Nevada Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

Are you presently in a position the place you need to have files for both organization or individual functions nearly every time? There are a lot of authorized document web templates accessible on the Internet, but discovering types you can rely on isn`t simple. US Legal Forms delivers a large number of kind web templates, much like the Nevada Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split, which are composed to fulfill state and federal specifications.

In case you are previously familiar with US Legal Forms site and get a free account, just log in. Next, you may acquire the Nevada Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split web template.

If you do not offer an account and wish to start using US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for the appropriate city/county.

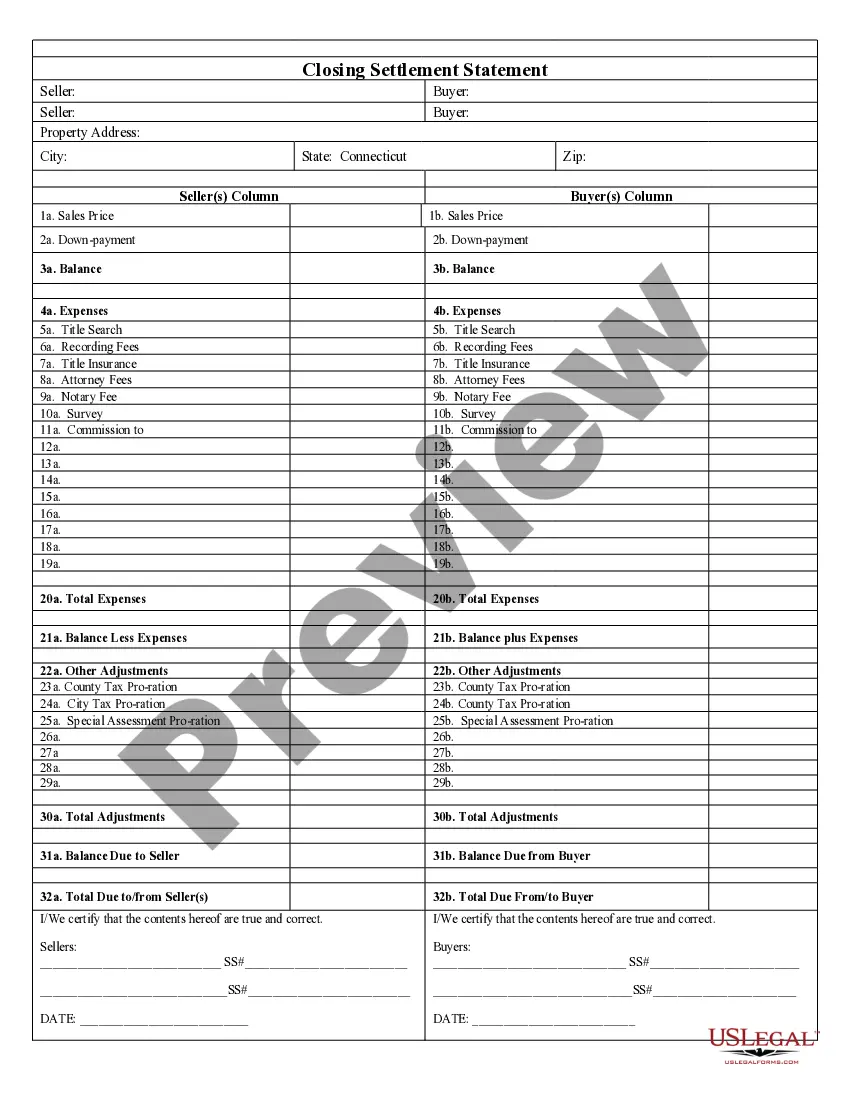

- Utilize the Review option to check the form.

- See the information to ensure that you have selected the proper kind.

- If the kind isn`t what you`re searching for, use the Lookup area to get the kind that meets your needs and specifications.

- Once you get the appropriate kind, simply click Acquire now.

- Select the pricing prepare you need, fill in the desired info to generate your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Choose a practical data file format and acquire your duplicate.

Discover all of the document web templates you may have purchased in the My Forms food list. You can get a additional duplicate of Nevada Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split any time, if necessary. Just go through the necessary kind to acquire or printing the document web template.

Use US Legal Forms, probably the most considerable variety of authorized forms, to save lots of time and prevent errors. The support delivers appropriately made authorized document web templates that you can use for a selection of functions. Generate a free account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

One of the few and arguably best trades in the market, is to short a stock that is going through a reverse stock split ? it will go invariably back down. This is because the stock performed so horribly, that the board of directors had to sit down and create a new facelift for the company.

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

A reverse stock split may be used to reduce the number of shareholders. If a company completes a reverse split in which 1 new share is issued for every 100 old shares, any investor holding fewer than 100 shares would simply receive a cash payment.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

If a company does not reduce its authorized shares in proportion to a reverse split?and it can elect not to do so?the company will be able to issue more shares in the future which will dilute the existing shares that were reduced as a result of the reverse stock split.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.