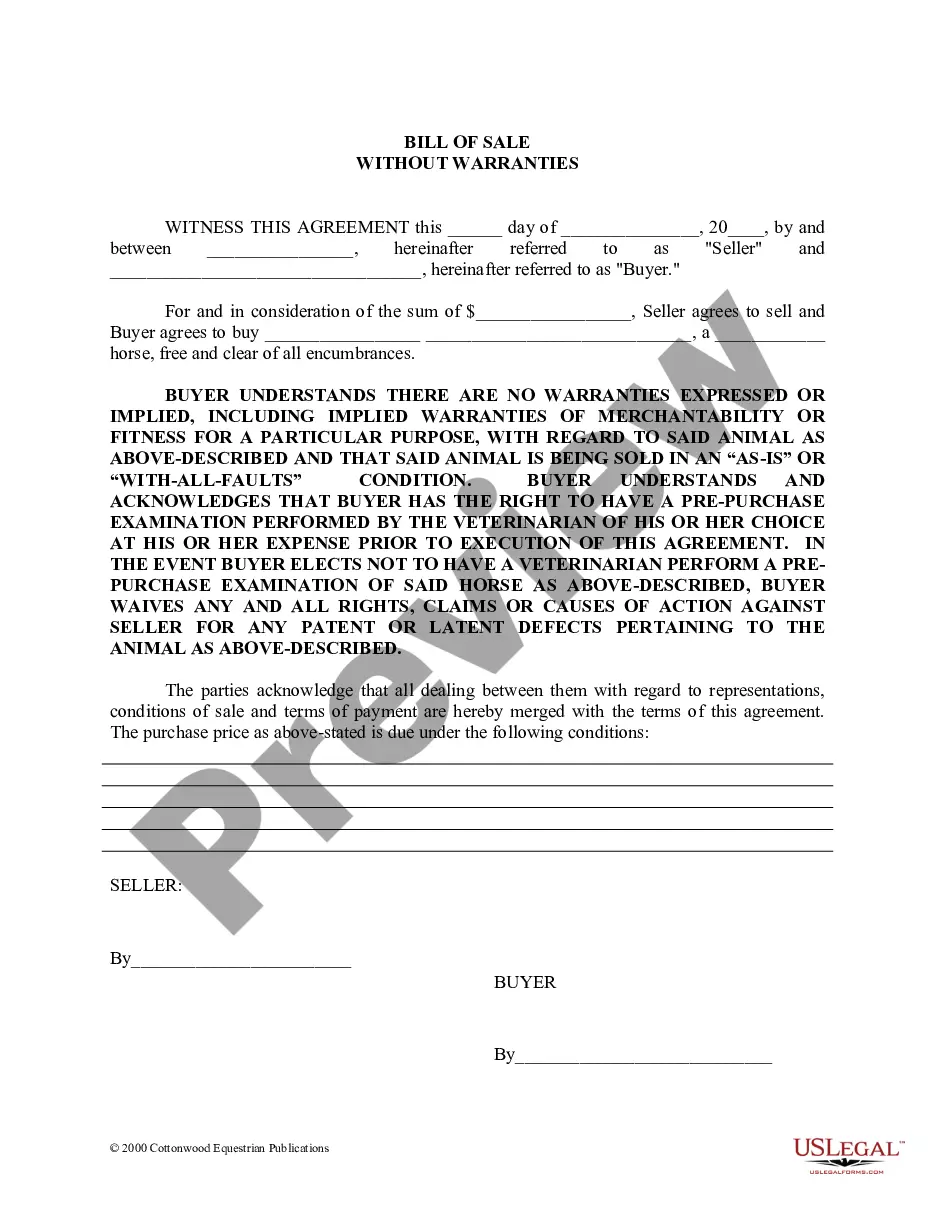

- Utilize the Review option to examine the document.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

- Once you find the correct form, click on Acquire now.

- Select the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Locate all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Nevada Metal Works Services Contract - Self-Employed at any time, if necessary.

- Simply select the required form to download or print the document template.

Form popularity

FAQ

While it is possible to work as a 1099 contractor without a formal contract, it can lead to ambiguity regarding your responsibilities and rights. Your status as a contractor remains unchanged, but a contract provides essential clarity. Using a Nevada Metal Works Services Contract - Self-Employed not only formalizes your relationship with clients, but also safeguards your professional reputation.

As an independent contractor, having a written contract is essential for establishing clear terms with clients. It helps clarify expectations regarding payment, deliverables, and timelines. A detailed Nevada Metal Works Services Contract - Self-Employed can significantly reduce misunderstandings and help you maintain a professional working relationship.

Yes, having a contract is highly advisable for self-employed individuals in Nevada. A contract clearly outlines your responsibilities and protects your rights and interests during a project. By using a Nevada Metal Works Services Contract - Self-Employed, you can formalize agreements and mitigate potential disputes with clients.

If you find yourself working without a formal contract in Nevada, you still have certain rights. Generally, courts may uphold verbal agreements, and you may have recourse under implied contract laws. However, moving forward with a Nevada Metal Works Services Contract - Self-Employed is advisable to ensure clear terms and conditions that protect your interests.

Independent contractors in Nevada must meet specific legal requirements, including obtaining the necessary licenses and permits applicable to their industry. They should also be aware of tax obligations, such as estimated tax payments. When establishing a Nevada Metal Works Services Contract - Self-Employed, having these legalities in order will help protect your business and ensure compliance.

In Nevada, an independent contractor operates as a self-employed individual, running their own business and controlling how they complete their work. Employees, on the other hand, work for an employer and follow their directives. Understanding this distinction is crucial when entering into a Nevada Metal Works Services Contract - Self-Employed, as it affects your rights, responsibilities, and tax obligations.

In Nevada, independent contractors are generally not required to carry workers' compensation insurance unless they have employees or specific exemptions apply. However, obtaining coverage can protect you and your clients in the event of an accident. If you are working on a Nevada Metal Works Services Contract - Self-Employed, considering workers' comp can enhance your business's professional standing.

While you can technically 1099 someone without a business license, it is not advisable. Doing so may lead to potential legal complications and affect the contractor's ability to operate legitimately. If you're entering into a Nevada Metal Works Services Contract - Self-Employed, it is best to ensure that all parties have the necessary licenses to avoid issues.

Yes, a 1099 contractor usually needs a business license in Nevada, particularly if they are providing services like those outlined in a Nevada Metal Works Services Contract - Self-Employed. This requirement applies to contractors working in various industries. Having a business license not only legitimizes your operation but also protects your interests.

In Nevada, anyone engaging in business activities, including independent contractors, must obtain a business license. This requirement applies to various sectors, ensuring that all businesses contribute to local tax revenues. If you offer services under a Nevada Metal Works Services Contract - Self-Employed, a business license is essential for compliance.