Nevada Reimbursable Travel Expenses Chart

Description

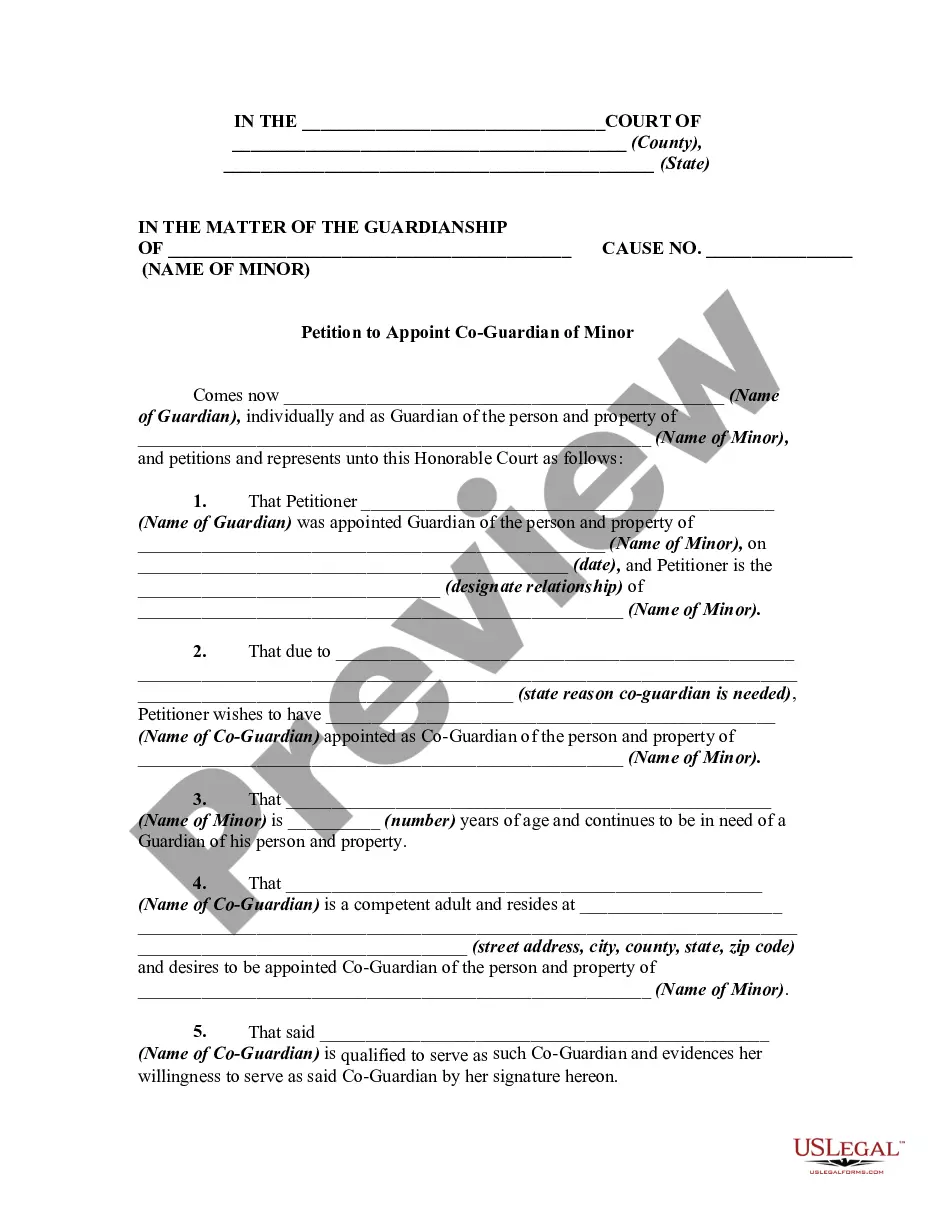

How to fill out Reimbursable Travel Expenses Chart?

US Legal Forms - among the largest libraries of authorized types in America - gives an array of authorized papers themes it is possible to obtain or printing. While using website, you can get a huge number of types for enterprise and personal uses, categorized by classes, says, or key phrases.You can get the newest versions of types such as the Nevada Reimbursable Travel Expenses Chart in seconds.

If you currently have a registration, log in and obtain Nevada Reimbursable Travel Expenses Chart through the US Legal Forms catalogue. The Obtain button can look on every type you view. You get access to all previously delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, listed here are straightforward guidelines to help you began:

- Make sure you have chosen the proper type to your town/state. Click on the Preview button to review the form`s content. Read the type outline to ensure that you have selected the appropriate type.

- In the event the type doesn`t satisfy your requirements, utilize the Lookup industry near the top of the display screen to get the one that does.

- Should you be pleased with the form, verify your decision by clicking on the Purchase now button. Then, opt for the rates program you prefer and offer your qualifications to sign up for an account.

- Method the deal. Make use of credit card or PayPal account to accomplish the deal.

- Pick the file format and obtain the form in your device.

- Make changes. Load, modify and printing and indicator the delivered electronically Nevada Reimbursable Travel Expenses Chart.

Each and every format you put into your account does not have an expiration particular date and is yours permanently. So, if you want to obtain or printing yet another backup, just proceed to the My Forms section and click on the type you will need.

Obtain access to the Nevada Reimbursable Travel Expenses Chart with US Legal Forms, by far the most considerable catalogue of authorized papers themes. Use a huge number of expert and express-particular themes that meet your business or personal demands and requirements.

Form popularity

FAQ

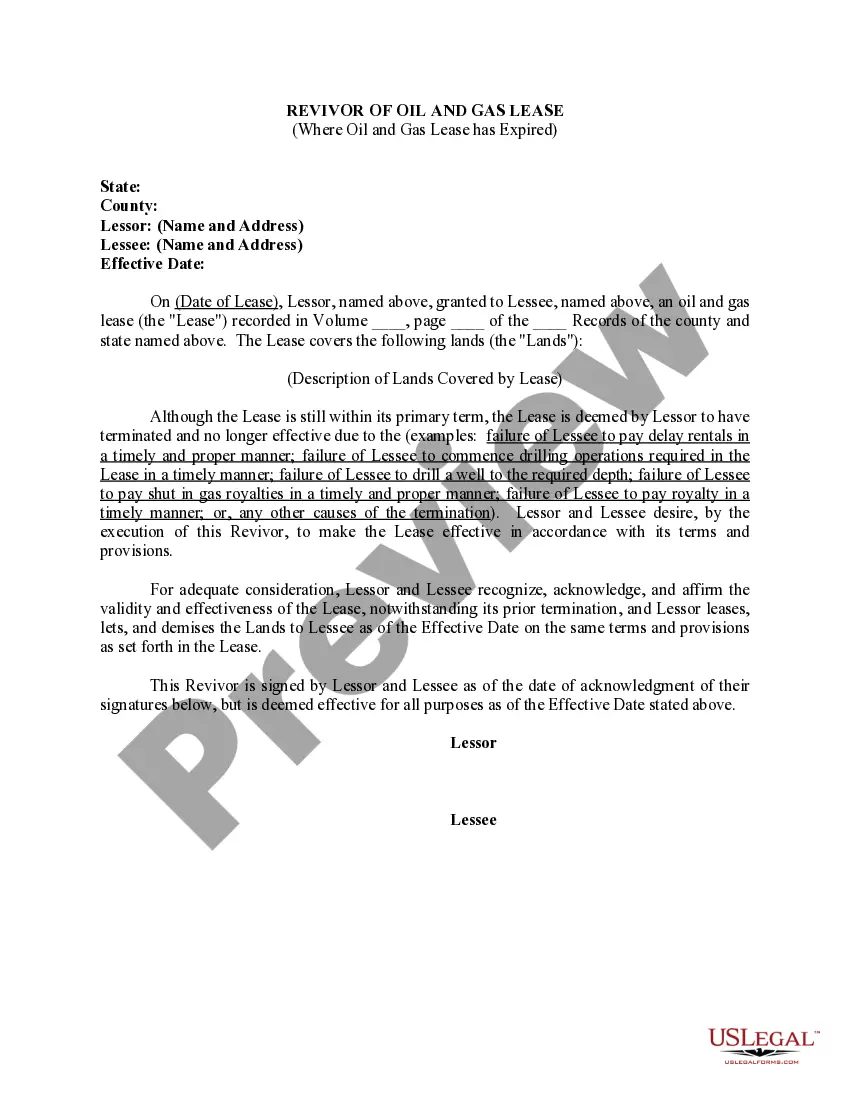

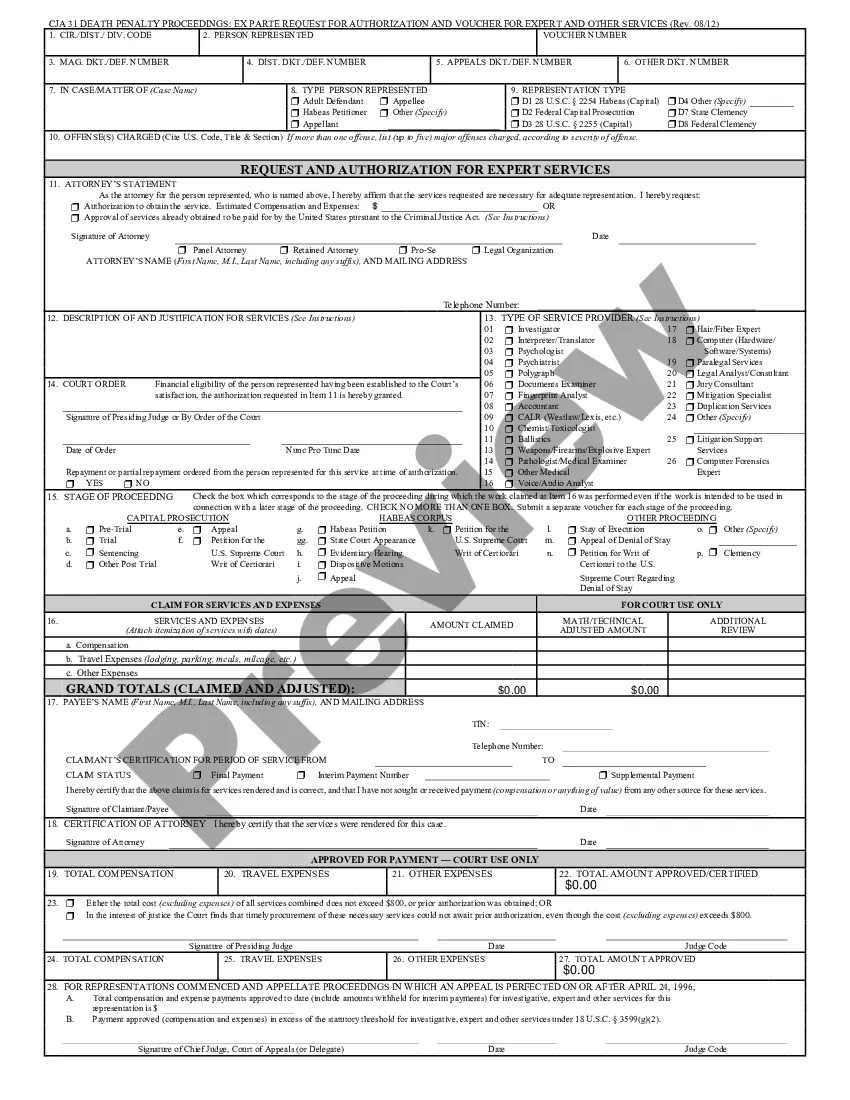

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation. Mileage reimbursement is typically set at a per-mile rate usually below $1 per mile.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

On the federal level, there is no requirement for employers to reimburse employees for mileage when using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point.

Reimbursement of travel expenses is based on documentation of reasonable and actual expenses supported by the original, itemized receipts where required. Reimbursements that may be paid by Company Name are shown below. Airfare.

Beginning January 1, 2021, the optional standard mileage rates are: 56 cents per mile driven for business use. 16 cents per mile driven for medical or moving purposes.

Non-Reimbursable ExpensesContracted services of any type are not reimbursable to employees.Annual fees for personal charge or credit cards.Baby-sitting.Vehicle cleaning.Corporate credit card delinquency fees / finance charges / annual charges.Expenses incurred on personal side trips while on business trip.More items...

Travel expense and mileage reimbursements in NevadaPrivate employers are not required to reimburse employees for business-related travel expenses in Nevada, but many do anyway.

A reimbursable expense is an expense that a business incurs on behalf of the customer while conducting their business. These expenses may include travel, delivery fees, currency conversion fees, office expenses, and business phone calls.

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

A: The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses are generally reimbursable expenses.