Nevada Shareholder Agreements - An Overview

Description

How to fill out Shareholder Agreements - An Overview?

You can spend several hours online looking for the legitimate document web template which fits the state and federal requirements you require. US Legal Forms supplies a huge number of legitimate forms which are evaluated by specialists. You can actually down load or print out the Nevada Shareholder Agreements - An Overview from the assistance.

If you already possess a US Legal Forms account, you are able to log in and click on the Obtain option. After that, you are able to comprehensive, modify, print out, or indicator the Nevada Shareholder Agreements - An Overview. Each legitimate document web template you get is yours eternally. To acquire an additional copy for any bought form, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms website the very first time, stick to the basic directions beneath:

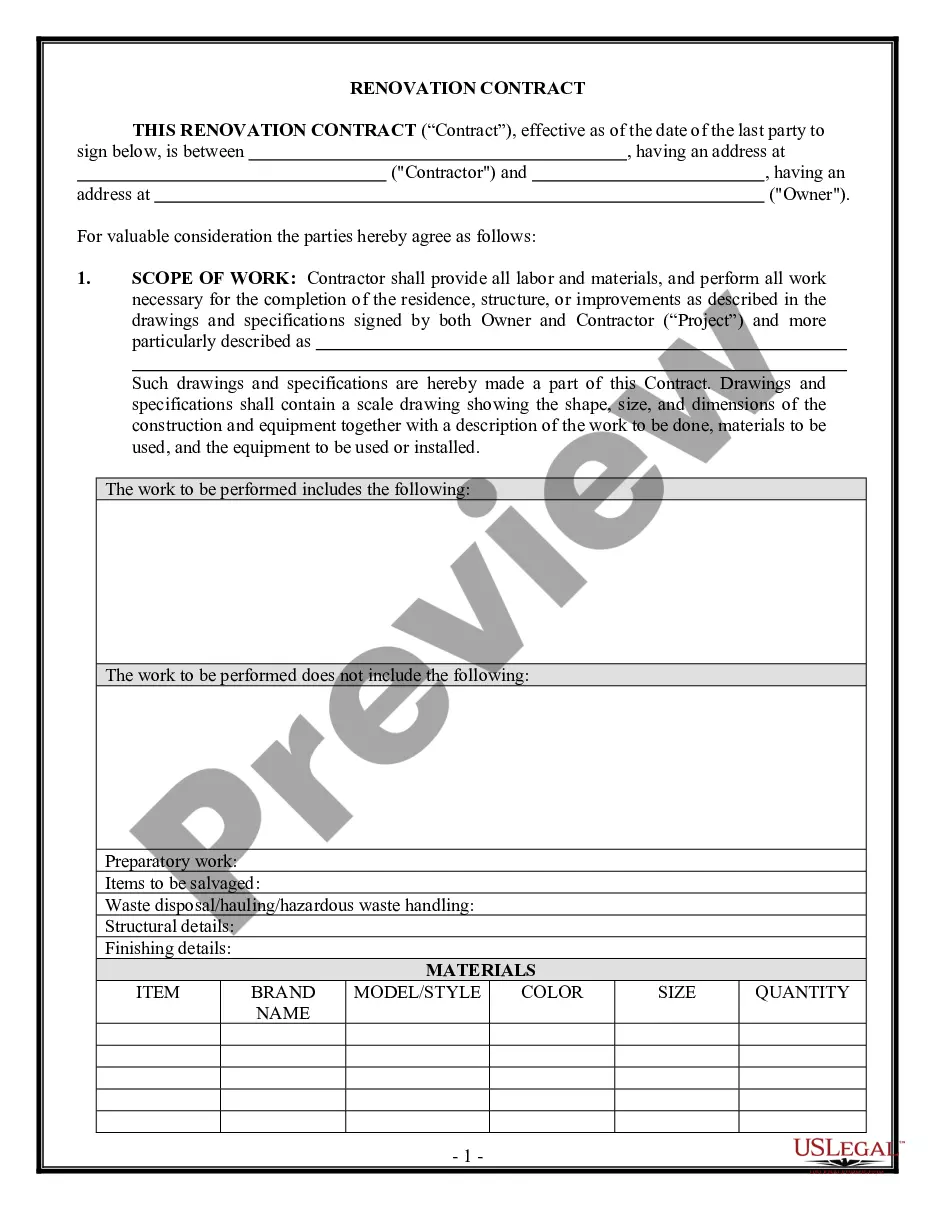

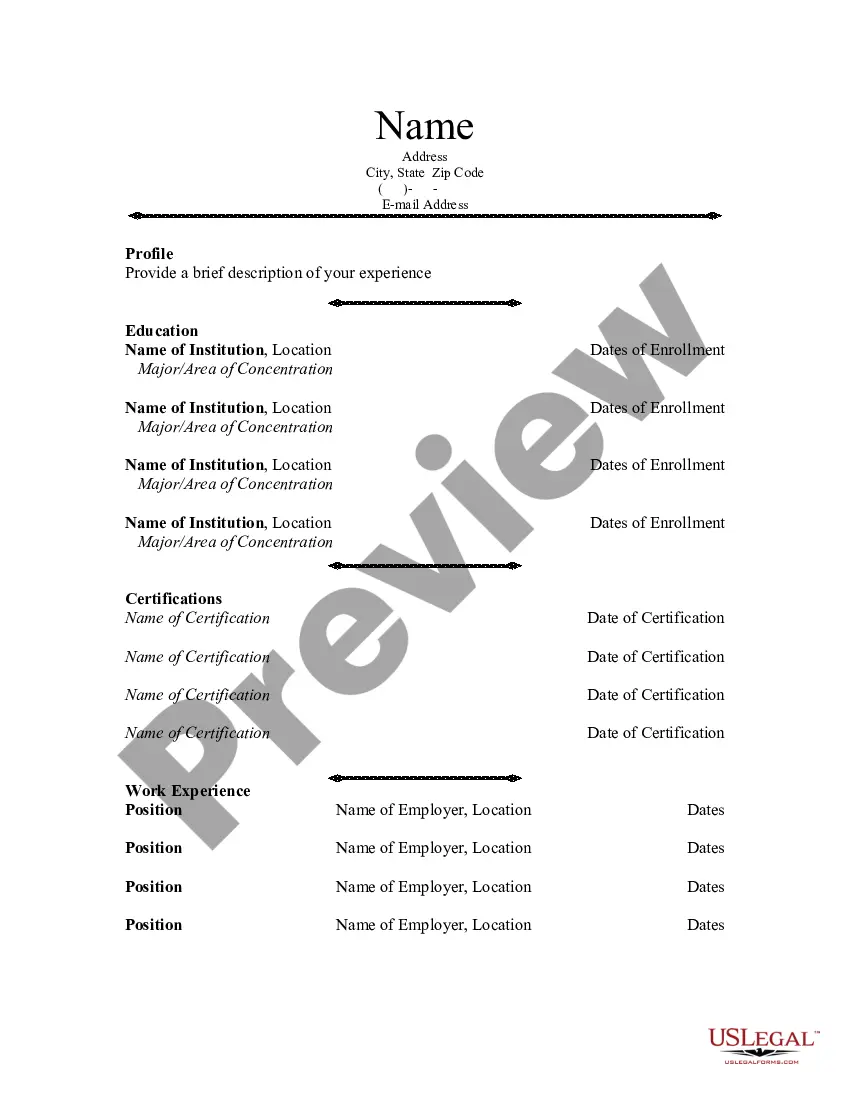

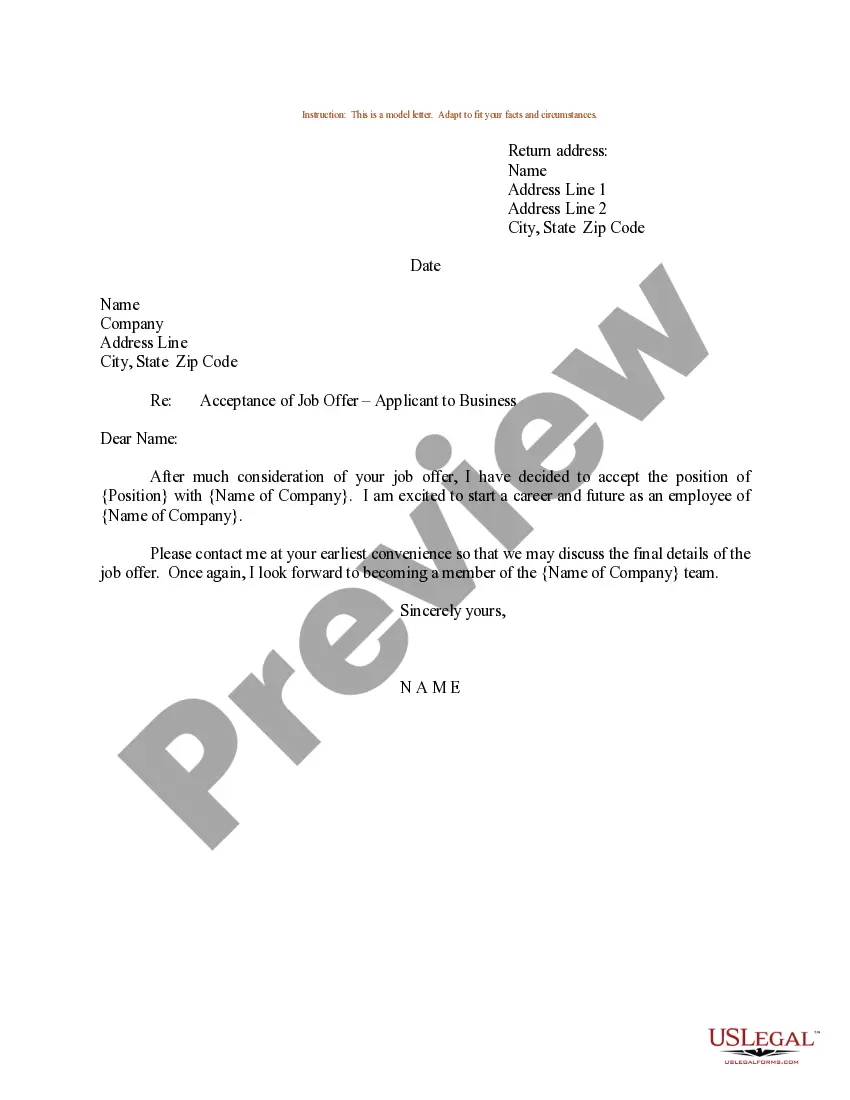

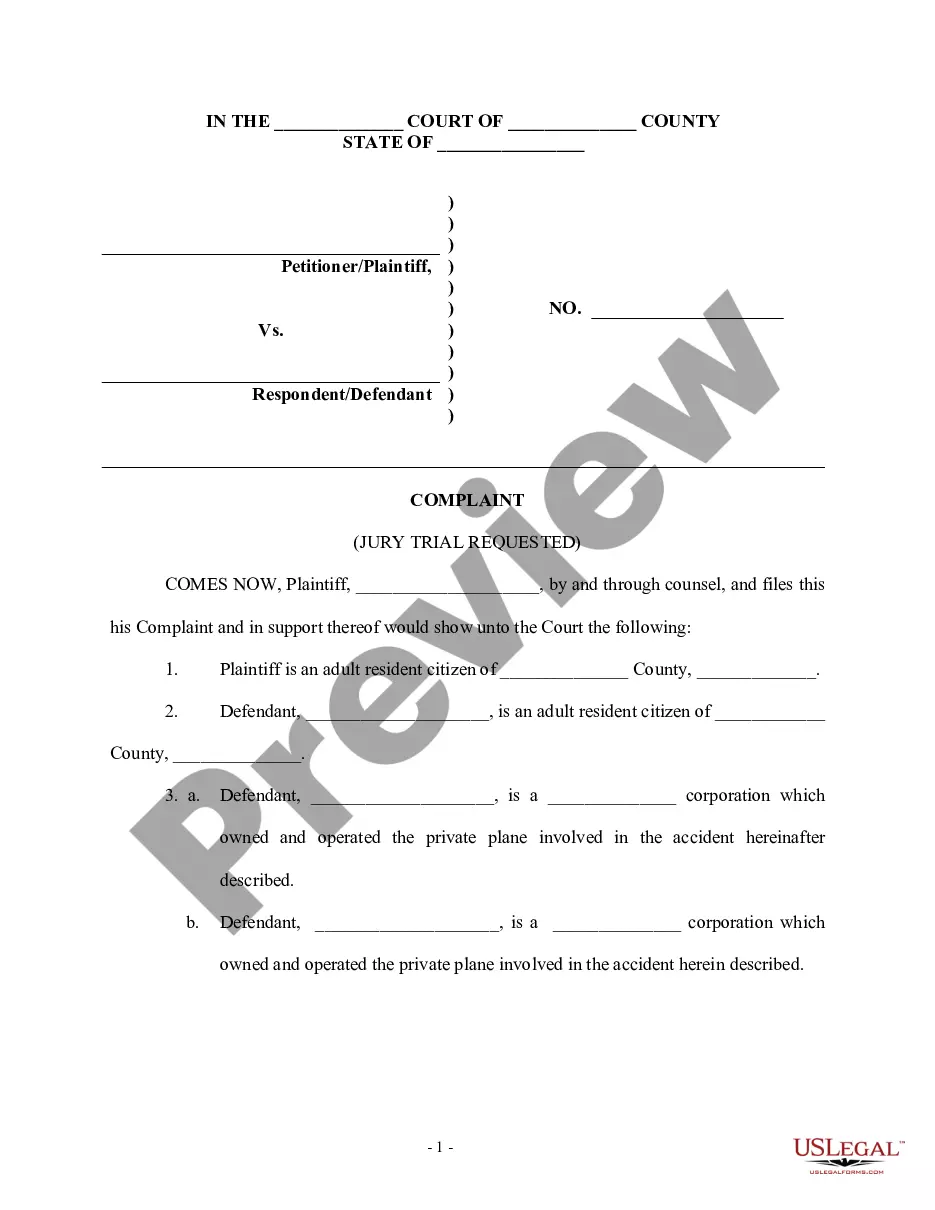

- Initial, ensure that you have selected the best document web template for that state/area of your choice. Browse the form information to make sure you have picked out the correct form. If available, use the Review option to appear through the document web template as well.

- If you wish to get an additional variation in the form, use the Lookup area to find the web template that fits your needs and requirements.

- Upon having identified the web template you desire, just click Acquire now to carry on.

- Choose the pricing strategy you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal account to fund the legitimate form.

- Choose the structure in the document and down load it to your gadget.

- Make modifications to your document if needed. You can comprehensive, modify and indicator and print out Nevada Shareholder Agreements - An Overview.

Obtain and print out a huge number of document templates utilizing the US Legal Forms website, which provides the greatest selection of legitimate forms. Use expert and express-particular templates to handle your company or personal requirements.

Form popularity

FAQ

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

A shareholders' agreement is a contract that regulates the relationship between the shareholders and the corporation. The agreement will detail what models or forms which the corporation should run and outline and the basic rights and obligations of the shareholders.

Pre-emptive rights and right of first refusal clause These clauses protect existing shareholders from the involuntary dilution of their stake in the company. Pre-emption rights provide the company's existing shareholders first offer on an issue of new shares; or first refusal over the sale of existing shares.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.