Nevada Credit Inquiry

Description

How to fill out Credit Inquiry?

Are you in a location where you frequently require documents for either business or personal reasons on a daily basis.

There are many legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, including the Nevada Credit Inquiry, designed to comply with both federal and state regulations.

Once you find the correct form, click Acquire now.

Choose a payment plan, fill out the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nevada Credit Inquiry template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct state/region.

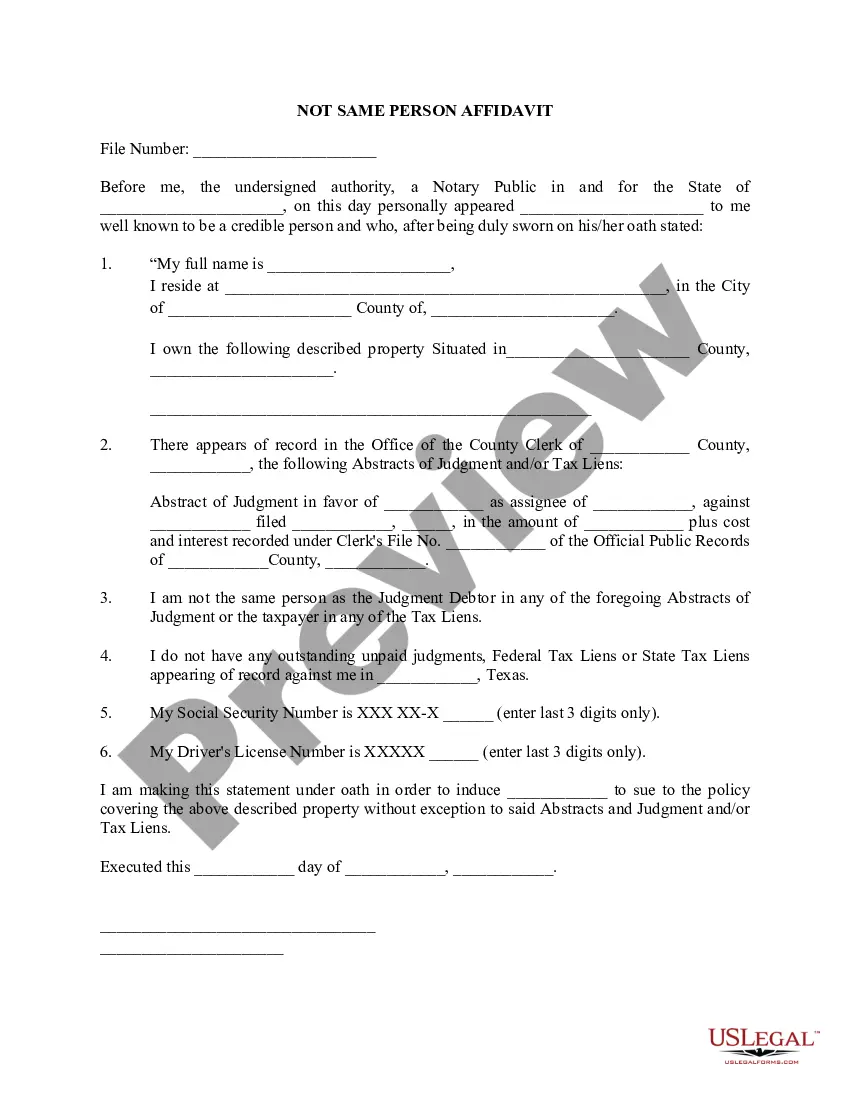

- Utilize the Preview button to check the form.

- Review the description to confirm you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the document that fits your needs and requirements.

Form popularity

FAQ

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that. The drop is temporary.

All new auto or mortgage loan or utility inquiries will show on your credit report; however, only one of the inquiries within a specified window of time will impact your credit score. This exception generally does not apply to other types of loans, such as credit cards.

No, requesting your credit report will not hurt your credit score. Checking your own credit report is not an inquiry about new credit, so it has no effect on your score.

What a credit card issuer or lender thinks when they see a hard inquiry on your credit report. Hard inquiries fall under the less influential category when calculating credit scores using the VantageScore model, and they make up only 10% of a FICO score calculation.

No, requesting your credit report will not hurt your credit score. Checking your own credit report is not an inquiry about new credit, so it has no effect on your score.

In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores. For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that.