Nevada Use of Company Equipment

Description

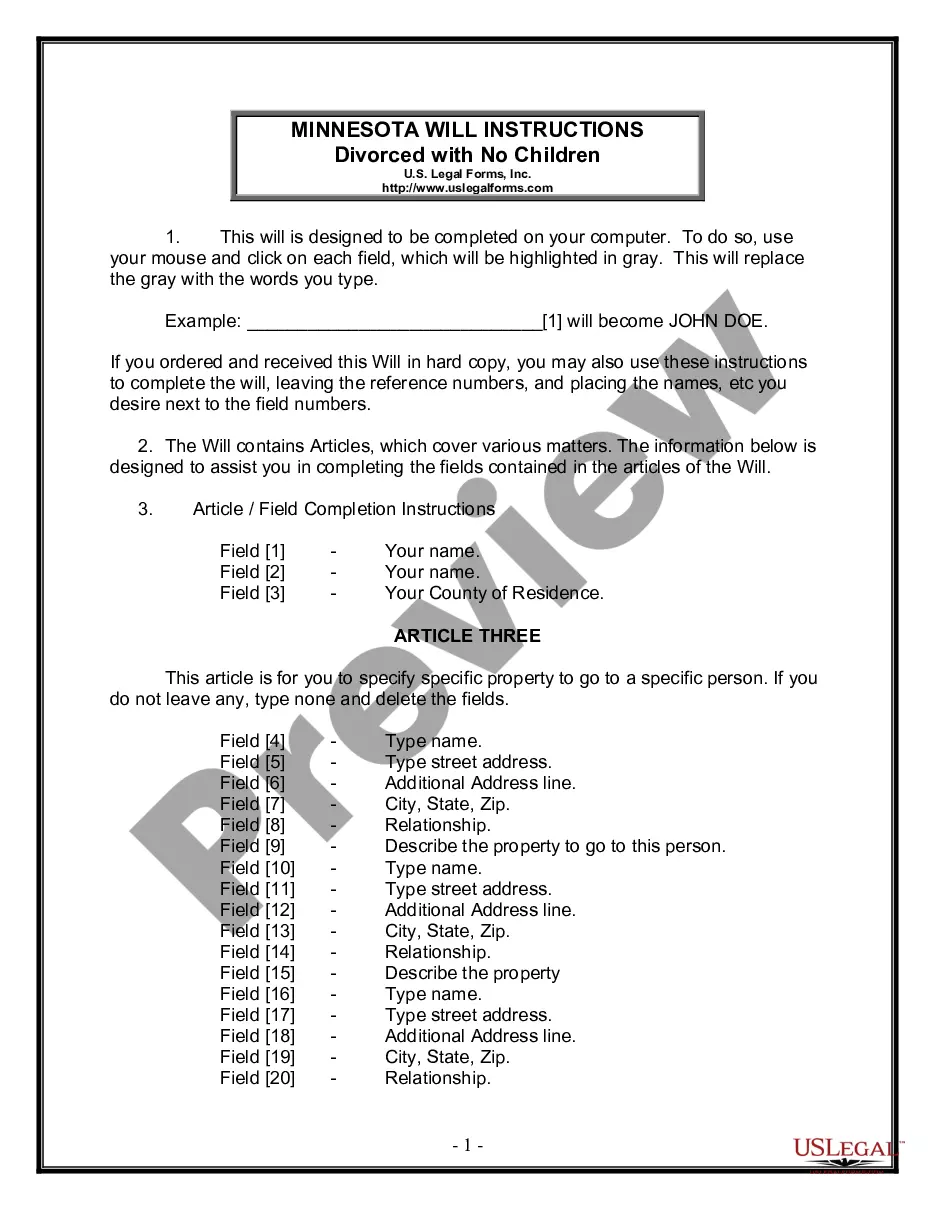

How to fill out Use Of Company Equipment?

Locating the appropriate authentic document template can be quite challenging.

Of course, there are numerous designs available online, but how do you locate the genuine form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Nevada Use of Company Equipment, suitable for both business and personal use.

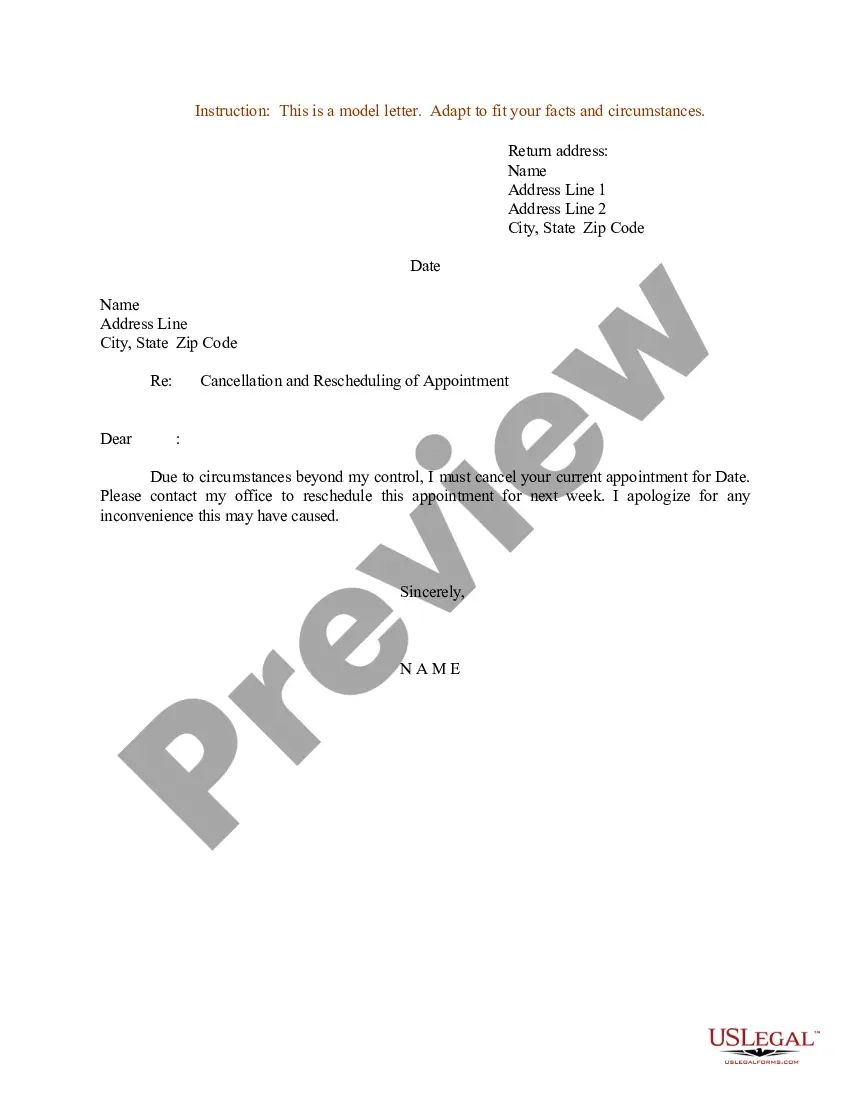

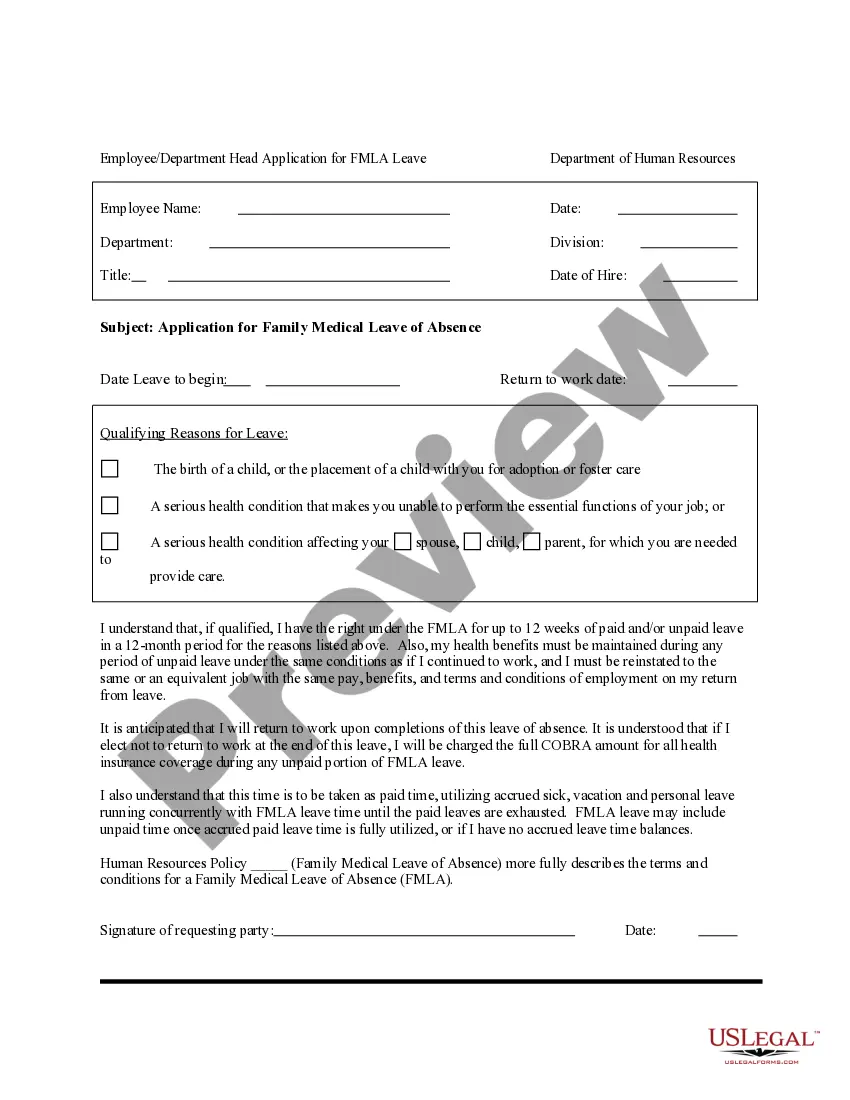

If the form does not satisfy your needs, use the Search box to find the appropriate form. Once you are confident that the form is correct, click the Buy now button to acquire the form. Choose your desired pricing plan and fill in the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Nevada Use of Company Equipment. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Utilize the service to access professionally crafted documents that comply with state regulations.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and then select the Download option to obtain the Nevada Use of Company Equipment.

- Use your account to browse through the legal forms you may have purchased previously.

- Visit the My documents section of your account to get another copy of the document you require.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your city/county. You can preview the form with the Review option and read the form description to confirm it is right for you.

Form popularity

FAQ

Any purchase, other than inventory, made by a retailer from a non-registered vendor, for use in the business, is subject to Use Tax and must be reported on the monthly or quarterly Sales and Use Tax return. Examples of this are supplies, forms, or equipment that is not re-sold.

Examples: A person buys a vehicle from a dealer in a neighboring state and the dealer does not charge sales tax on the vehicle. The buyer must pay use tax on the purchase price of the vehicle when he/she returns to his/her state and/or city.

All purchases of tangible personal property by mail order or from catalogs are subject to Use Tax if Nevada Sales Tax is not charged by the seller.

Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Yes. Inventory tax is a taxpayer active tax. That means that it must be calculated by the taxpayer (business owner). Unsold inventory should be counted and valued based on one of the three accepted valuation methods: cost, retail, or lower of cost or retail.

Nevada has NO Inventory Tax on inventories held for sale within Nevada or for interstate transit.

Consumer Use TaxesIf you purchase taxable property or services by phone, from catalogs, or on the Internet, and the property or services are delivered into Nevada; If you purchase taxable property from a seller who is located outside of Nevada and the property is delivered into or used in Nevada; or.

Sales of machinery are subject to sales tax in Nevada. Sales of raw materials are exempt from the sales tax in Nevada. Sales of utilities & fuel are subject to sales tax in Nevada.

Traditional Goods or Services Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.