Nevada Child Care or Day Care Services Contract - Self-Employed

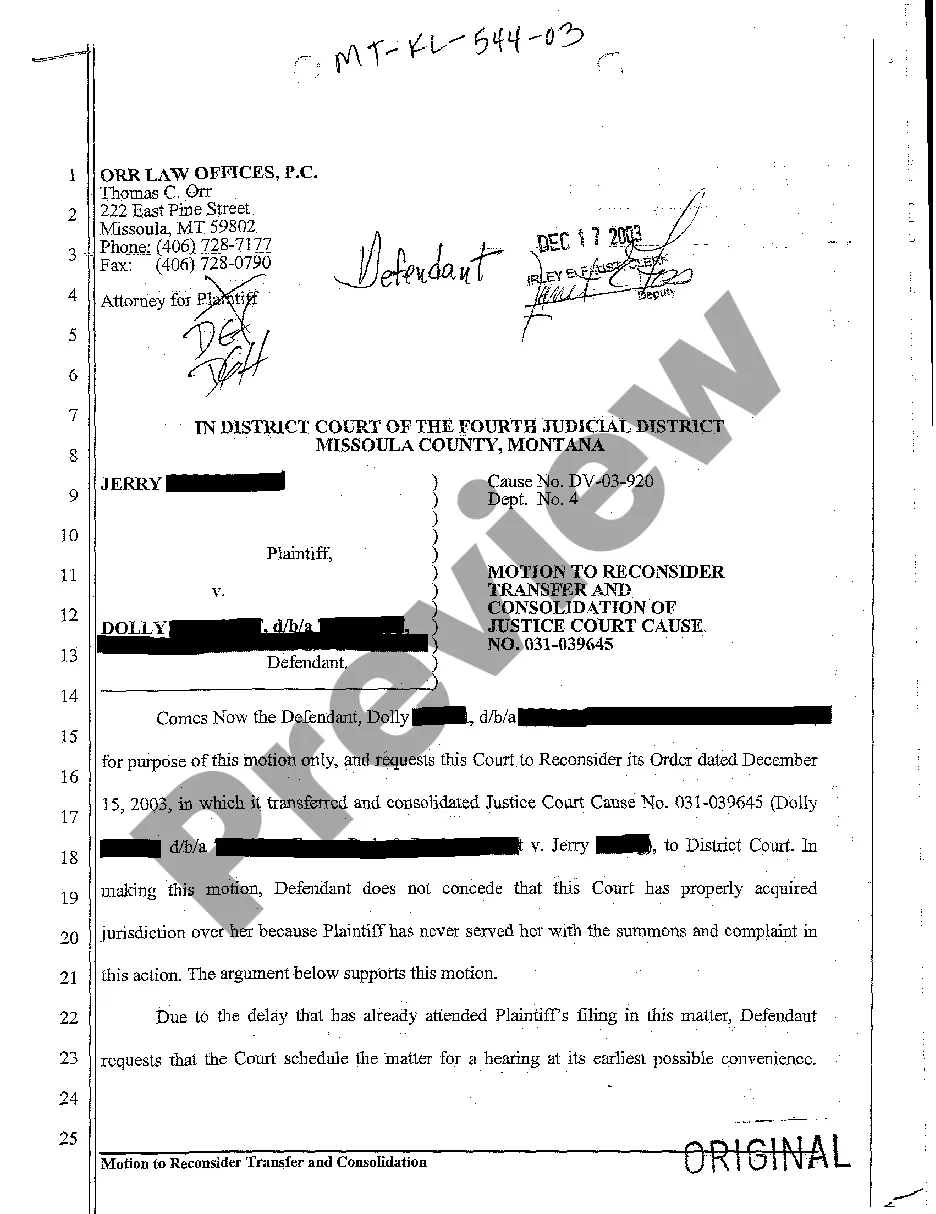

Description

How to fill out Child Care Or Day Care Services Contract - Self-Employed?

It is feasible to invest numerous hours online searching for the valid document template that aligns with the state and federal requirements you will need.

US Legal Forms offers thousands of valid forms that are evaluated by specialists.

You can effortlessly acquire or print the Nevada Child Care or Day Care Services Contract - Self-Employed from the support.

If available, utilize the Review button to look through the document template as well. If you want to find another model in the form, use the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the Nevada Child Care or Day Care Services Contract - Self-Employed.

- Every valid document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents section and click the respective button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/town of your choice.

- Review the form outline to confirm you have selected the proper template.

Form popularity

FAQ

The independent contractor law in Nevada establishes guidelines for the classification and treatment of independent contractors. It defines the rights of contractors and outlines the responsibilities of those hiring them. For those entering into a Nevada Child Care or Day Care Services Contract - Self-Employed, understanding this law is vital for ensuring that you comply and protect your business interests.

Yes, having a contract as an independent contractor is crucial for defining the terms of your working relationship. A clear contract protects your rights and outlines the expectations between you and your clients. When creating a Nevada Child Care or Day Care Services Contract - Self-Employed, make sure to include critical elements like payment terms and service descriptions to avoid misunderstandings.

Independent contractors in Nevada must meet specific legal requirements, including obtaining necessary business licenses and permits. They also need to have proper tax documentation to classify their earnings correctly. When drafting a Nevada Child Care or Day Care Services Contract - Self-Employed, address these requirements to ensure compliance and protection for you and your clients.

In Nevada, you may perform up to $1,000 worth of work without needing a contractor license. This includes various services but can vary based on specific conditions or job types. If you are involved in providing child care or day care services under a Nevada Child Care or Day Care Services Contract - Self-Employed, ensure that you understand licensing requirements so that you operate within legal bounds.

In Nevada, independent contractors work for themselves and have more control over their working hours and methods. Employees, on the other hand, are under direct supervision and follow the employer’s established policies. If you are pursuing a Nevada Child Care or Day Care Services Contract - Self-Employed, recognizing this distinction can guide how you structure your services and agreements.

The 4/10 rule in Nevada refers to a guideline that allows certain employees to work four days a week for ten hours each day. This schedule can enhance productivity and provide better work-life balance. It’s essential to consider how this rule impacts your Nevada Child Care or Day Care Services Contract - Self-Employed. Understanding this rule informs how many hours you can effectively manage as a self-employed provider.

To open your own daycare business in Nevada, start by researching state and local licensing requirements. You will need a Nevada Child Care or Day Care Services Contract - Self-Employed to ensure compliance. Next, create a business plan that outlines your services and target market. Finally, consider using US Legal Forms to obtain the necessary documents and forms, making the process smoother for you.

Yes, independent contractors in Nevada are generally required to obtain a business license, especially when providing services such as child care. This requirement helps ensure that all providers meet local regulations and standards. By securing a proper license, you enhance your credibility and compliance, particularly if you are working under a Nevada Child Care or Day Care Services Contract - Self-Employed.

Yes, self-employed parents in Nevada can often qualify for child care subsidies, provided they meet certain income guidelines. To secure these benefits, applicants may need to supply documentation proving their income and the necessity of child care for their work commitments. Understanding the specifics of Nevada Child Care or Day Care Services Contracts - Self-Employed can help you navigate the application process and ensure your eligibility for support.

Daycare contracts outline the terms of care for children, setting clear expectations for both the provider and the parent. In a Nevada Child Care or Day Care Services Contract - Self-Employed, this agreement typically includes details on services offered, payment schedules, and policies regarding cancellations or late pickups. By having a written contract, both parties can avoid misunderstandings and establish a professional relationship that benefits everyone involved.