Nevada Depreciation Schedule

Description

How to fill out Depreciation Schedule?

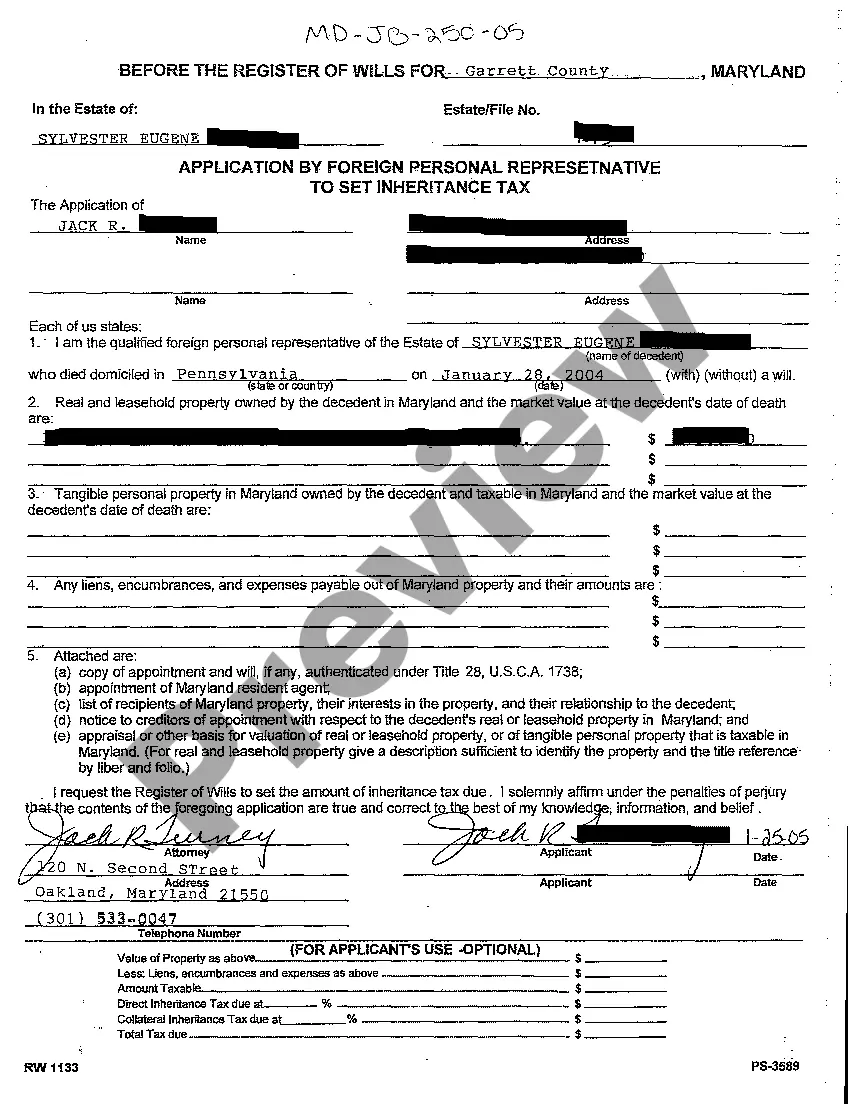

Selecting the finest authorized document template can be challenging. Of course, there are numerous templates accessible online, but how can you find the proper legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Nevada Depreciation Schedule, which can be utilized for business and personal needs. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Nevada Depreciation Schedule. Use your account to browse the legal forms you have acquired previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps to follow.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Nevada Depreciation Schedule. US Legal Forms is the premier repository of legal documents where you can access various document templates. Take advantage of the service to acquire professionally crafted papers that comply with state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can review the document using the Review button and examine the form overview to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the correct document.

- Once you are confident that the document is appropriate, click the Buy now button to purchase the form.

- Choose the pricing option you prefer and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

The Nevada Constitution, which was adopted in 1864, provides for the exemption of homesteads from forced sale (Article 4, Section 30). The current version of the State law is found in Chapter 115, Homesteads, of the Nevada Revised Statutes (NRS).

The Nevada State Legislature has passed a law to provide property tax relief to all citizens. NRS 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single-family house, townhouse, condominium or manufactured home).

Are There Property Tax Exemptions for Seniors in Nevada? While the senior citizen exemption is one of the most common types of property tax relief, the state of Nevada does not provide it. If you are a senior and own a property in Nevada, don't fret!

In Las Vegas, NV, the estimated annual property taxes can be calculated at roughly . 5% to . 75% of the home purchase price. The average effective property tax rate in Nevada is 0.53%, while the national average is 1.07%.

APPRAISAL - The valuation of property. Nevada Revised Statutes require all real property to be reappraised at least once every five years.

Determine the assessed value by multiplying the taxable value by the assessment ratio: 200,000 (taxable value) x . 35 (assessment ratio) = 70,000 assessed value. To calculate the tax, multiply the assessed value by the applicable tax rate: 70,000 (assessed value) x .

To calculate the amount of property taxes a Nevada homeowner needs to pay, the tax rate is multiplied by the assessed value of the property, including both land and improvements made on the house.

Nevada Property Tax Rules The taxable value of a property is calculated as the cash value of the land (the amount the land alone would sell for on the market), and the replacement cost of all buildings minus depreciation of 1.5% per year since construction. Assessed value is equal to 35% of that taxable value.

This statewide program refunds up to a maximum of $500 on the property tax paid by eligible senior citizens on their primary residence.