Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

If you need to finalize, obtain, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded within your account.

Stay competitive and obtain, and print the Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Obtain option to access the Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock.

- You can even retrieve forms you have previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, please follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific city/state.

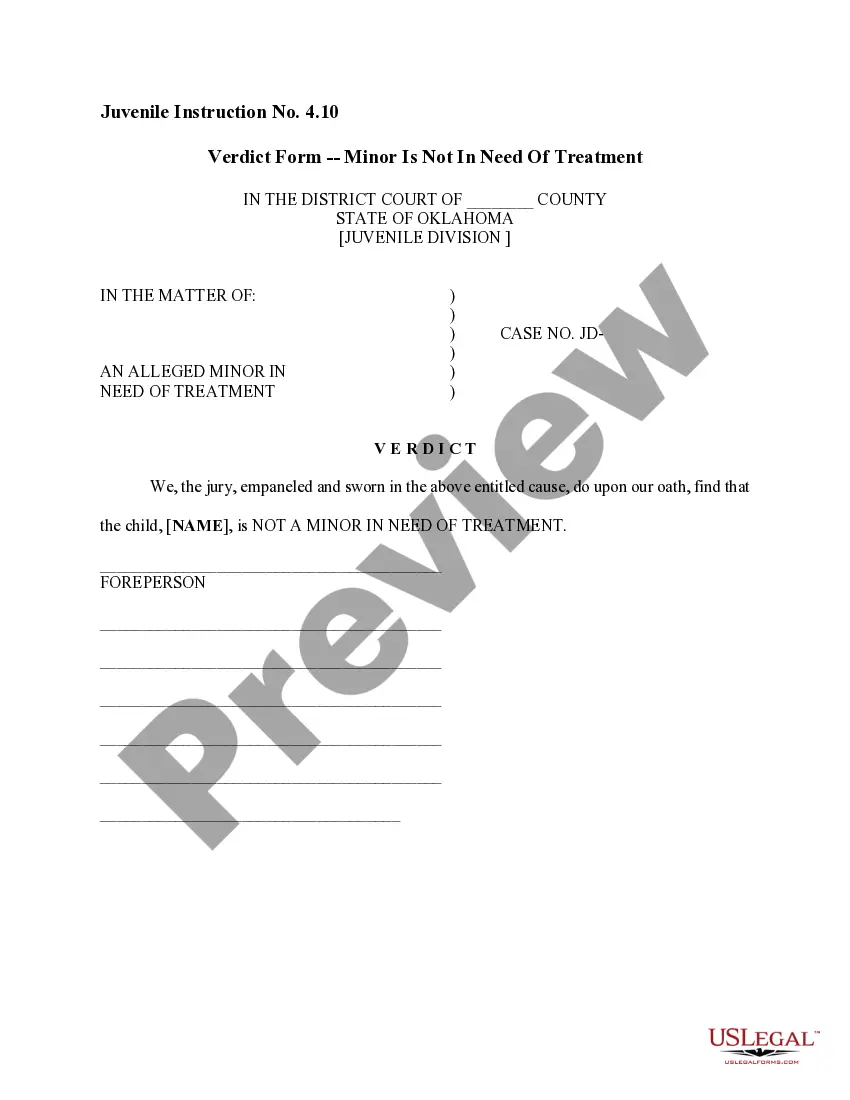

- Step 2. Utilize the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to discover other variants of the legal form template.

- Step 4. Once you find the form you need, click the Get now option. Select your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the purchase process. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock.

Form popularity

FAQ

The business judgment rule in Nevada protects LLC members and managers when making business decisions. Under this principle, the Nevada Resolution of Meeting of LLC Members to Sell or Transfer Stock comes into play, guiding members in taking appropriate actions without fear of legal liability. This rule assumes that members act in the best interest of the company, allowing for healthy risk-taking and decision-making. Consequently, it fosters a productive business environment where thoughtful decisions can lead to growth.

Structure: A series LLC is a type of master LLC that constitutes several sub LLC's or a series of business divisions with separate members or managers and assets. A Nevada restricted LLC is like a traditional LLC and does not have separate members or assets under divisions or series.

NRS 86.138 Company records: Manner of storage; conversion of electronic records into clear and legible paper form; admissibility in evidence of electronic records. ORGANIZATION. NRS 86.141 Purpose for organization; prohibition against organization of limited-liability company for certain illegal purposes.

A corporation is a legal entity that is separate and distinct from its owners. Under the law, corporations possess many of the same rights and responsibilities as individuals. They can enter contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes.

You can't simply gift an interest in profits. If the LLC were to distribute its assets, the LLC operating agreement must provide for the donee to receive a share of the assets on dissolution or if the donee withdraws from the LLC. If the donor provides services to the LLC, she must be reasonably compensated.

In operation, a close corporation is a corporation whose shareholders and directors are entitled to operate much like a partnership. Typically, shareholders must agree unanimously to close corporation status, and a written shareholders' agreement governing the affairs of the corporation must be drafted.

Under Chapter 78 of the Nevada Revised Statutes (Nevada Corporations Act) (NRS 78.010 et seq.), a corporation may, but need not, adopt bylaws consistent with federal and Nevada law for: The management, regulation, and government of its affairs and property.

NRS 78.347 Application by stockholder for order of court appointing custodian or receiver; requirements of custodian; authority of custodian; adoption of regulations by Secretary of State.

Member/Manager Information of LLCs Unlike some states, Nevada does not require members or managers to live in the state itself. In order to successfully form an LLC, you must be 18+ years old and file your articles of organization.

For details you may call (775) 684-5708, visit , or write to the Secretary of State, 202 North Carson Street, Carson City, NV 89701-4201. 2. REGISTERED AGENT: Persons wishing to incorporate in the State of Nevada must designate a person as a registered agent who resides or is located in this state.