Nevada Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

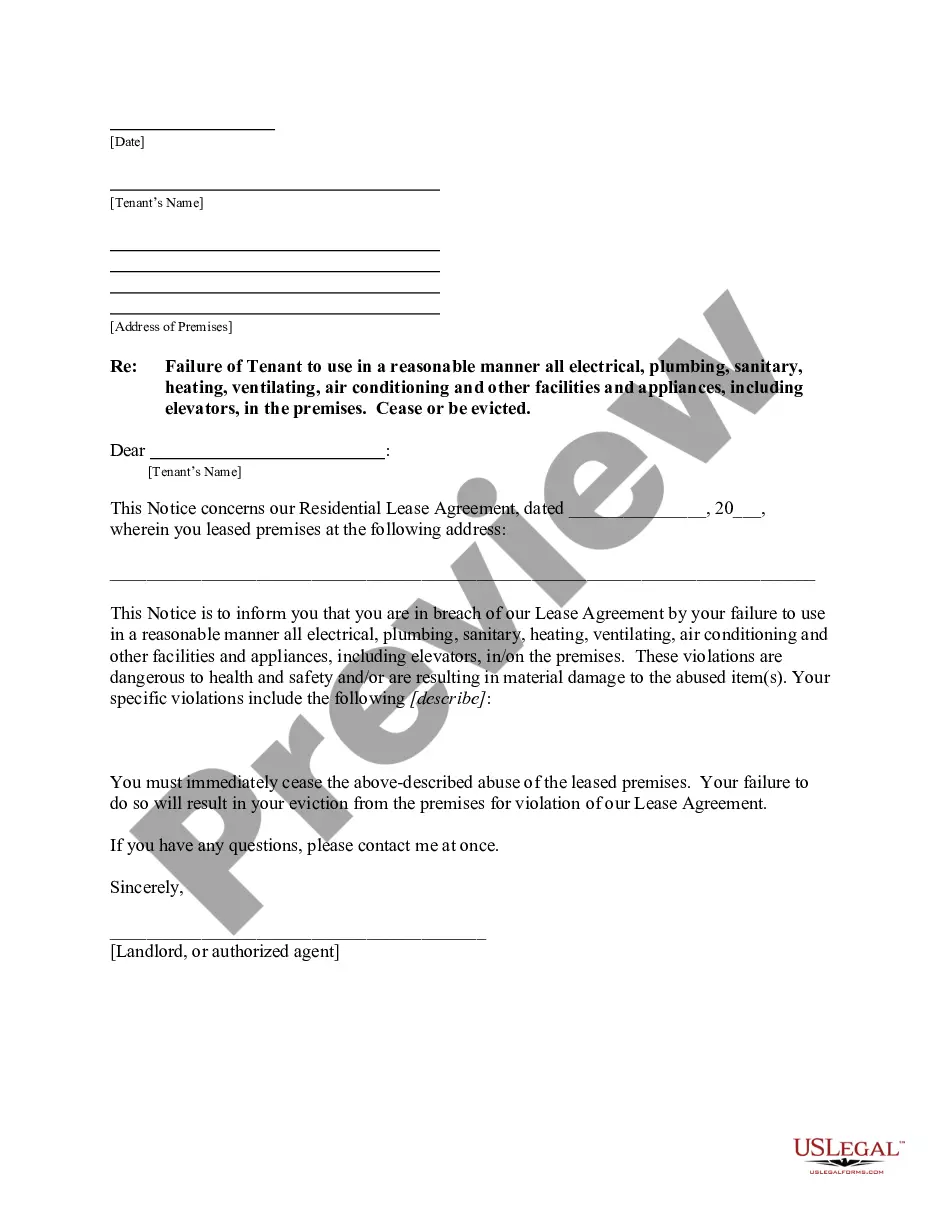

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

If you wish to total, download, or produce authorized file layouts, use US Legal Forms, the largest assortment of authorized varieties, which can be found on the Internet. Utilize the site`s easy and convenient search to find the documents you need. A variety of layouts for business and personal purposes are categorized by categories and claims, or key phrases. Use US Legal Forms to find the Nevada Sample Letter regarding Information for Foreclosures and Bankruptcies in just a couple of clicks.

In case you are presently a US Legal Forms buyer, log in to the account and click the Acquire switch to have the Nevada Sample Letter regarding Information for Foreclosures and Bankruptcies. You may also accessibility varieties you in the past downloaded inside the My Forms tab of your own account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form to the right metropolis/land.

- Step 2. Make use of the Preview choice to examine the form`s content material. Do not forget to read the explanation.

- Step 3. In case you are not satisfied using the kind, make use of the Search field at the top of the display screen to locate other versions from the authorized kind design.

- Step 4. Upon having identified the form you need, select the Get now switch. Opt for the pricing prepare you prefer and add your references to sign up for the account.

- Step 5. Process the purchase. You may use your credit card or PayPal account to accomplish the purchase.

- Step 6. Choose the format from the authorized kind and download it on your own product.

- Step 7. Comprehensive, revise and produce or indication the Nevada Sample Letter regarding Information for Foreclosures and Bankruptcies.

Every single authorized file design you buy is your own eternally. You may have acces to every kind you downloaded within your acccount. Click on the My Forms section and choose a kind to produce or download once more.

Remain competitive and download, and produce the Nevada Sample Letter regarding Information for Foreclosures and Bankruptcies with US Legal Forms. There are thousands of skilled and status-specific varieties you can use for your personal business or personal needs.

Form popularity

FAQ

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

Some states also provide foreclosed borrowers a redemption period after the foreclosure sale, during which they can buy back the home. However, Nevada law doesn't provide a redemption period following a nonjudicial foreclosure sale.

Foreclosure is a process that begins when a borrower fails to make their mortgage payments. When a home is foreclosed upon, the lender typically repossesses and attempts to sell the house. This happens because mortgage loans are secured by real estate, meaning your home is used as collateral.

The significant impacts for homeowners include the loss of Down Payment, Mortgage Loan Payments, and of the Equity in the home. Through foreclosure, homeowners lose the down payment made at the time of purchase and the mortgage loan payments they made during the ownership of their home.

When a homeowner stops paying on a loan used to purchase a home, the home is deemed to be in foreclosure. What this ultimately means is that the ownership of the home switches from the homeowner to the bank or lender that provided the loan.

If you are unable to pay off the default or work out a foreclosure alternative with your lender, 3 months after the Notice of Default is recorded, your lender can begin the process to sell your home. Your lender must record a Notice of Sale at least 21 days before the sale date and send the Notice of Sale to you.