Nevada Form of Note

Description

How to fill out Form Of Note?

If you have to total, acquire, or printing legitimate papers templates, use US Legal Forms, the most important variety of legitimate types, that can be found on the web. Use the site`s simple and convenient lookup to get the documents you want. Numerous templates for enterprise and personal functions are categorized by categories and states, or keywords. Use US Legal Forms to get the Nevada Form of Note in a handful of clicks.

Should you be previously a US Legal Forms buyer, log in to the accounts and then click the Down load key to obtain the Nevada Form of Note. Also you can accessibility types you earlier delivered electronically within the My Forms tab of your respective accounts.

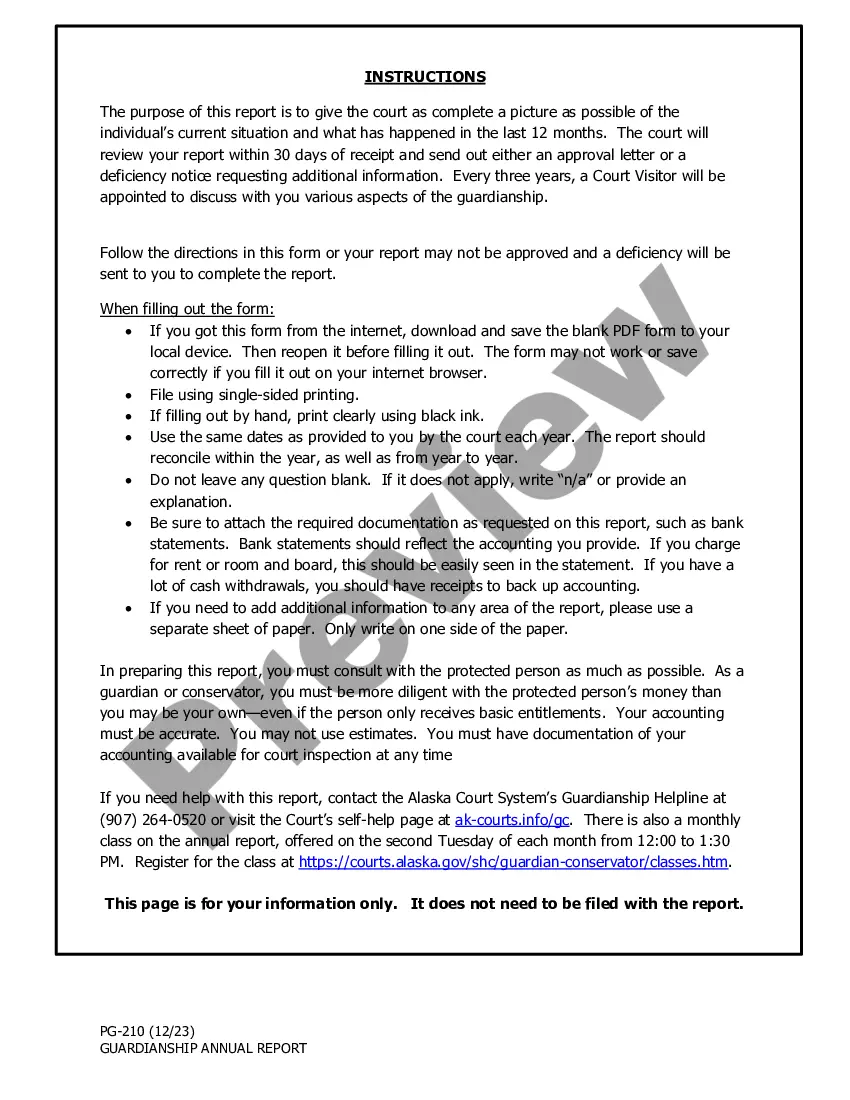

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that right area/land.

- Step 2. Utilize the Review solution to look through the form`s information. Do not overlook to read through the explanation.

- Step 3. Should you be not happy using the type, make use of the Look for area towards the top of the monitor to get other versions of the legitimate type web template.

- Step 4. Once you have discovered the form you want, click the Purchase now key. Pick the rates prepare you choose and put your credentials to sign up to have an accounts.

- Step 5. Process the purchase. You can use your bank card or PayPal accounts to perform the purchase.

- Step 6. Pick the format of the legitimate type and acquire it on the gadget.

- Step 7. Complete, modify and printing or indication the Nevada Form of Note.

Each legitimate papers web template you purchase is your own eternally. You possess acces to each and every type you delivered electronically in your acccount. Go through the My Forms section and pick a type to printing or acquire once again.

Compete and acquire, and printing the Nevada Form of Note with US Legal Forms. There are millions of expert and condition-particular types you can use for your personal enterprise or personal needs.

Form popularity

FAQ

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

The promissory note could be declared invalid if it doesn't reveal the amount that the borrower owes the lender, or what installments are due. If there are multiple installments, then include each installment's due date.

A California Promissory Note form is a binding document outlining the terms of a loan agreement. This Promissory Note Agreement is between a borrower and a lender in the state of California. It contains fundamental information, such as the loan sum, rate of interest, and payment plan.

The promissory note is paper evidence of the debt that the borrower has incurred. It outlines the amount of the loan, the interest rate to be paid, and either the date when it needs to be paid in full or the repayment schedule. ?Basically, a promissory note is a promise to pay back money.

A California promissory note template is a document designed to add security and structure to agreements involving the lending of money between two parties. Included in the document are sections that address late fees, interest rates, details on both parties, and other sections involving pertinent information.