Nevada Qualified Written RESPA Request to Dispute or Validate Debt

Description

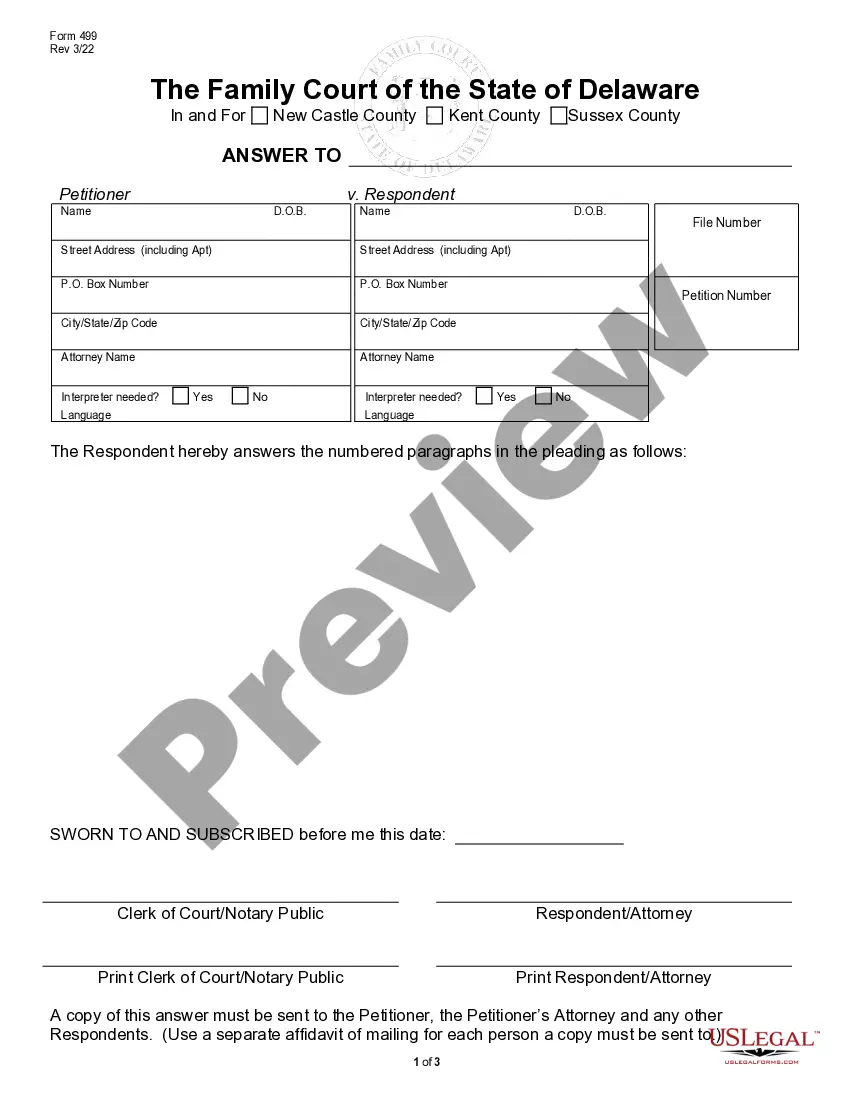

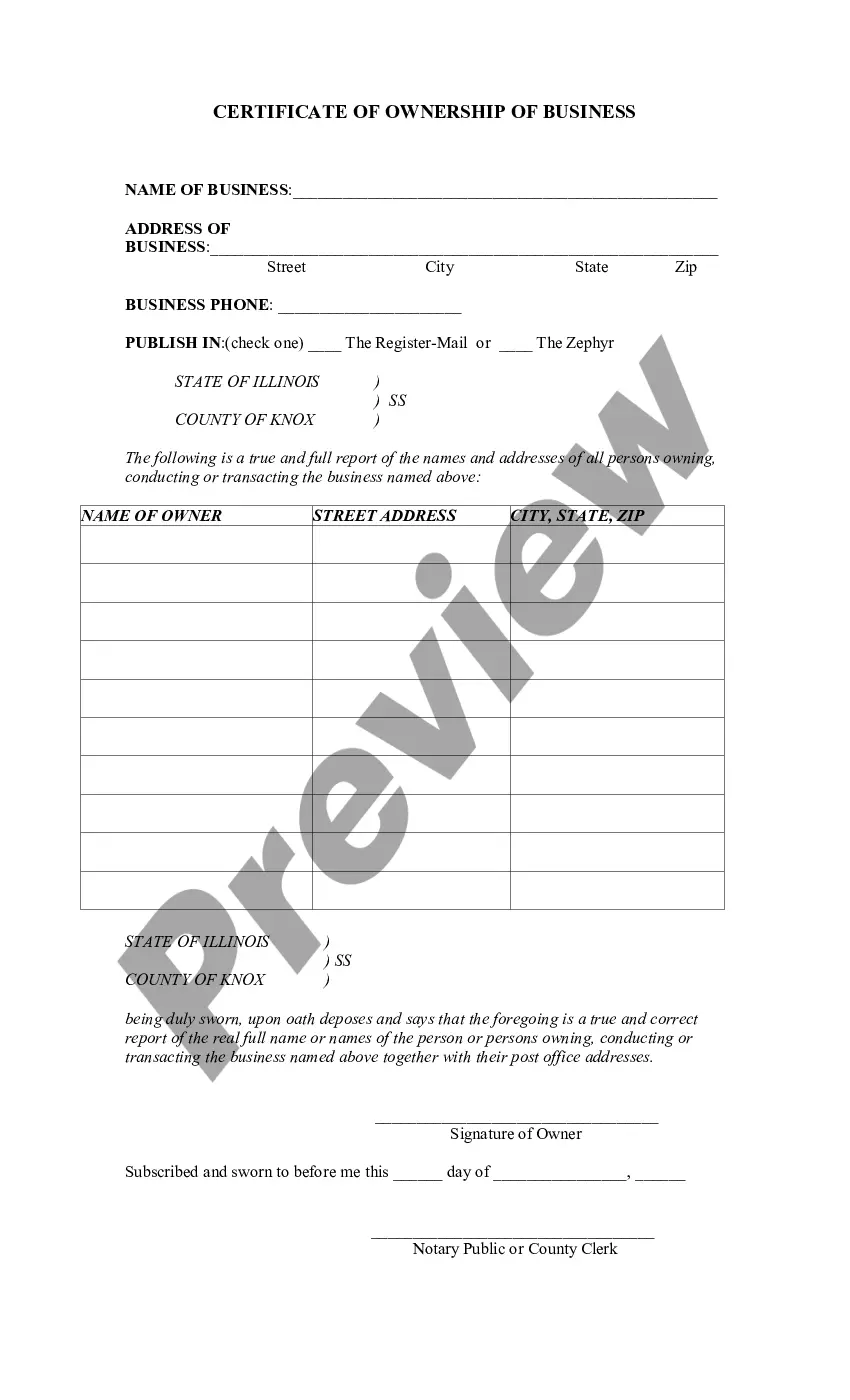

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

If you want to comprehensive, down load, or print lawful file templates, use US Legal Forms, the biggest collection of lawful kinds, that can be found on the web. Make use of the site`s basic and hassle-free look for to discover the files you want. Different templates for enterprise and individual uses are sorted by classes and suggests, or key phrases. Use US Legal Forms to discover the Nevada Qualified Written RESPA Request to Dispute or Validate Debt with a handful of clicks.

When you are currently a US Legal Forms buyer, log in for your accounts and then click the Obtain option to obtain the Nevada Qualified Written RESPA Request to Dispute or Validate Debt. You can also access kinds you previously downloaded within the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for your proper metropolis/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Never overlook to learn the description.

- Step 3. When you are unsatisfied together with the kind, use the Search discipline at the top of the monitor to locate other types of your lawful kind design.

- Step 4. Upon having located the shape you want, select the Get now option. Pick the costs plan you favor and add your references to sign up on an accounts.

- Step 5. Method the deal. You may use your credit card or PayPal accounts to complete the deal.

- Step 6. Select the structure of your lawful kind and down load it in your system.

- Step 7. Full, modify and print or sign the Nevada Qualified Written RESPA Request to Dispute or Validate Debt.

Every lawful file design you buy is your own property for a long time. You may have acces to each kind you downloaded within your acccount. Select the My Forms section and decide on a kind to print or down load once more.

Contend and down load, and print the Nevada Qualified Written RESPA Request to Dispute or Validate Debt with US Legal Forms. There are thousands of specialist and express-specific kinds you can use to your enterprise or individual demands.

Form popularity

FAQ

Yes, you can dispute a valid debt if you believe there are errors or miscommunications regarding its details. Using a Nevada Qualified Written RESPA Request to Dispute or Validate Debt enables you to formally raise your concerns with the creditor. By doing this, you can assert your rights and seek clarification or corrections where necessary.

Upon receiving a debt validation letter, carefully evaluate the information provided to ensure accuracy. If you find discrepancies or wish to dispute the debt, reply with your own Nevada Qualified Written RESPA Request to Dispute or Validate Debt, outlining your concerns and requesting further evidence. A responsible response helps protect your rights and clarifies the situation.

To file a debt validation claim, begin by drafting a Nevada Qualified Written RESPA Request to Dispute or Validate Debt, which clearly states the debt you are questioning. Ensure you send this letter via certified mail to maintain a record of your communication. Following your submission, monitor for any response from the creditor, and remember that you have the right to request more information about the debt.

Writing a letter to dispute a debt involves outlining your name, address, and the details of the disputed debt. In your Nevada Qualified Written RESPA Request to Dispute or Validate Debt, you should state why you believe the debt is incorrect, provide evidence if possible, and request the necessary documentation from your creditor. This approach not only clarifies your position but also prompts the creditor to take your claim seriously.

The best sample for a debt validation letter includes clear language that states your request for validation and the specific debt in question. Additionally, a well-structured Nevada Qualified Written RESPA Request to Dispute or Validate Debt will ensure you include your personal details, the creditor's information, and a concise statement asserting your rights under the Fair Debt Collection Practices Act. You can find effective templates on platforms like uslegalforms, which cater to this need.

To obtain a debt validation letter, you must request it from the creditor or debt collector. Your request should be formal and include your identifying information alongside a clear statement asking for validation. Utilizing the Nevada Qualified Written RESPA Request to Dispute or Validate Debt can be very effective in this process. Remember, this letter serves as your tool to ensure the debt is legitimate and accurately reflects what you owe.

To write a letter that disputes the validity of a debt, start by clearly identifying the debt in question. Include your personal information, such as your name and contact details, and reference the specific debt. Use the Nevada Qualified Written RESPA Request to Dispute or Validate Debt template to ensure you include all necessary elements. Always send your letter via certified mail to track it and keep a copy for your records.

Debt collectors are required to deliver a written validation notice shortly after their initial contact with you, typically within five days. This notice must include important details like the amount owed and the creditor's identity. By utilizing a Nevada Qualified Written RESPA Request to Dispute or Validate Debt, you can formally ask for this information and initiate a verification process. This proactive step helps safeguard your rights and promotes transparency in the debt collection process.

A validation notice must be provided to consumers within five days of a debt collector's first communication regarding a debt. This notice informs you of your right to request a detailed explanation of the debt. By submitting a Nevada Qualified Written RESPA Request to Dispute or Validate Debt, you can challenge or verify the debt's validity effectively. Understanding your rights in this process is essential to ensure fair treatment from debt collectors.

A lender must provide the required RESPA information to a buyer within a specified time frame after receiving a qualified written request. Typically, this information must be sent within five business days. When drafting a Nevada Qualified Written RESPA Request to Dispute or Validate Debt, you should be aware of these timelines to track your lender’s compliance effectively.