Nevada Limited Partnership Agreement for Real Estate Development

Description

How to fill out Limited Partnership Agreement For Real Estate Development?

Choosing the best lawful file web template can be a struggle. Obviously, there are a lot of layouts available on the net, but how will you get the lawful kind you need? Take advantage of the US Legal Forms site. The support offers a large number of layouts, like the Nevada Limited Partnership Agreement for Real Estate Development, which can be used for company and private needs. Every one of the forms are checked by professionals and satisfy state and federal requirements.

Should you be already listed, log in in your accounts and then click the Down load key to obtain the Nevada Limited Partnership Agreement for Real Estate Development. Make use of your accounts to look with the lawful forms you may have bought formerly. Go to the My Forms tab of the accounts and get yet another backup of your file you need.

Should you be a new end user of US Legal Forms, here are simple recommendations for you to stick to:

- First, make sure you have selected the proper kind to your city/region. You can examine the form using the Review key and study the form explanation to make certain it is the best for you.

- In the event the kind does not satisfy your requirements, make use of the Seach field to obtain the proper kind.

- When you are certain that the form is proper, click on the Acquire now key to obtain the kind.

- Select the rates plan you need and type in the required info. Make your accounts and pay for an order with your PayPal accounts or credit card.

- Select the document structure and down load the lawful file web template in your product.

- Total, change and print out and indication the obtained Nevada Limited Partnership Agreement for Real Estate Development.

US Legal Forms may be the largest library of lawful forms that you can discover various file layouts. Take advantage of the company to down load professionally-manufactured documents that stick to express requirements.

Form popularity

FAQ

A real estate limited partnership (RELP) is a group of investors who pool their money to invest in property purchasing, development, or leasing. It is one of several forms of real estate investment group (REIG).

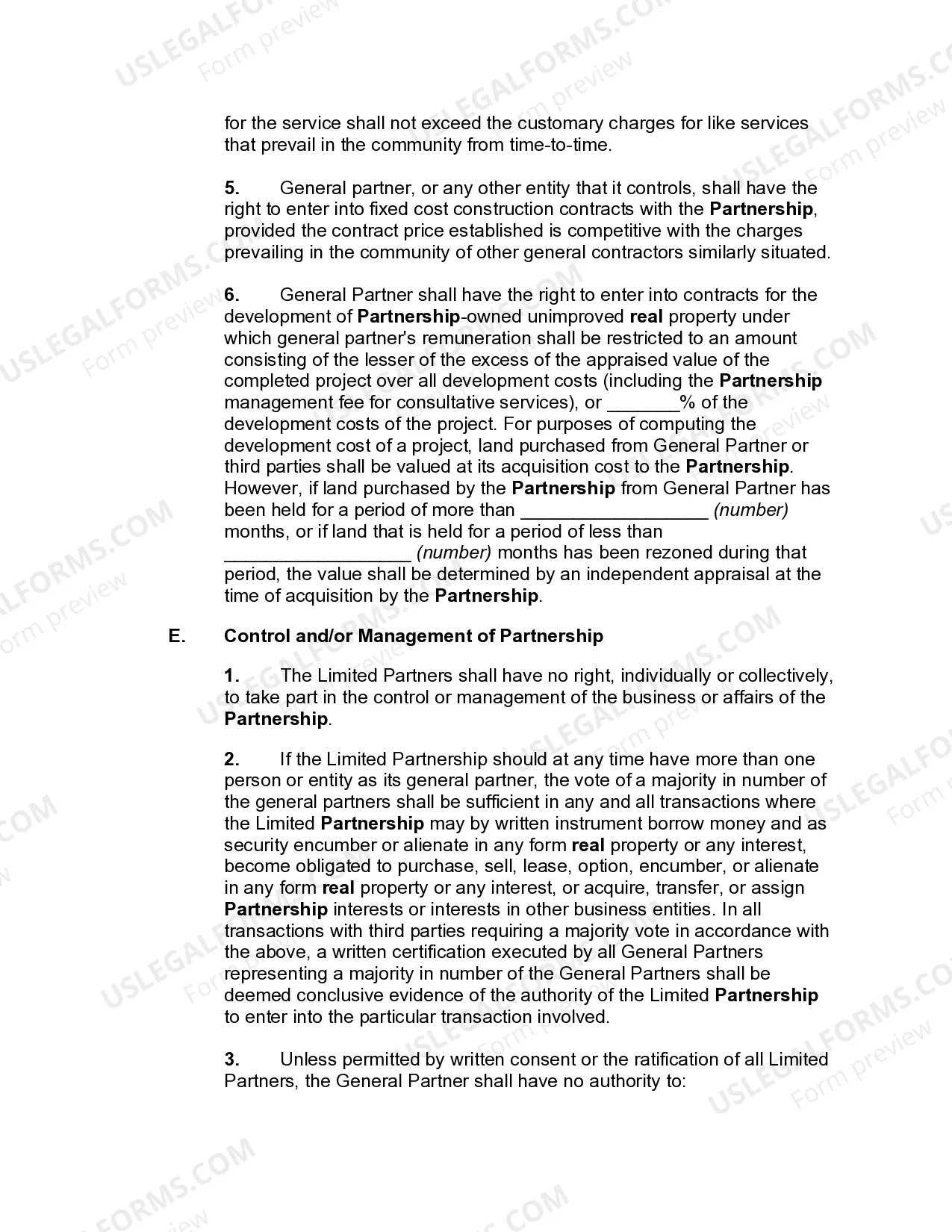

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership);

In limited partnerships, the only entity legally capable of holding title to the real property is the general partner 29. A limited partner is entitled to a return of his or her contribution upon dissolution of the partnership.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

Limited Partnership (LP) is a special partnership type with limited legal liabilities. General partners are personally liable. Limited partners are liable for their business investment. Management and control is exercised through general partners.

Real estate investors, for example, might use a limited partnership. Another common use of a limited partnership is in a family business, called a family limited partnership. Members of a family may pool their money, designate a general partner, and watch their investments grow.

A family limited partnership (FLP) is a holding company owned by two or more family members, created to retain a family's business interests, real estate, publicly traded and privately held securities, or other assets contributed by its members.

A real estate limited partnership (RELP) is a private investment that pools investors' funds to buy, develop, and sell properties. During their lifespan, RELPs may furnish a regular income, but mainly pay profits at the end when their properties sell.

Can Limited Partnership Hold Title? The only entity legally able to own title to the property held by a limited partnership is the general partner 29. Upon dissolution of a limited partnership, the partner will be entitled to a refund of his or her contributions.

NRS 88.400 Certificate of authorization to transact business; identification of defaulting partnerships; reinstatement of partnership which is unit-owners' association; forfeiture and penalty.