Nevada Home based Worker Checklist

Description

How to fill out Home Based Worker Checklist?

If you wish to acquire, obtain, or produce legal document templates, utilize US Legal Forms, the most extensive selection of legal documents accessible online.

Take advantage of the site’s straightforward and user-friendly search function to find the documents you require.

A variety of templates for business and personal purposes are organized by categories, states, or keywords.

Every legal document template you acquire is yours permanently. You will have access to every document you have downloaded in your account.

Select the My documents section to choose a document for printing or downloading again. Complete and download, and print the Nevada Home-based Worker Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to access the Nevada Home-based Worker Checklist in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the Nevada Home-based Worker Checklist.

- You can also view templates you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

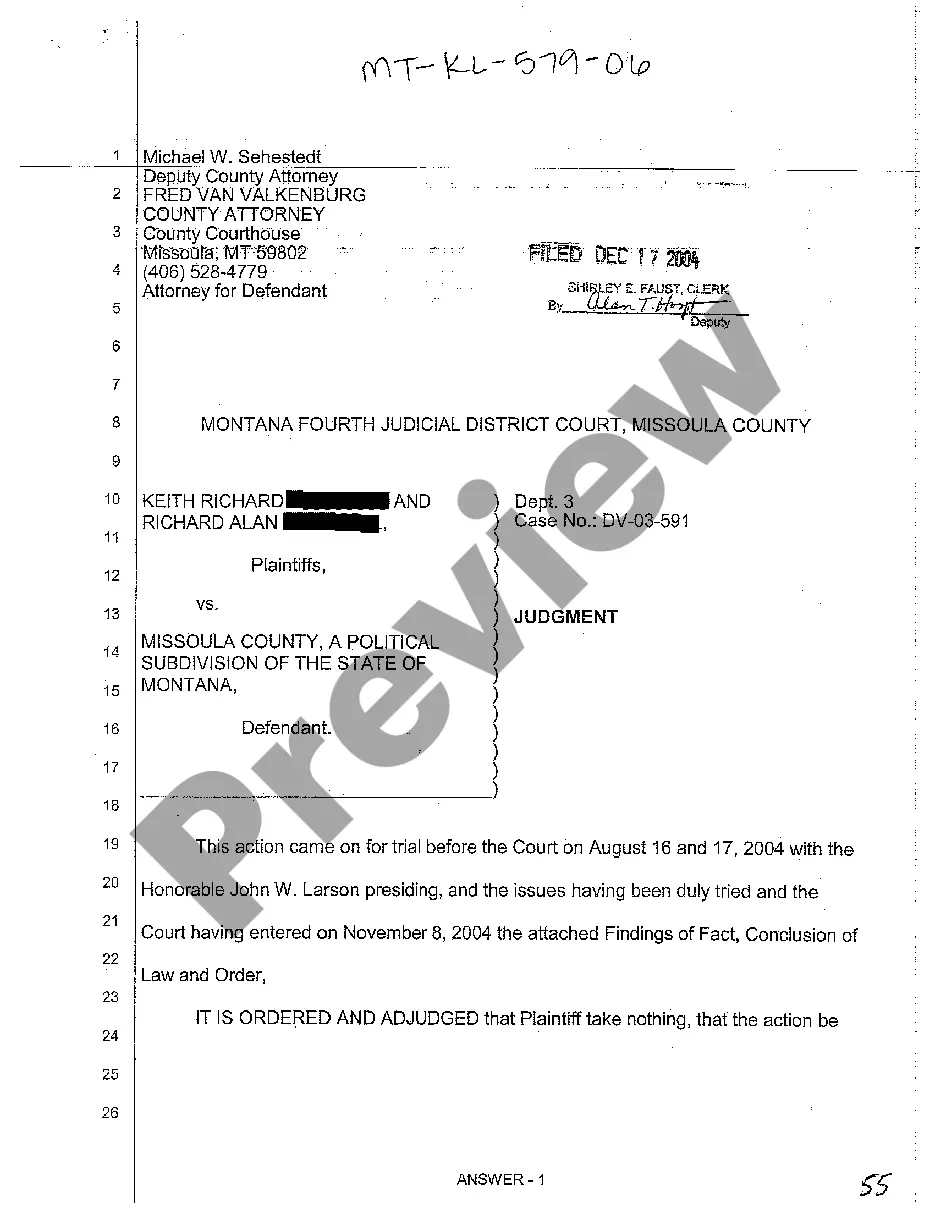

- Step 2. Use the Review option to examine the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have located the required form, click the Get now button. Choose your desired payment plan and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nevada Home-based Worker Checklist.

Form popularity

FAQ

Yes, in Nevada, a 16-year-old needs a work permit to legally work. This permit ensures that minors are protected in the workplace and can only work under safe conditions. If you are a young worker or a parent, using the Nevada Home based Worker Checklist will help you navigate this requirement smoothly.

based business should be one that has no impact on the neighborhood and is essentially invisible to the neighbors. occupation permit is required and there is an additional charge of $50 for this permit, but the licensing process is essentially the same as any other business.

To open a home care business in Nevada, you need to apply for a Tax ID Number, Employer Number (EIN), NPI Numbers, and licenses. Certified Homecare Consulting will contact the IRS to request the EIN. The business also needs a state tax pass, which we will get from the Secretary of State's office upon registration.

Here is all you need to know about starting a home health care agency in India.Create a Business Plan.Register Your Business.Obtain Medicare and Medicaid certifications.Hiring Healthcare Professionals.Operate Your Business.

Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

Here are the main steps for starting a business in Nevada.Choose a Business Structure.Name Your Business.Designate a Registered Agent.Find a Business Location.Register Your Business.Obtain an EIN.Open a Business Bank Account.Seek Funding for Your Business.More items...?17-May-2019

Personal Care Aides: Must complete at least 16 hours of topic specific training and at least 8 hours of CE annually. Certified Nurse Aides: After completing a state approved CNA school program, CNAs in Nevada must complete 12 hours of CE annually.

To apply for a license to operate an agency to provide personal care services in the home, you must complete the following:Apply for a new license/renew an existing license - myhealthfacilitylicense.nv.gov.Licensing checklist for agencies to provide personal care services in the home.Background check requirements.More items...?28-Mar-2022

Sole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

In many cases, operating a business from your home is not legal. Laws in most cities and towns in the U.S. and most developed countries severely limit the locations and under what conditions businesses may operate.