Nevada Equity Compensation Plan

Description

How to fill out Equity Compensation Plan?

US Legal Forms - one of many most significant libraries of authorized types in the United States - offers a wide range of authorized papers themes you may down load or printing. Making use of the site, you will get thousands of types for company and personal reasons, sorted by groups, claims, or search phrases.You can find the most up-to-date models of types just like the Nevada Equity Compensation Plan within minutes.

If you already have a registration, log in and down load Nevada Equity Compensation Plan from your US Legal Forms catalogue. The Obtain key will show up on each and every kind you perspective. You have accessibility to all previously acquired types in the My Forms tab of your own bank account.

In order to use US Legal Forms for the first time, allow me to share basic directions to get you started off:

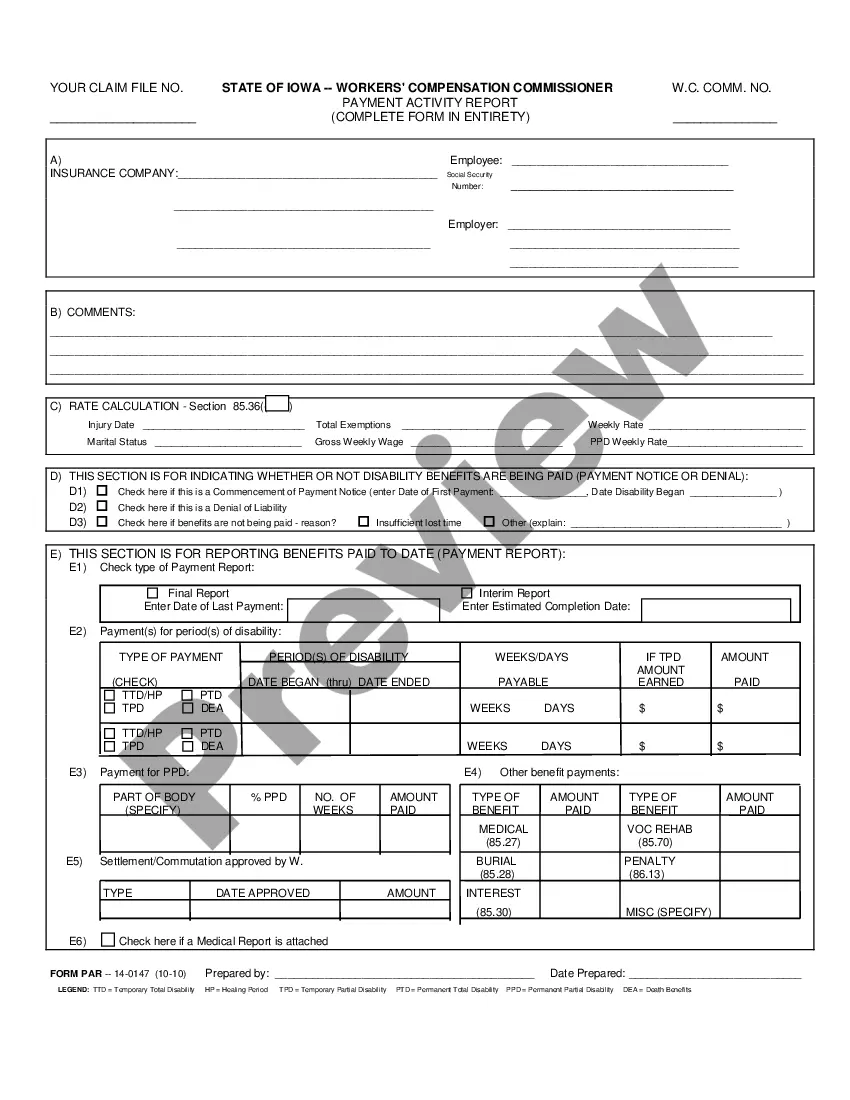

- Ensure you have picked out the proper kind for your metropolis/state. Click the Review key to check the form`s information. See the kind description to actually have chosen the proper kind.

- When the kind doesn`t satisfy your needs, make use of the Research industry towards the top of the display to discover the the one that does.

- In case you are happy with the shape, verify your choice by visiting the Acquire now key. Then, opt for the pricing program you favor and offer your qualifications to sign up for an bank account.

- Method the purchase. Use your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Choose the structure and down load the shape on your own device.

- Make alterations. Fill up, revise and printing and sign the acquired Nevada Equity Compensation Plan.

Every design you put into your money lacks an expiry time and it is your own forever. So, if you wish to down load or printing one more duplicate, just visit the My Forms portion and then click in the kind you will need.

Obtain access to the Nevada Equity Compensation Plan with US Legal Forms, the most extensive catalogue of authorized papers themes. Use thousands of expert and express-distinct themes that fulfill your organization or personal requirements and needs.

Form popularity

FAQ

FICA is the Federal Insurance Contributions Act. Contributing to FICA. As a FICA-Alternative employee, you must contribute 7.5% of your gross compensation per pay period to the Plan. Your contributions are made on a tax deferred basis.

The Plan will be administered and operated in ance with applicable legal requirements at all times, including, but not limited to, IRC Section 409A. This program is governed by the Voya Financial Advisors Deferred Compensation Plan document, as amended in the future.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

More details on the retirement plan limits are available from the IRS. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. Employees age 50 or older may contribute up to an additional $7,500 for a total of $30,500.

The Nevada Deferred Compensation Program (NDC) is a voluntary 457(b) retirement savings program for employees of the State of Nevada and other local government employers. The program is designed to supplement your PERS pension and/or other retirement savings and pensions.

A deferred compensation plan is another name for a 457(b) retirement plan, or ?457 plan? for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

The FICA alternative plan is mandatory for all part-time, seasonal, temporary, and casual employees. Contributions will be made on a pretax basis, and participants become 100 percent vested upon enrollment. The plan's vendor is Voya financial services group and offers guaranteed interest rates on all deposited funds.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.