Nevada Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock

Description

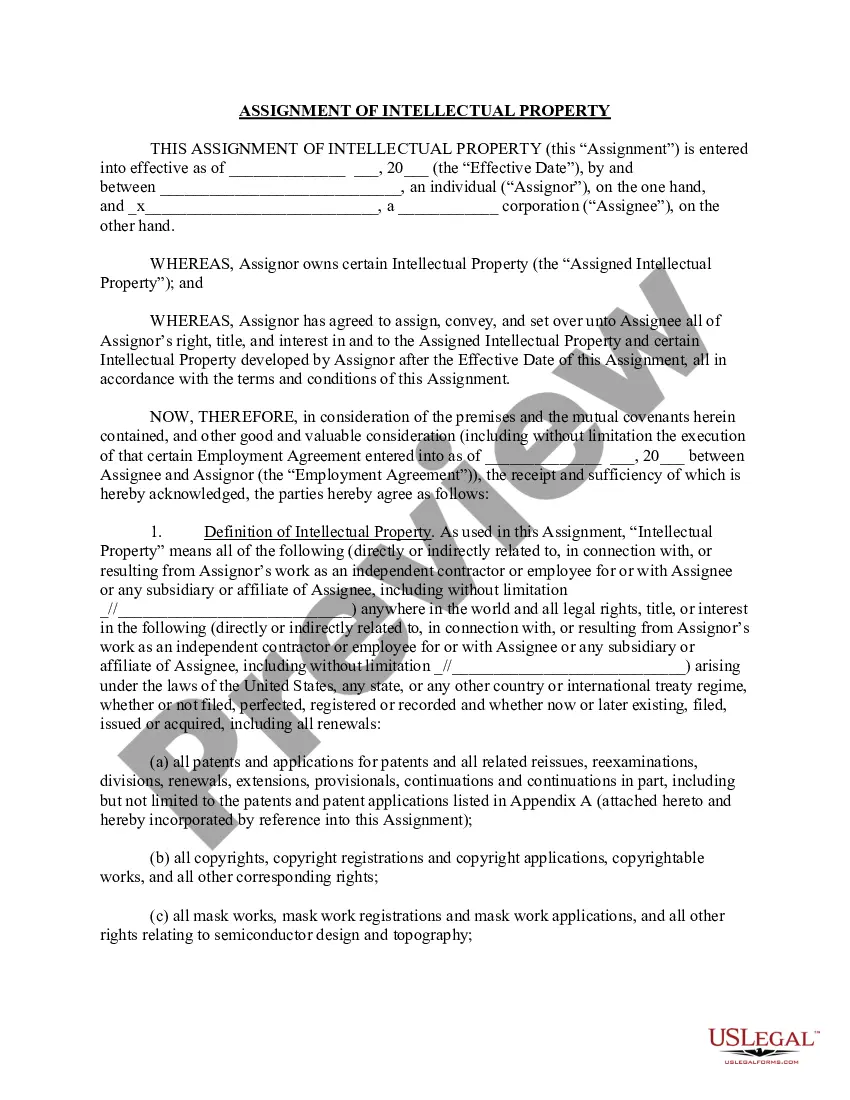

How to fill out Form Of Certificate Of Designations, Preferences And Rights Of Series C Convertible Preferred Stock?

Discovering the right legitimate document format can be a have difficulties. Needless to say, there are plenty of web templates accessible on the Internet, but how will you find the legitimate type you want? Take advantage of the US Legal Forms website. The support delivers a huge number of web templates, for example the Nevada Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, that can be used for enterprise and personal needs. All the kinds are checked out by experts and meet federal and state specifications.

Should you be previously listed, log in to the accounts and click on the Down load key to get the Nevada Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock. Utilize your accounts to search throughout the legitimate kinds you might have acquired formerly. Go to the My Forms tab of your own accounts and have one more version in the document you want.

Should you be a new customer of US Legal Forms, listed here are basic recommendations that you should adhere to:

- Very first, make sure you have chosen the appropriate type for the city/area. It is possible to look through the form while using Review key and look at the form outline to make certain this is the best for you.

- In case the type fails to meet your needs, take advantage of the Seach area to find the right type.

- Once you are positive that the form is suitable, click the Buy now key to get the type.

- Pick the prices strategy you desire and enter the necessary information. Design your accounts and pay for your order using your PayPal accounts or bank card.

- Select the data file formatting and download the legitimate document format to the gadget.

- Total, modify and print out and signal the acquired Nevada Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock.

US Legal Forms is the greatest catalogue of legitimate kinds where you can find a variety of document web templates. Take advantage of the service to download professionally-made papers that adhere to condition specifications.

Form popularity

FAQ

What Is Convertible Preferred Stock? Convertible preferred stocks are preferred shares that include an option for the holder to convert them into a fixed number of common shares after a predetermined date.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

If a preferred stock is redeemable, it means that the issuing company can exchange those shares for cash, while convertible shares can be exchanged by the shareholder for common stock.

With a redeemable debenture, the issuer must fully repay their debt by the bond's maturity date. A third categorisation method is convertibility. A convertible debenture can be converted into the issuer's equity shares after a specific period and under the conditions specified in the debenture certificate.

Normally, the preferential rights are the rights to fixed dividends, priority to dividends over ordinary shares and to a return of capital when the company goes into liquidation. Redeemable preference shares allow for the repayment of the principal share capital to shareholders.

Convertible preferred shares typically pay a fixed cash dividend out of a company's retained earnings. Convertible bonds pay a coupon rate, which is a periodic interest payment.

Series C Convertible Preferred Stock means the Series C Convertible Redeemable Preferred Stock, par value $. 01 per share, of the Company, having the same voting rights as the Class A Common Stock determined on an as converted basis.

Convertible preference shares are those shares that can be easily converted into equity shares. Non-Convertible preference shares are those shares that cannot be converted into equity shares.