Nevada Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al

Description

How to fill out Sample Partnership Interest Purchase Agreement Between Franklin Covey Company, Daytracker.com, Et Al?

Are you in the place that you will need paperwork for possibly organization or individual functions almost every time? There are plenty of authorized document layouts available on the Internet, but locating kinds you can depend on isn`t effortless. US Legal Forms provides a huge number of type layouts, such as the Nevada Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al, which are published to fulfill state and federal demands.

If you are already acquainted with US Legal Forms web site and possess a free account, merely log in. Next, you may acquire the Nevada Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al template.

Unless you have an account and want to begin using US Legal Forms, adopt these measures:

- Get the type you need and make sure it is for your right city/area.

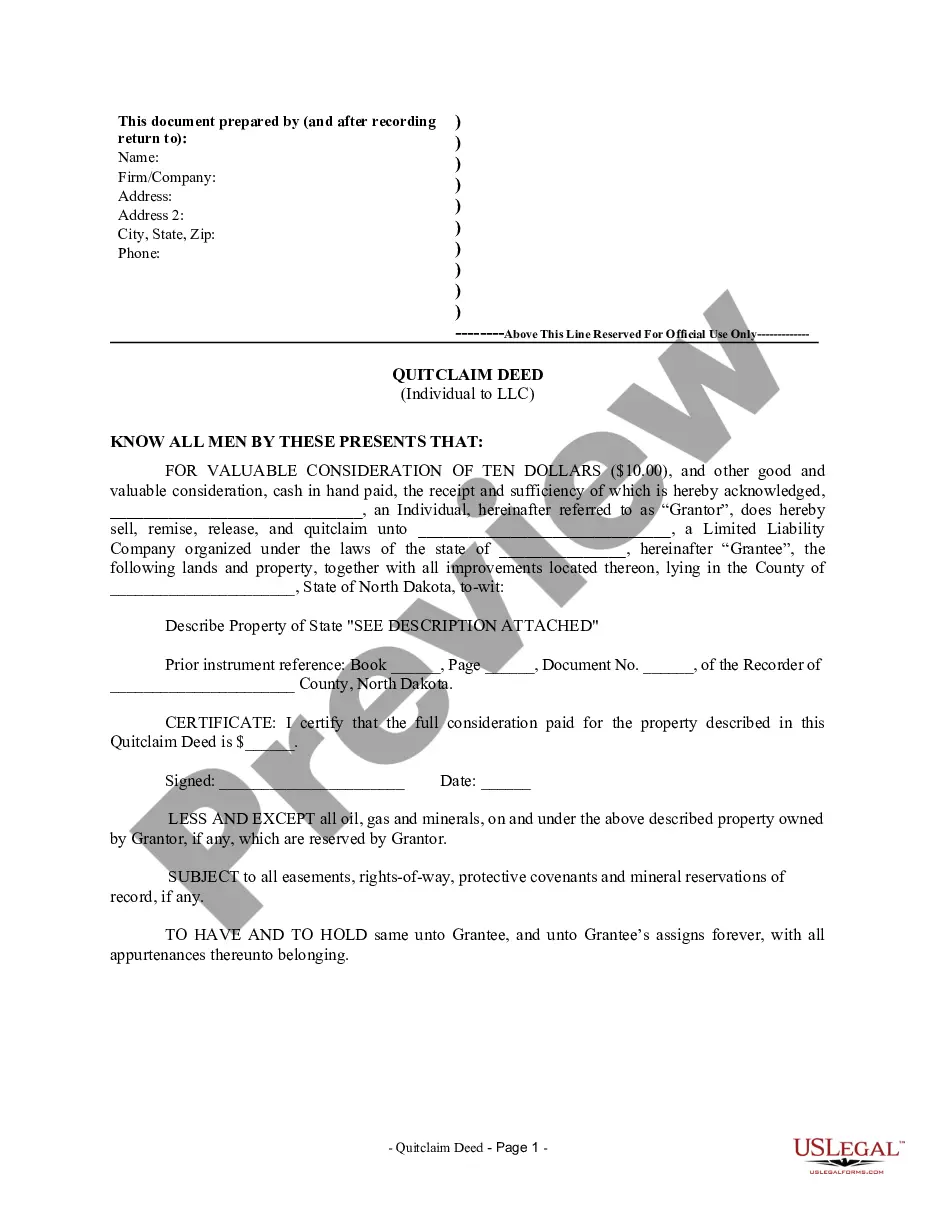

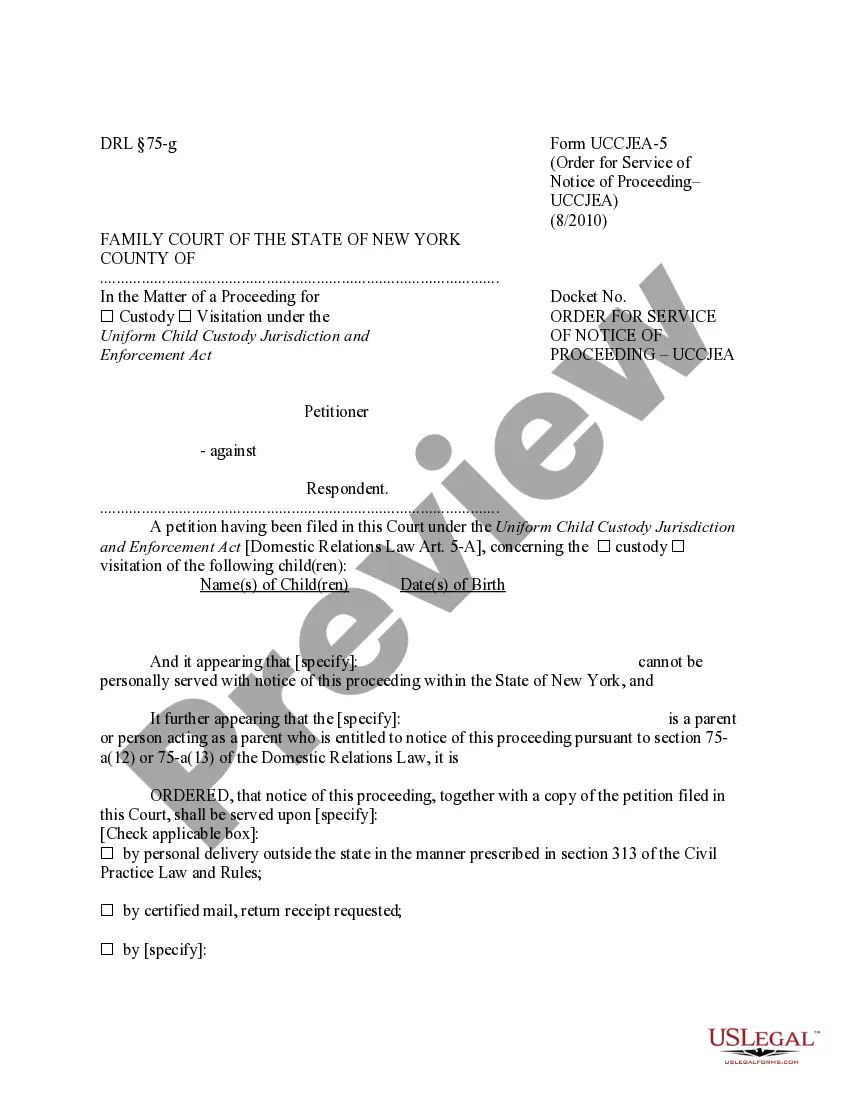

- Utilize the Review switch to review the form.

- Look at the information to ensure that you have selected the right type.

- If the type isn`t what you are searching for, take advantage of the Look for discipline to discover the type that suits you and demands.

- Once you get the right type, click Get now.

- Select the prices strategy you need, complete the required details to generate your account, and pay for your order using your PayPal or charge card.

- Decide on a hassle-free file structure and acquire your duplicate.

Get all the document layouts you possess bought in the My Forms menus. You can get a extra duplicate of Nevada Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al whenever, if necessary. Just go through the needed type to acquire or print the document template.

Use US Legal Forms, by far the most comprehensive assortment of authorized forms, to conserve time as well as avoid faults. The service provides professionally manufactured authorized document layouts that can be used for a selection of functions. Make a free account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Updated November 2, 2020: A sales partner agreement is a contract that exists between multiple business partners and is used to define what the responsibilities of the company are.

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

The sale of a partnership interest is generally treated as the sale of a capital asset. As a result, the sale of a partnership interest will generally generate capital gain or loss for the difference between the amount realized on the sale and the partner's adjusted basis in the partnership interest.

Overview. The sale of an entire partnership business generally takes one of two forms: the partners sell all of their partnership interests, or. the partnership sells some or all of its assets, and distributes the cash and any remaining property to the partners.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction.

Generally, a partner selling his partnership interest recognizes capital gain or loss on the sale. The amount of the gain or loss recognized is the difference between the amount realized and the partner's adjusted tax basis in his partnership interest.