Nevada Contract with Independent Contractor to Work as a Consultant

Description

How to fill out Contract With Independent Contractor To Work As A Consultant?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal form templates that you can download or create.

By using the site, you will access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the most recent versions of forms such as the Nevada Agreement with Independent Contractor to Act as a Consultant in minutes.

If you currently hold a monthly membership, Log In and download the Nevada Agreement with Independent Contractor to Act as a Consultant from your US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finish the purchase.

Select the format and download the form to your device. Make modifications. Fill in, edit, print, and sign the downloaded Nevada Agreement with Independent Contractor to Act as a Consultant. Every template you add to your account has no expiration date and is yours indefinitely. Thus, if you want to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Nevada Agreement with Independent Contractor to Act as a Consultant with US Legal Forms, one of the most extensive collections of legal document templates. Use thousands of professional and state-specific forms that fulfill your business or personal needs and requirements.

- If you are looking to use US Legal Forms for the first time, follow these simple steps to get started.

- Make sure you select the appropriate form for the area/state.

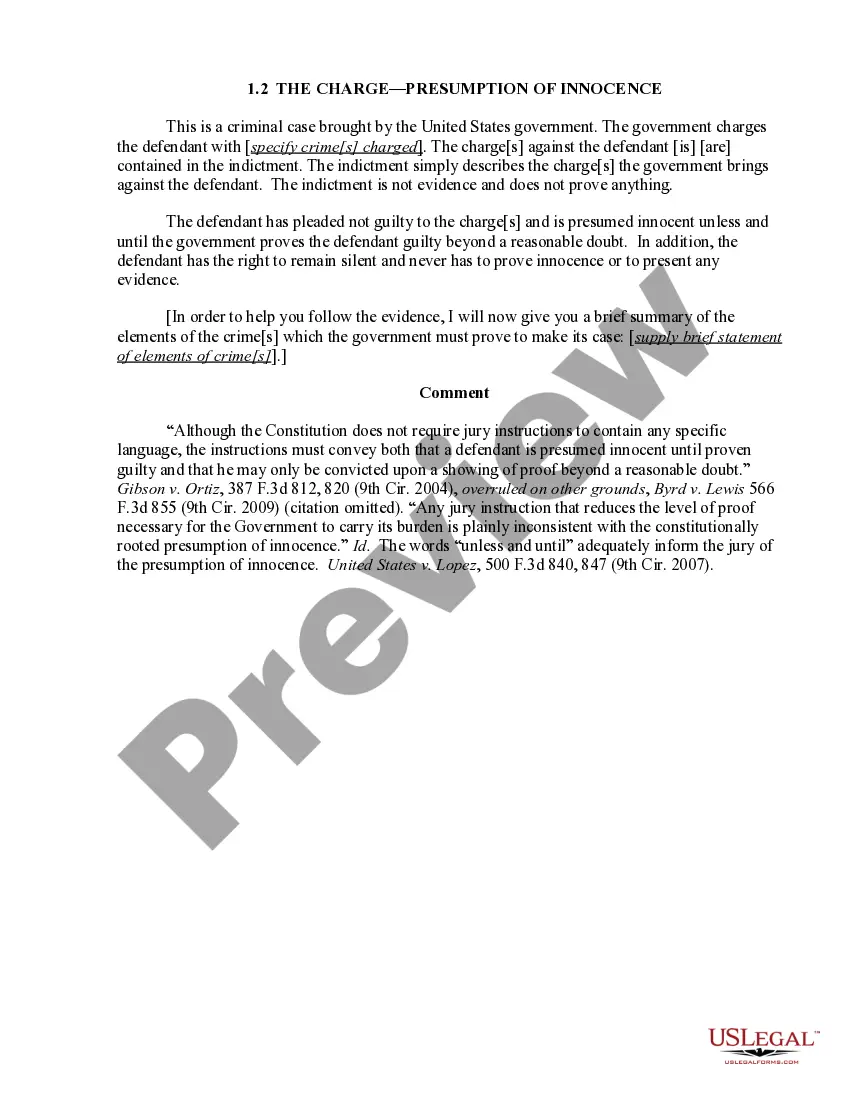

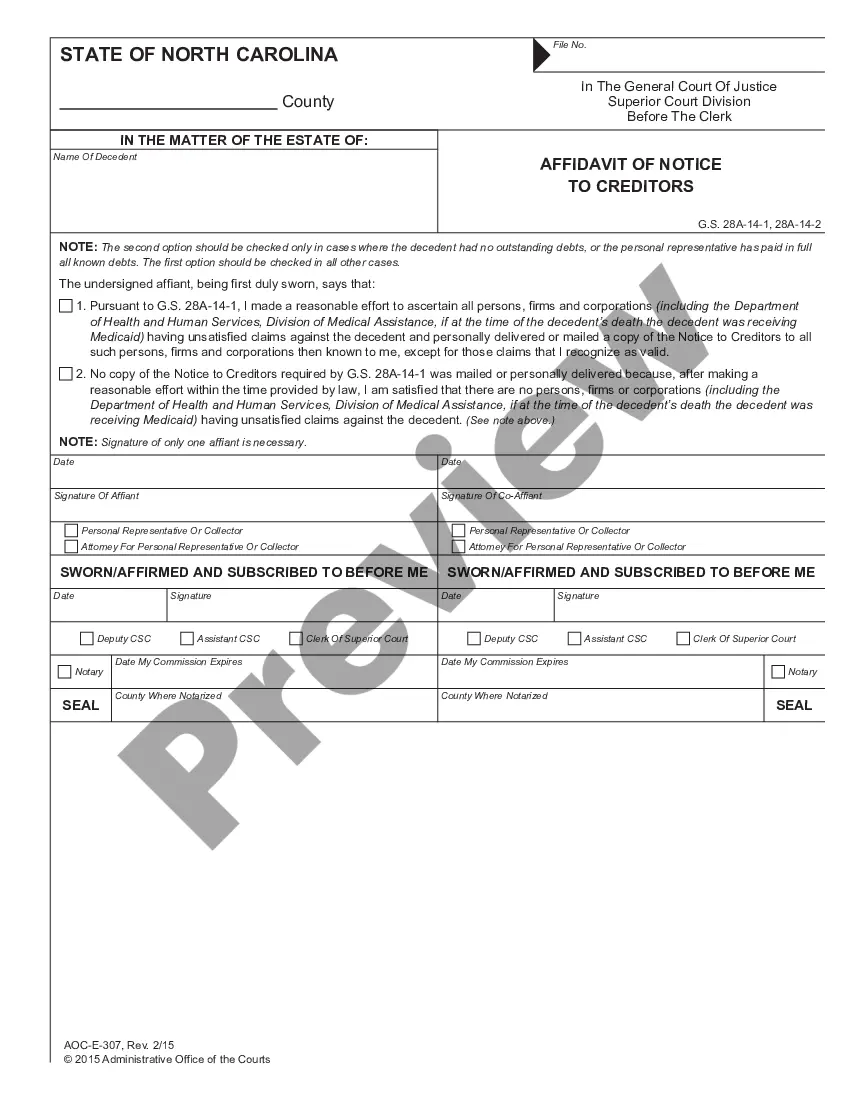

- Click the Review button to examine the form's content.

- Read the form description to ensure you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, choose the pricing plan you want and provide your details to register for an account.

Form popularity

FAQ

Nevada law requires a person to provide workers' compensation coverage for employees but also subcontractors, independent contractors and their employees. Such contractors are deemed to be employees of the prime contractor unless the subcontractor is an independent enterprise.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

Under the NIIA, an independent contractor is defined as follows: Any person who renders service for a specified recompense for a specified result, under the control of the person's principal as to the result of the person's work only and not as to the means by which such result is accomplished.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.