Nevada Assignment of Equipment Lease by Dealer to Manufacturer

Description

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

If you wish to complete, procure, or print licensed document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and user-friendly search to acquire the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After finding the form you’re looking for, click on the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize your purchase.

- Utilize US Legal Forms to download the Nevada Assignment of Equipment Lease from Dealer to Manufacturer with just a few clicks.

- If you are already a customer of US Legal Forms, sign in to your account and select the Get option to locate the Nevada Assignment of Equipment Lease from Dealer to Manufacturer.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have chosen the form for the correct city/region.

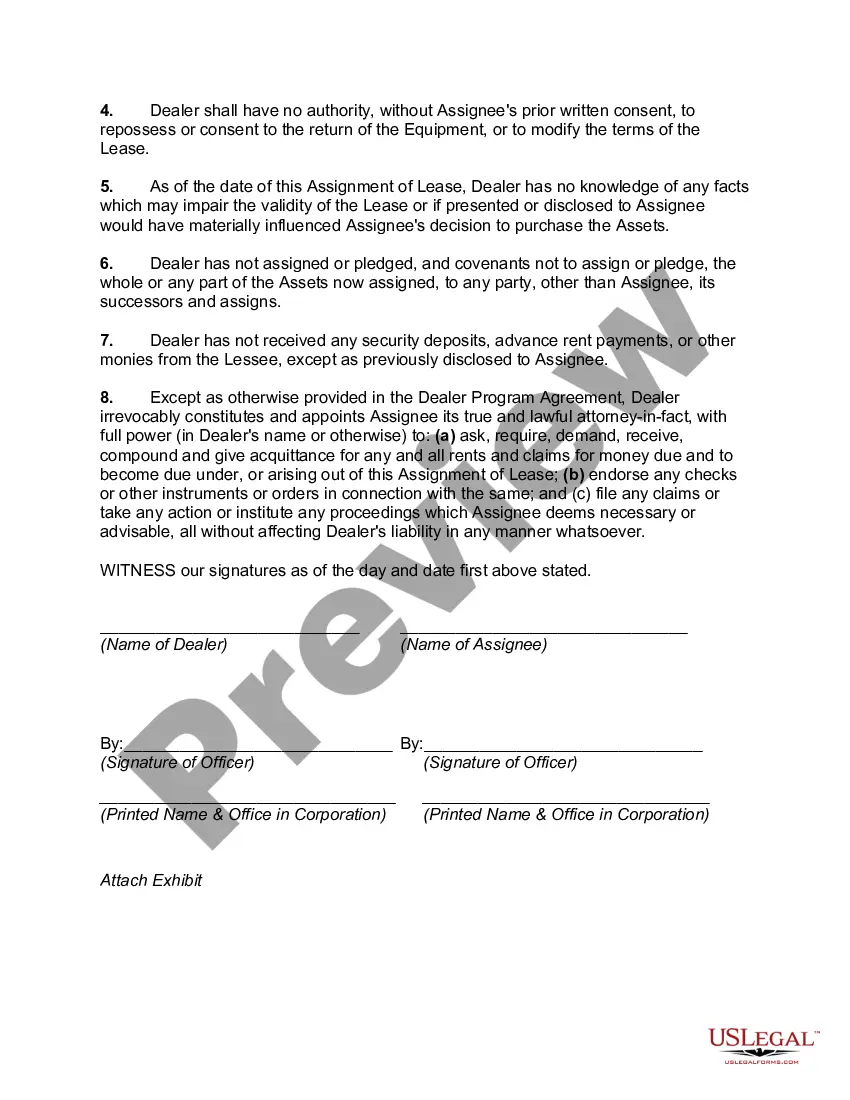

- Step 2. Use the Preview option to review the form’s details. Be sure to read the information carefully.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

4 Types of Equipment LeasesPUT or Purchase Upon Termination Lease. The example we provided above is a PUT option lease.Capital Lease.Operating Equipment Lease.TRAC Lease.

The leasing process starts when the lessee enters into a leasing contract with the lessor. Lessee approaches the Manufacturers and Suppliers, gathers all details about the required asset (design, specifications, price, installation, warranty, servicing etc.)

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

Capital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Because they are both a form of lease, they have one thing in common. That is, the owner of the equipment (the lessor) provides to the user (the lessee) the authority to use the equipment and then returns it at the end of a set period.

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

Capital Lease / Finance Lease / $1 Buyout Finance type lease may not qualify under I.R.S. regulations for deductibility. The lessee is considered the owner of the equipment (unlike an FMV lease) and maintains full control of the residual value. The lessee can depreciate the equipment.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Definition. An equipment rental agreement (also known as an equipment rental form or an equipment rental contract) is a legally binding document that is used to rent equipment from one party to another for a fixed period of time.