Nevada Authorization to increase bonded indebtedness

Description

How to fill out Authorization To Increase Bonded Indebtedness?

You may spend hrs on the web searching for the authorized record template that fits the federal and state specifications you want. US Legal Forms offers a huge number of authorized types which are examined by experts. You can actually down load or print the Nevada Authorization to increase bonded indebtedness from your assistance.

If you already possess a US Legal Forms profile, you can log in and click on the Download key. Following that, you can total, revise, print, or signal the Nevada Authorization to increase bonded indebtedness. Every single authorized record template you buy is yours eternally. To obtain another duplicate associated with a obtained form, proceed to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site initially, follow the simple instructions beneath:

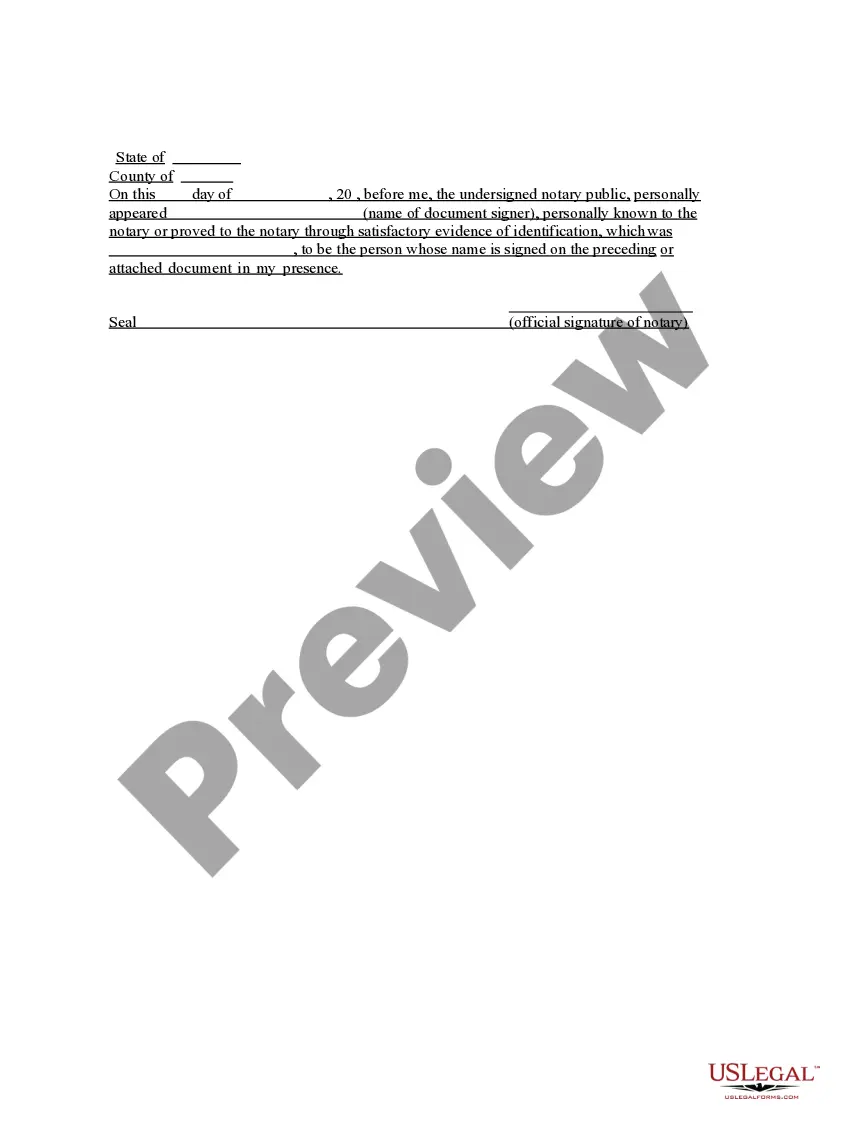

- Initially, ensure that you have selected the correct record template for your state/town of your choosing. Look at the form information to make sure you have selected the correct form. If accessible, make use of the Review key to check through the record template too.

- If you would like find another version from the form, make use of the Look for industry to obtain the template that suits you and specifications.

- Upon having discovered the template you need, just click Acquire now to carry on.

- Choose the costs program you need, type in your accreditations, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal profile to fund the authorized form.

- Choose the formatting from the record and down load it to the gadget.

- Make adjustments to the record if necessary. You may total, revise and signal and print Nevada Authorization to increase bonded indebtedness.

Download and print a huge number of record themes while using US Legal Forms website, which provides the biggest assortment of authorized types. Use specialist and condition-particular themes to take on your company or person needs.

Form popularity

FAQ

The Monetary Limit is the maximum contract a licensed contractor may undertake on one or more construction contracts on a single construction site or subdivision site for a single client.

? This license allows for the construction and remodeling of houses and other structures which support, shelter or enclose persons or animals or other chattels, and which do not extend more than 3 stories above ground and 1 story below ground.

You don't need a license to work as a handyman in Nevada. However, if you plan to take on projects which require a building license or have a value of $1,000 or more (including labor and materials), you must have a Nevada general contractor license issued by the Nevada State Contractors Board.

A person who holds a classification C-5 license may: - Prepare the surface and place reinforcement steel and other embedded materials essential to or comprising an integral part of the concrete or concrete construction; - pour, place, finish and concrete; - construct and assemble forms, molds, slipforms and ...

General contractor license fees You must pay a non-refundable application fee of $300. Upon approval, you'll pay $600 for a two-year license (one-year licenses are not available). While not a fee, residential contractors are also required to contribute to a Residential Recovery Fund for the state of Nevada.

The bond must be written by a surety company authorized to transact business in the State of Nevada, and whose long-term obligations are rated ?A? or better. An applicant or licensee can post a cash deposit In lieu of a surety bond. Cash deposits must be in the form of a Cashier's Check for the full amount of the bond.