Nevada Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

Finding the right authorized record web template could be a have difficulties. Obviously, there are tons of layouts available online, but how can you discover the authorized develop you need? Use the US Legal Forms web site. The service delivers a huge number of layouts, including the Nevada Sample Letter for Assets and Liabilities of Decedent's Estate, that can be used for organization and personal requires. Each of the types are checked by specialists and satisfy state and federal needs.

Should you be previously authorized, log in in your bank account and click the Obtain key to have the Nevada Sample Letter for Assets and Liabilities of Decedent's Estate. Make use of bank account to check throughout the authorized types you have bought earlier. Go to the My Forms tab of your own bank account and get an additional copy from the record you need.

Should you be a whole new end user of US Legal Forms, listed here are basic directions for you to stick to:

- Initial, make sure you have selected the proper develop for your personal town/state. You may look through the shape utilizing the Review key and study the shape outline to make certain this is the right one for you.

- When the develop fails to satisfy your needs, take advantage of the Seach discipline to obtain the proper develop.

- When you are certain that the shape is suitable, go through the Purchase now key to have the develop.

- Pick the costs plan you need and type in the necessary information and facts. Create your bank account and purchase an order using your PayPal bank account or bank card.

- Pick the data file file format and acquire the authorized record web template in your product.

- Complete, modify and printing and signal the acquired Nevada Sample Letter for Assets and Liabilities of Decedent's Estate.

US Legal Forms may be the biggest library of authorized types where you can discover a variety of record layouts. Use the company to acquire skillfully-created documents that stick to condition needs.

Form popularity

FAQ

In Nevada, the law requires that assets worth more than $20,000 go through probate. There are many other factors that can affect how much an estate has to be worth in order for it to go through probate.

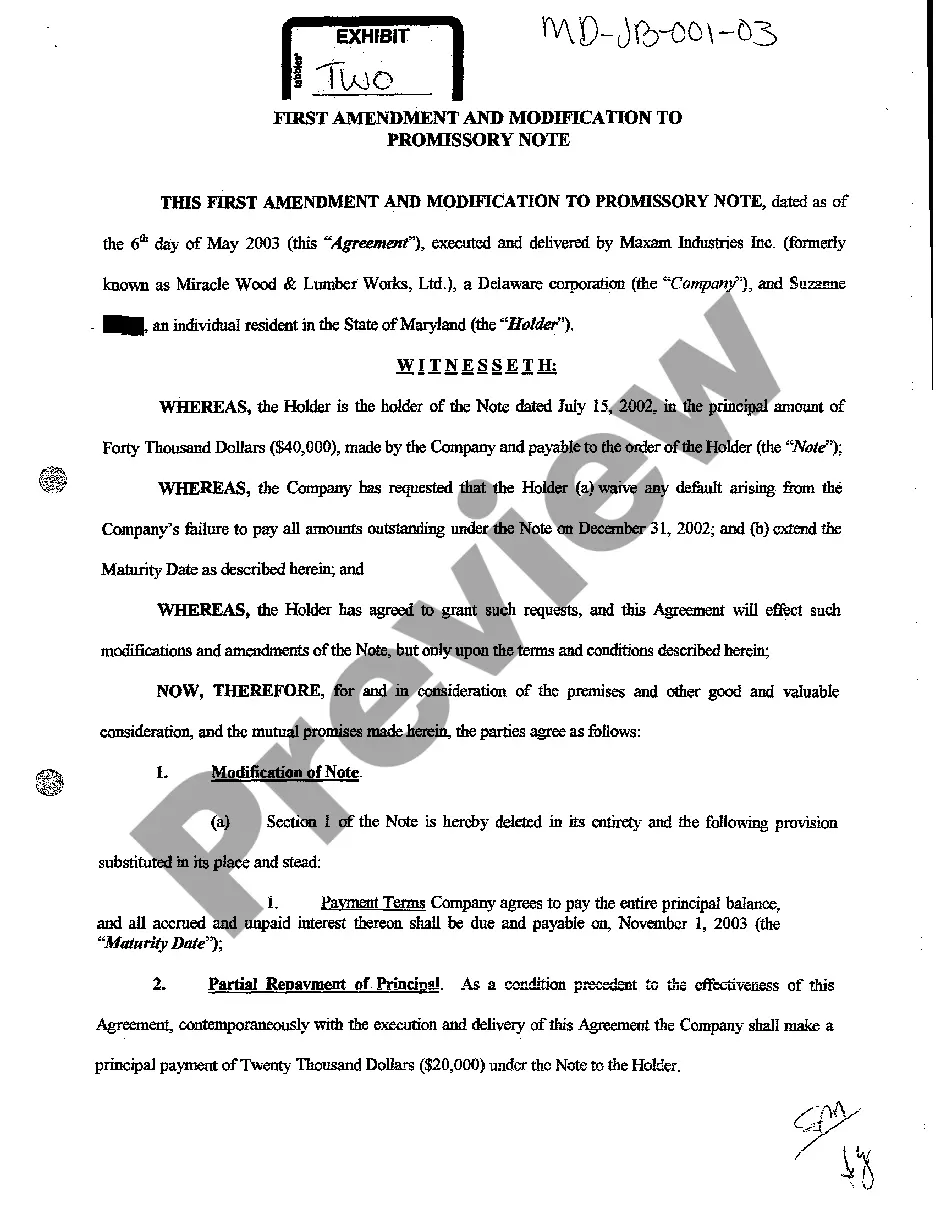

The Administrator or Executor will receive a document called ?Letters Testamentary? or ?Letters of Administration? which will be issued by the court, and outlines the Administrator's or Executor's authority and responsibility.

Letters Testamentary in Las Vegas Courts refers to a legal document offered by the probate court to determine a person's authority as the Executor.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

The administrator of the estate is usually named in the letters. Special letters of administration, on the other hand, are issued by the court for an estate only in certain circumstances specified under Nevada law. They include: where letters of administration have been granted irregularly.

Use joint ownership: You can also avoid probate by using joint ownership. If you own an asset jointly with another person, the asset will automatically pass to the other person upon your death. Create a payable-on-death account: A payable-on-death account is another way to avoid probate.

?Summary Administration? is a type of probate proceeding in Nevada that exists as an alternative to the full probate proceeding known as a ?General Administration.? It's intended to help modest sized estates avoid some of the cost and delay of general administration.

The probate court will require that interested parties, such as beneficiaries and heirs, be notified of the hearing on the petition for letters of administration. After the hearing, the court will issue letters of administration to the person or persons named in the petition.