Nevada Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

Have you found yourself in a situation where you frequently require documentation for either business or personal purposes almost every day.

There are numerous trustworthy document templates accessible online, yet discovering those you can trust is challenging.

US Legal Forms offers an extensive collection of forms, such as the Nevada Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, designed to satisfy state and federal requirements.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, fill out the required information to create your account, and pay for the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Nevada Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it corresponds to the correct city/state.

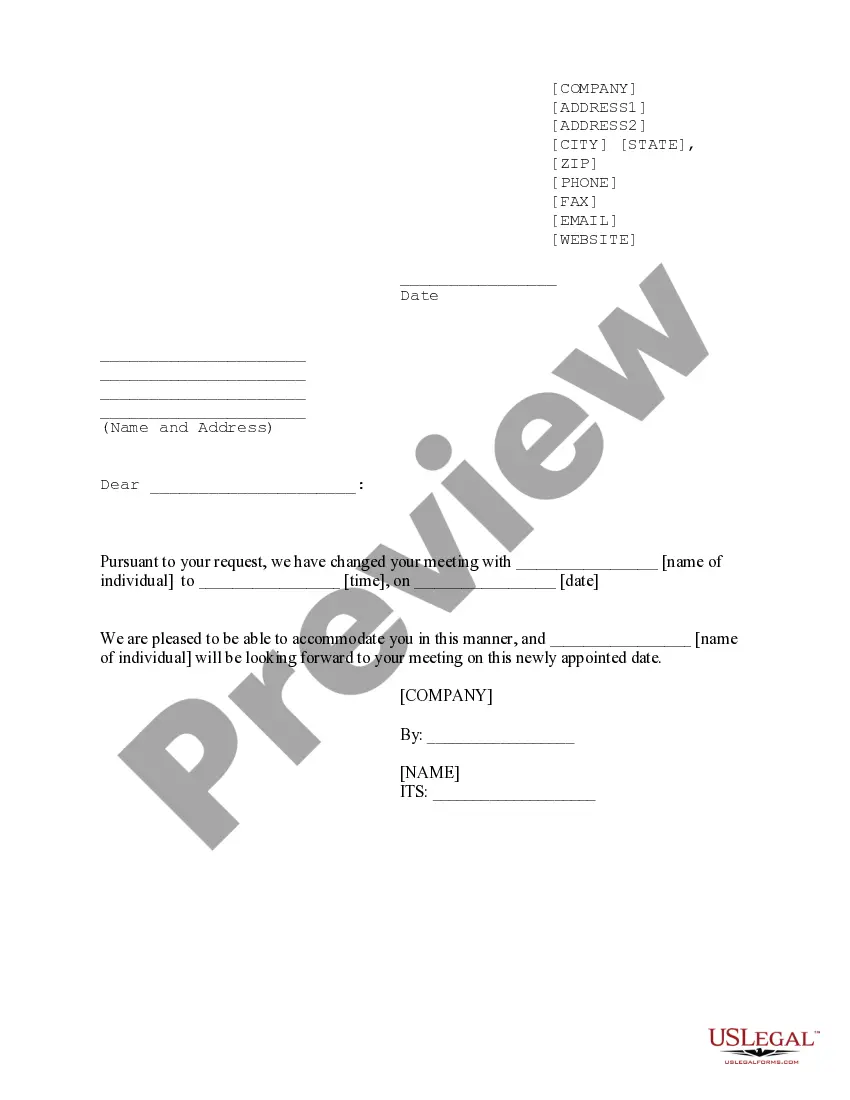

- Use the Preview feature to review the form.

- Examine the details to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search area to locate the form that aligns with your needs.

Form popularity

FAQ

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

Affordable business financing. Crazy fast.Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...