Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you require to obtain, download, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Take advantage of the site's straightforward and efficient search to find the documents you need.

Numerous templates for corporate and personal use are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you want, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Nevada Personal Guaranty - Assurance of Agreement for the Lease and Purchase of Real Estate in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Nevada Personal Guaranty - Assurance of Agreement for the Lease and Purchase of Real Estate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your relevant city/state.

- Step 2. Utilize the Review option to examine the form’s details. Don't forget to review the information.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other versions in the legal form template.

Form popularity

FAQ

A guarantor clause is a provision in a contract that outlines the responsibilities of a guarantor regarding financial obligations. For instance, in a lease agreement, a guarantor may agree to cover unpaid rent or damages in case the tenant defaults. This is especially important in the context of the Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as it adds an extra layer of security for landlords and property owners. Utilizing platforms like USLegalForms can help you draft clear and effective guarantor clauses that protect all parties involved.

Yes, it is quite normal to have a personal guarantee on a commercial lease, as it protects the landlord from potential losses. Many landlords require this to reduce their risk, especially if the business is newly established or lacks an extensive financial history. If you are navigating this process, you can find helpful templates and guidance at USLegalForms, specifically tailored for a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

The primary purpose of a personal guarantee is to provide assurance to landlords or lenders that lease obligations will be met. It helps create trust in the transaction, especially in cases where the lessee may not have a substantial credit history. In Nevada, such a guarantee strengthens agreements and can facilitate smoother business operations, serving as a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Being a personal guarantor involves several risks that require careful consideration. The most significant risk is the financial liability if the lessee defaults in payments or breaches the lease terms. This can lead to personal financial strain, especially if the obligations are substantial. Understanding these risks can help you make informed decisions, and resources like USLegalForms can guide you through a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guarantee for a lease is a commitment by an individual to take personal responsibility for the lease obligations. If the primary tenant fails to uphold the lease terms, the guarantor agrees to cover the costs, protecting the landlord’s interests. This assurance can be particularly important in commercial real estate, where solid agreements are vital, including those defined as a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

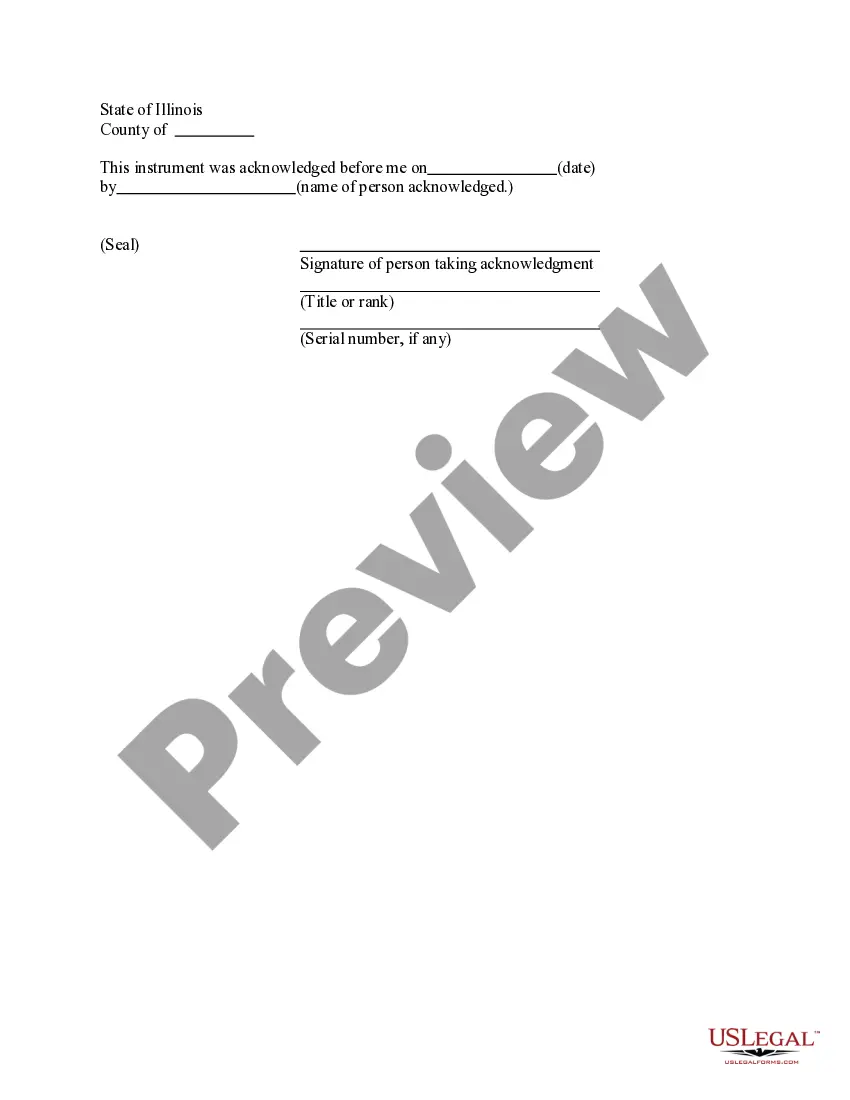

In many cases, notarization adds credibility to a personal guarantee, especially in Nevada. While it may not be legally required for every situation, having it notarized can enhance its enforceability in court. To ensure you meet any specific requirements, you can refer to resources from USLegalForms, which provide guidelines for a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Filling out a personal guaranty requires specific steps to ensure its validity. First, provide your full name and contact information, as well as the details of the lease or purchase agreement. Next, clearly state your intention to guarantee the obligations of the lease or contract. Finally, sign and date the document, which can typically be done easily using platforms like USLegalForms that offer state-specific templates tailored for a Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guarantee clause typically includes language that states the individual agrees to be personally responsible for fulfilling obligations outlined in the contract. For instance, it may say, 'I, Guarantor's Name, unconditionally guarantee the payment of all obligations related to the Nevada Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.' This clause ensures that the guarantor is legally bound to cover any defaults by the tenant or buyer.

Filling out a personal guarantee can be straightforward. Start by clearly identifying the parties involved and the obligations being guaranteed. Then, include specific details about the lease or purchase of real estate associated with the Nevada Personal Guaranty. Finally, ensure all signatures are collected and consider having the document reviewed by a legal professional to confirm its adequacy.