Nevada Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Acceleration?

Discovering the right lawful document format could be a struggle. Of course, there are a lot of themes available on the net, but how do you discover the lawful type you want? Utilize the US Legal Forms internet site. The assistance provides a huge number of themes, for example the Nevada Sample Letter for Attempt to Collect Debt before Acceleration, that you can use for business and personal requires. All the varieties are checked out by specialists and meet state and federal requirements.

When you are presently authorized, log in for your bank account and then click the Download switch to obtain the Nevada Sample Letter for Attempt to Collect Debt before Acceleration. Make use of your bank account to look throughout the lawful varieties you may have bought earlier. Proceed to the My Forms tab of your respective bank account and get another version from the document you want.

When you are a new consumer of US Legal Forms, listed below are straightforward guidelines for you to stick to:

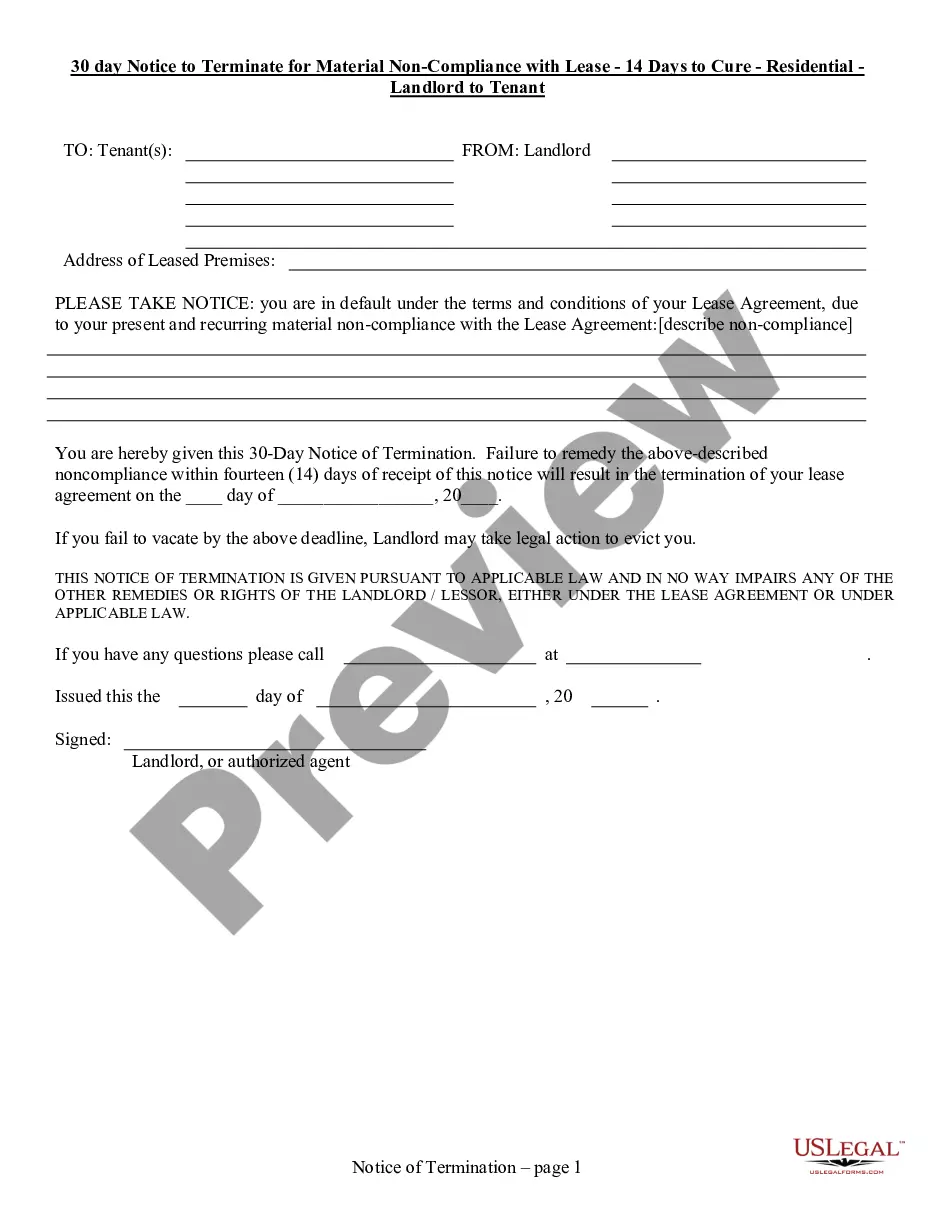

- First, be sure you have chosen the correct type for your town/county. You can check out the form making use of the Review switch and study the form explanation to ensure this is the best for you.

- When the type is not going to meet your needs, make use of the Seach industry to get the correct type.

- When you are sure that the form is proper, select the Purchase now switch to obtain the type.

- Pick the rates prepare you would like and enter in the needed info. Make your bank account and buy your order using your PayPal bank account or Visa or Mastercard.

- Pick the document file format and acquire the lawful document format for your device.

- Complete, change and produce and sign the attained Nevada Sample Letter for Attempt to Collect Debt before Acceleration.

US Legal Forms is the greatest catalogue of lawful varieties that you can see different document themes. Utilize the company to acquire skillfully-produced files that stick to state requirements.

Form popularity

FAQ

The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees. Debt collection letters are often the first step in the debt collection process.

This collection letter is another reminder that the amount of [include outstanding amount] due on [include due date] remains unpaid. Please pay this amount as soon as possible / within the stated time frame, X days from the date at the top of this collection letter [include payment instructions].

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

DEBT COLLECTION LETTER [SENDER MAILING ADDRESS] Date [DATE] Dear [RECIPIENT'S NAME], DUE AMOUNT: $[AMOUNT] PLEASE REMIT PAYMENT TO: [COLLECTIONS AGENCY] We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer. ... Sincerely,