Nevada Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

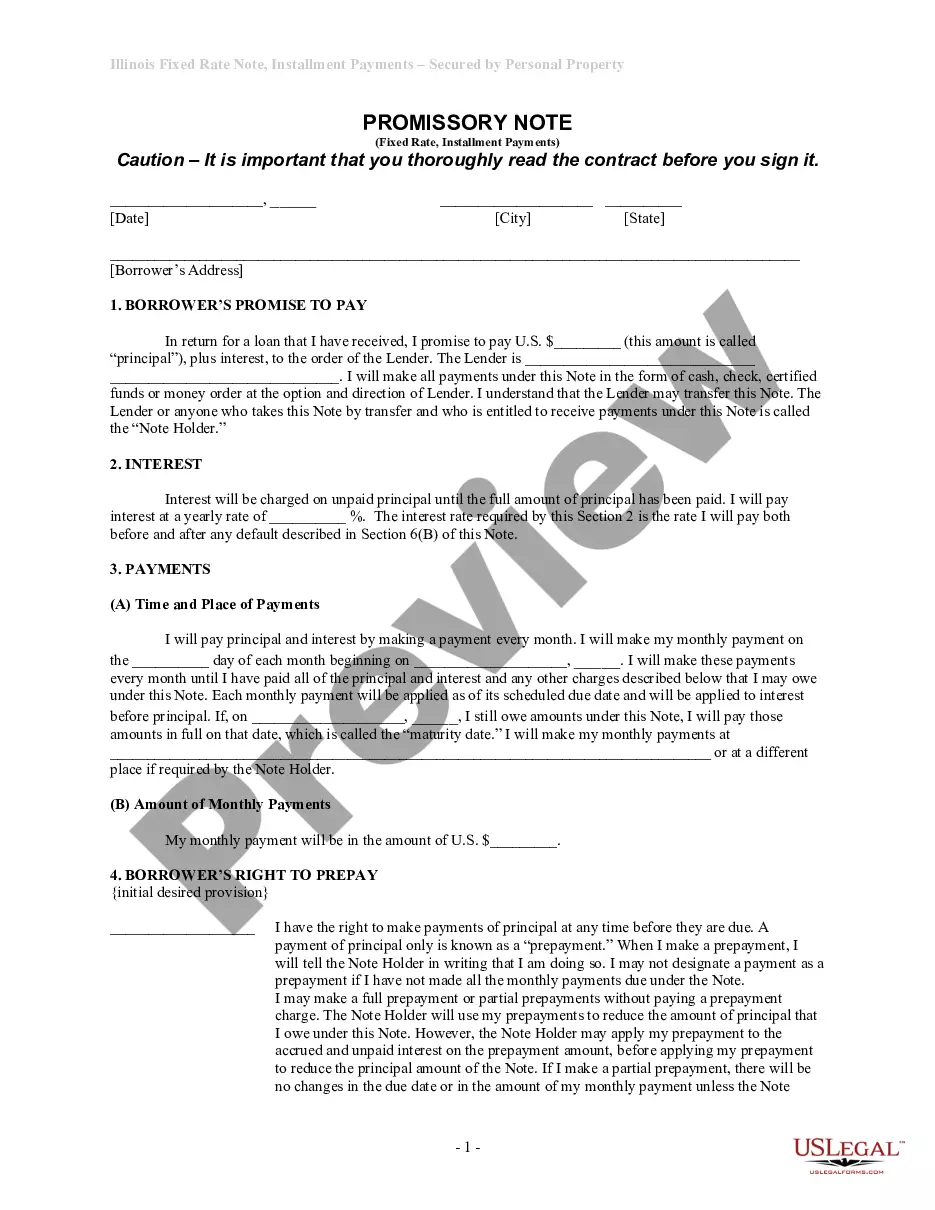

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

US Legal Forms - one of the most significant libraries of lawful types in the States - gives a variety of lawful papers themes you can acquire or produce. Making use of the website, you can get a huge number of types for enterprise and specific reasons, sorted by classes, claims, or keywords and phrases.You will discover the latest variations of types just like the Nevada Sample Letter for Request for IRS not to Off Set against Tax Refund within minutes.

If you already have a subscription, log in and acquire Nevada Sample Letter for Request for IRS not to Off Set against Tax Refund through the US Legal Forms catalogue. The Acquire switch can look on every form you see. You gain access to all earlier delivered electronically types from the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed below are simple recommendations to get you started off:

- Ensure you have picked out the best form for your city/state. Select the Preview switch to analyze the form`s content material. Look at the form information to ensure that you have selected the appropriate form.

- When the form does not match your requirements, use the Search discipline at the top of the display screen to get the one which does.

- Should you be pleased with the shape, confirm your option by clicking the Purchase now switch. Then, choose the costs plan you favor and offer your references to register for the bank account.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Select the structure and acquire the shape on the system.

- Make adjustments. Load, modify and produce and indication the delivered electronically Nevada Sample Letter for Request for IRS not to Off Set against Tax Refund.

Every single design you put into your money does not have an expiry day and is also the one you have forever. So, if you wish to acquire or produce yet another copy, just visit the My Forms area and click on in the form you need.

Get access to the Nevada Sample Letter for Request for IRS not to Off Set against Tax Refund with US Legal Forms, the most extensive catalogue of lawful papers themes. Use a huge number of professional and condition-specific themes that meet your organization or specific requirements and requirements.

Form popularity

FAQ

You should contact the agency shown on the notice if you believe you don't owe the debt or if you're disputing the amount taken from your refund. Contact the IRS only if your original refund amount shown on the BFS offset notice differs from the refund amount shown on your tax return.

The TOP Interactive Voice Response (IVR) system on 800-304-3107 can tell you who to call. If you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services (TRS).

Get IRS Form 8379 from or by calling the IRS at 800-829-3676. For help with the form - or if you have already filed Form 8379 and still do not have your correct refund - call the IRS at 800-829-1040 or call your local IRS office.

In order to request an offset bypass refund, the taxpayer, or representative, should make the request when the return is filed. The request must occur prior to assessment. The request needs to demonstrate the financial hardship the taxpayer faces. The amount of the offset limits the amount of the OBR.

Prevent an offset Pay the full amount listed on the Intent to Offset Federal Payments (FTB 1102). Use the payment coupon included in the letter when you send your check or money order. To make a payment online, visit Payment options .

In your formal protest, include a statement that you want to appeal the changes proposed by the IRS and include all of the following: ? Your name, address, and a daytime telephone number. ? List of all disputed issues, tax periods or years involved, proposed changes, and reasons you disagree with each issue.

The IRS may, for example, choose not to offset an overpayment against an outstanding federal tax refund because of undue hardship. However, the IRS's authority not to offset generally disappears once the offset has been done?it cannot reverse an offset.