Nevada Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp.

Description

How to fill out Share Exchange Agreement Between ZC Acquisition Corp., Zefer Corp. And The Stockholders Of Zefer Corp.?

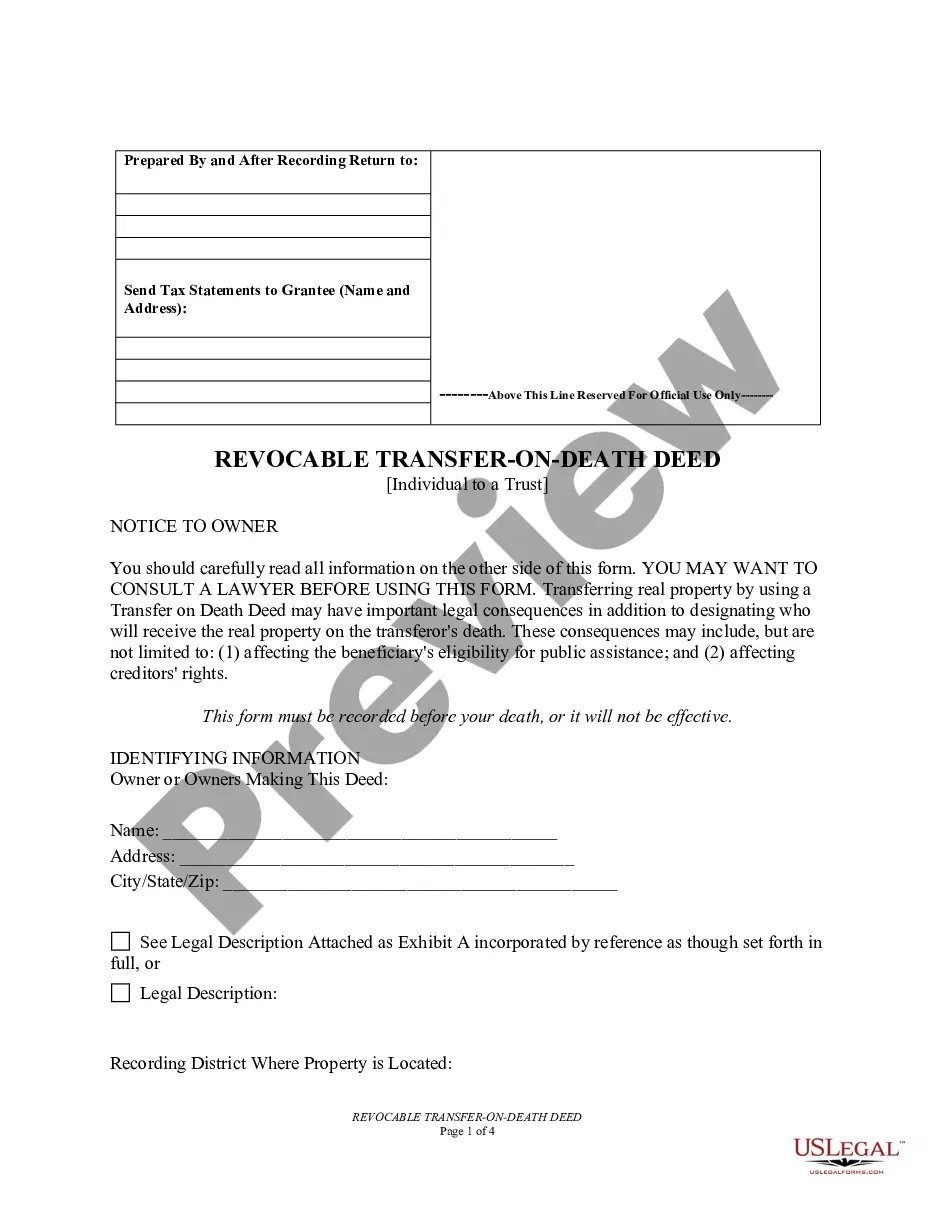

Finding the right authorized papers web template could be a battle. Needless to say, there are a lot of web templates available on the net, but how will you find the authorized kind you require? Make use of the US Legal Forms internet site. The assistance offers a large number of web templates, for example the Nevada Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp., which you can use for business and personal requirements. All the forms are checked out by pros and meet state and federal requirements.

When you are previously listed, log in to your bank account and click the Acquire button to obtain the Nevada Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp.. Utilize your bank account to check with the authorized forms you may have bought previously. Proceed to the My Forms tab of your respective bank account and get yet another duplicate of the papers you require.

When you are a brand new customer of US Legal Forms, allow me to share simple recommendations that you can stick to:

- Very first, be sure you have chosen the correct kind to your area/county. It is possible to look over the form while using Preview button and study the form description to make sure it is the best for you.

- In case the kind does not meet your expectations, take advantage of the Seach industry to discover the correct kind.

- When you are positive that the form is acceptable, click the Buy now button to obtain the kind.

- Pick the prices strategy you would like and type in the required details. Make your bank account and purchase your order with your PayPal bank account or credit card.

- Pick the file file format and down load the authorized papers web template to your product.

- Full, change and produce and indication the received Nevada Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp..

US Legal Forms may be the most significant library of authorized forms where you can find a variety of papers web templates. Make use of the service to down load skillfully-manufactured documents that stick to status requirements.

Form popularity

FAQ

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.

A Share Exchange is a type of share transaction where the shares of one class are exchanged for shares of another class. Unlike a share conversion, shares are not simply converted from one class to another directly.

What is a share for share exchange? In simple terms a share for share exchange is where a company exchanges or issues shares in consideration of the exchange or issue of shares from another company.

A share for share exchange occurs where a company (company B) acquires the shares in another company (company A) and in exchange issues its own shares to the shareholders of company A.

By Practical Law Corporate. This standard document is a short form agreement intended for use in an intra-group share purchase transaction where the consideration is to be satisfied by an issue of shares by the buyer to the seller.

For the clearance to be valid the application must be made and dealt with before the new shares or debentures are issued. The information provided in support of the application must fully and accurately disclose all the relevant facts. If it does not the clearance may be void.