Nevada Recovery Services Contract - Self-Employed

Description

How to fill out Recovery Services Contract - Self-Employed?

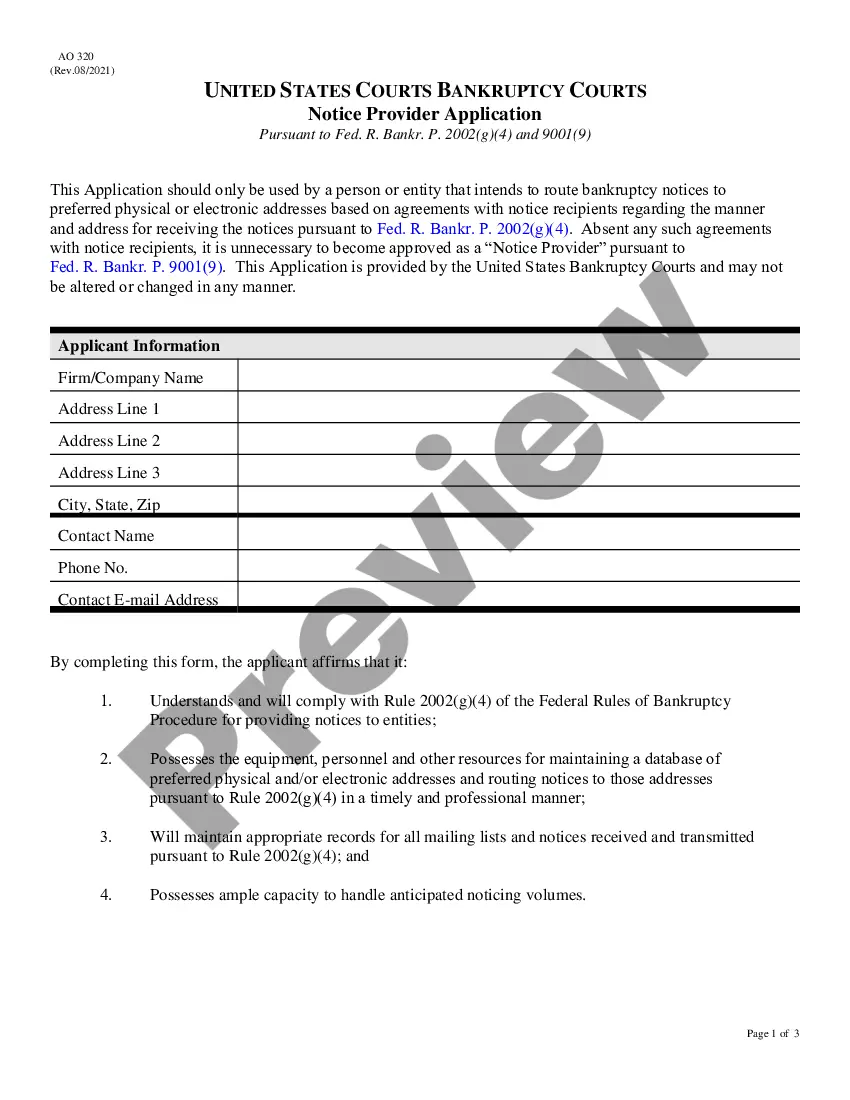

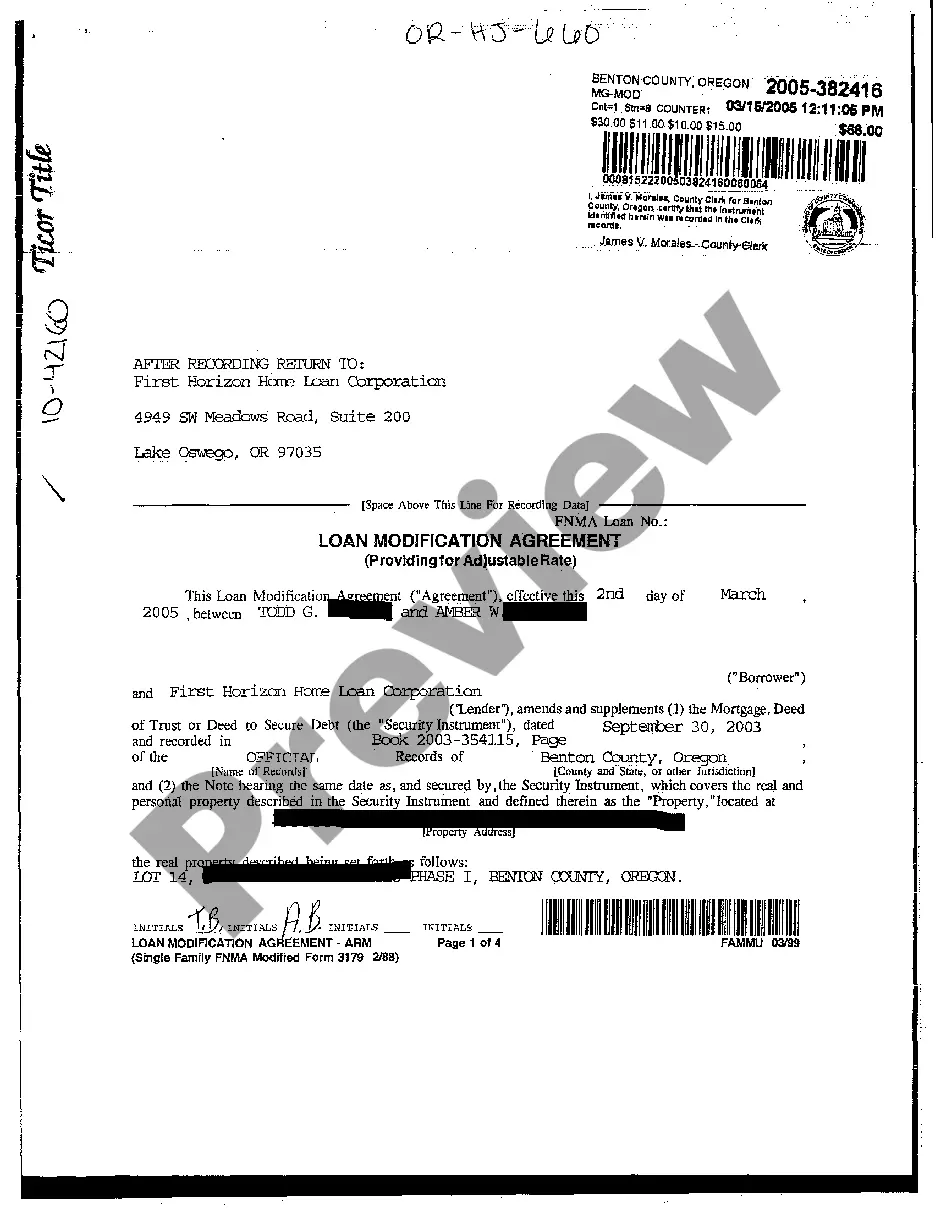

You can allocate time on the web attempting to discover the valid document template that meets the federal and state standards you require.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

You can easily obtain or print the Nevada Recovery Services Contract - Self-Employed from our service.

If available, use the Preview button to review the document template as well. If you wish to obtain another version of the document, utilize the Search field to find the template that meets your needs and requirements. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the valid document. Retrieve the format of the document and download it to your system. Make modifications to your document if necessary. You can complete, alter, sign, and print the Nevada Recovery Services Contract - Self-Employed. Access and print thousands of document layouts using the US Legal Forms site, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Nevada Recovery Services Contract - Self-Employed.

- Every valid document template you receive is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your preference.

- Check the form description to ensure you have chosen the right document.

Form popularity

FAQ

Yes, independent contractors in Nevada generally need a business license depending on the nature of their work. Licensing requirements help ensure that your business complies with local regulations and standards. If you’re engaging in the Nevada Recovery Services Contract - Self-Employed, checking your licensing needs is a crucial first step.

Yes, self-employed individuals can and should have contracts. Contracts serve as formal agreements that outline the specifics of the work being done, ensuring both parties understand their rights and responsibilities. If you’re considering the Nevada Recovery Services Contract - Self-Employed, a clear contract is vital for a successful business relationship.

New rules for the self-employed focus on tax reporting, deductions, and benefits eligibility. It's essential for self-employed individuals to stay updated on any changes that may impact their income and tax obligations. Understanding these regulations can help you effectively manage your finances, especially if you're pursuing the Nevada Recovery Services Contract - Self-Employed.

Both terms are often used interchangeably, but they can convey slightly different meanings. 'Self-employed' generally refers to anyone running their own business, while 'independent contractor' implies a specific type of work arrangement. When discussing the Nevada Recovery Services Contract - Self-Employed, using the term that best describes your relationship with your clients may enhance understanding.

Absolutely, a self-employed person can and often should have a contract. A contract helps define the scope of work, payment terms, and expectations, protecting both parties involved. If you are looking into the Nevada Recovery Services Contract - Self-Employed, having a written agreement is crucial for clarity and legal protection.

To get authorized as an independent contractor in the US, you need to register your business and obtain any necessary licenses. Each state has specific regulations, so it’s important to research local requirements. For those in Nevada, the Nevada Recovery Services Contract - Self-Employed may require additional documentation, which platforms like uslegalforms can simplify.

To qualify as an independent contractor, you need to demonstrate that you work independently and control your business operations. You must establish a clear agreement with your clients, outlining the terms and conditions of your services. Understanding the requirements for the Nevada Recovery Services Contract - Self-Employed can help you navigate this process smoothly.

Yes, contract work typically qualifies as self-employment. When you engage in a contract for services, you operate as an independent entity, responsible for your own taxes and business decisions. This structure is essential for those considering the Nevada Recovery Services Contract - Self-Employed, as it allows for flexibility and autonomy.

Yes, contract employees are often classified as self-employed individuals. This classification means they generally manage their own taxes and do not benefit from employer-provided benefits. Understanding this distinction is crucial for navigating your financial responsibilities and rights under a Nevada Recovery Services Contract - Self-Employed. Resources like USLegalForms can assist you in grasping the legal aspects of your employment status and help ensure you are properly protected.

If you get hurt while working as an independent contractor, your options for recovery may differ from those of traditional employees. Typically, independent contractors do not have the same access to workers' compensation benefits, which can leave you seeking alternative solutions. This is where a Nevada Recovery Services Contract - Self-Employed can be beneficial, as it may outline the assistance available for injury recovery. Utilizing platforms like USLegalForms can help clarify your rights and guide you through the recovery process.