Nevada Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

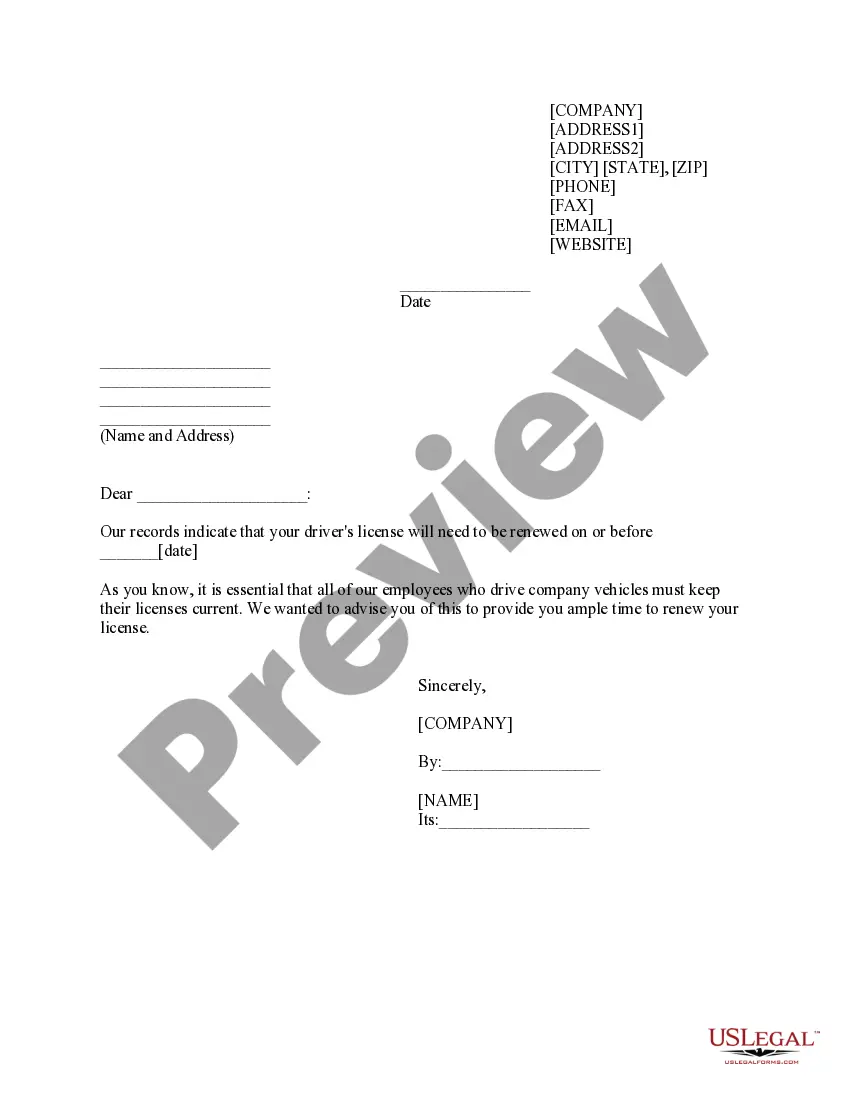

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

US Legal Forms - among the greatest libraries of lawful kinds in America - provides an array of lawful file templates it is possible to obtain or printing. Utilizing the site, you will get a large number of kinds for company and individual purposes, sorted by groups, suggests, or search phrases.You will discover the latest models of kinds such as the Nevada Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights within minutes.

If you currently have a membership, log in and obtain Nevada Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights through the US Legal Forms collection. The Down load switch will show up on every kind you view. You gain access to all earlier downloaded kinds inside the My Forms tab of your account.

In order to use US Legal Forms for the first time, listed here are easy directions to help you get started:

- Be sure to have picked the right kind to your city/area. Select the Preview switch to examine the form`s information. Browse the kind description to actually have chosen the appropriate kind.

- In the event the kind doesn`t match your needs, use the Look for industry near the top of the monitor to get the one who does.

- If you are pleased with the shape, affirm your choice by simply clicking the Get now switch. Then, pick the rates prepare you favor and supply your accreditations to sign up on an account.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal account to finish the financial transaction.

- Find the file format and obtain the shape on the gadget.

- Make alterations. Fill up, edit and printing and indicator the downloaded Nevada Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Every single design you included with your money lacks an expiration date and is also the one you have forever. So, in order to obtain or printing yet another version, just check out the My Forms section and click on in the kind you want.

Obtain access to the Nevada Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights with US Legal Forms, one of the most substantial collection of lawful file templates. Use a large number of professional and express-distinct templates that meet your company or individual needs and needs.

Form popularity

FAQ

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares. NSO stock options and notable differences between ISO and RSU forgeglobal.com ? insights ? blog ? nso-stock-opti... forgeglobal.com ? insights ? blog ? nso-stock-opti...

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income. Incentive Stock Options (ISO): Definition and Meaning - Investopedia investopedia.com ? terms ? iso investopedia.com ? terms ? iso

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Non-qualified stock options are more straightforward, as the tax implications at exercise are generally agreed to be easier to understand. Incentive stock options, while more complicated, offer the opportunity for long-term capital gains if you meet the requisite holding period requirements. Comparing Incentive Stock Options and Non Qualified Stock Options zajacgrp.com ? insights ? comparing-incentive-sto... zajacgrp.com ? insights ? comparing-incentive-sto...

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them. What is a stock grant? | Global HR glossary | Oyster® oysterhr.com ? glossary ? stock-grant oysterhr.com ? glossary ? stock-grant

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.