Nevada Invoice Template for Consultant

Description

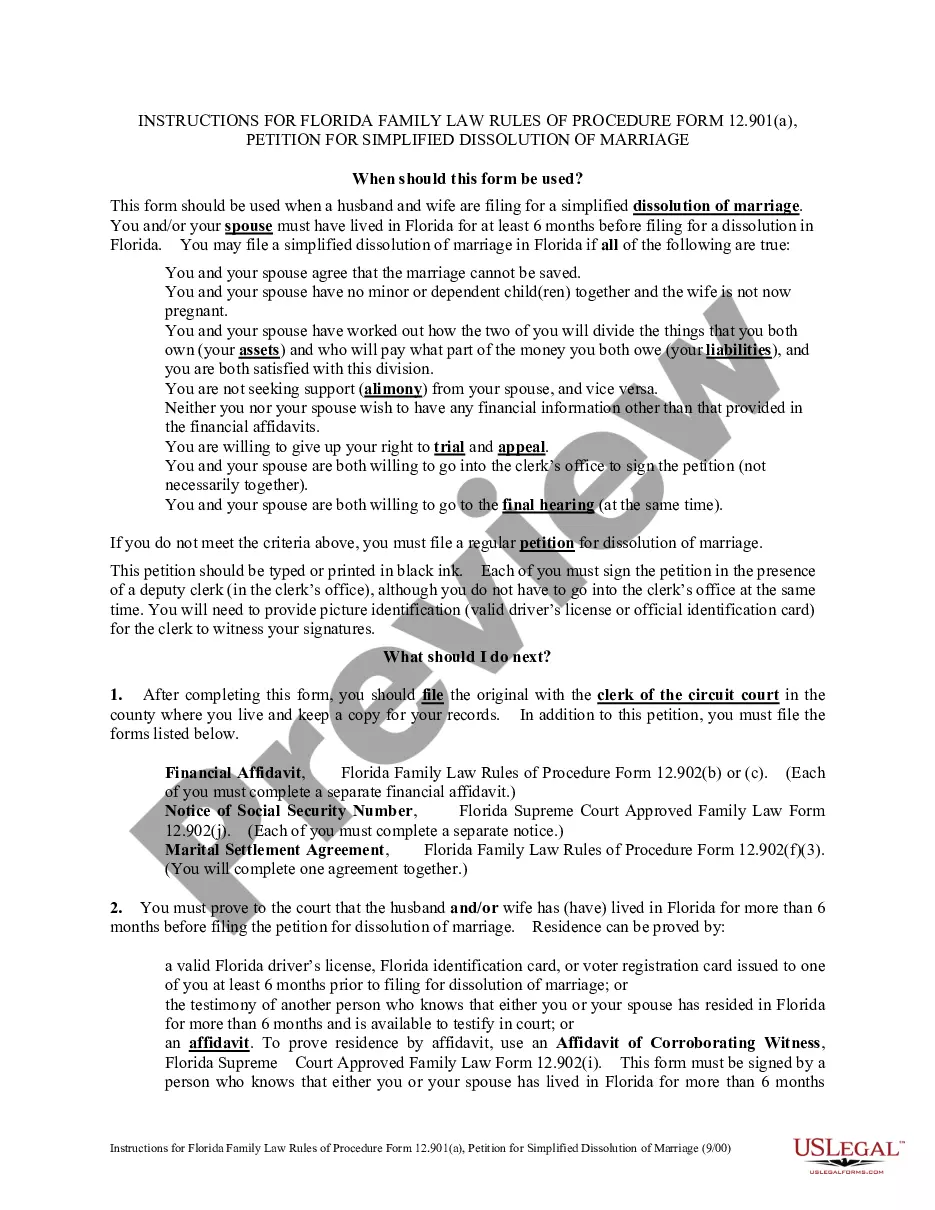

How to fill out Invoice Template For Consultant?

Locating the appropriate valid document format can be quite challenging.

It goes without saying that there is a plethora of templates accessible online, but how can you identify the valid type you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, follow these simple steps: First, ensure you have selected the correct form for your area. You can inspect the document using the Preview option and review the form outline to verify it is indeed suitable for you.

- The platform offers thousands of templates, including the Nevada Invoice Template for Consultant, suitable for both business and personal uses.

- All documents are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and select the Download option to acquire the Nevada Invoice Template for Consultant.

- Leverage your account to browse through the valid forms you have obtained previously.

- Visit the My documents tab in your account and download an additional copy of the document you need.

Form popularity

FAQ

To make an independent contractor invoice, start by choosing a Nevada Invoice Template for Consultant that suits your style. Include your name and contact information, your client's details, a detailed description of your services, the total amount due, and your payment terms. This structured format not only enhances professionalism but also ensures both you and your client stay organized.

Invoicing yourself is a common practice, especially for freelancers and consultants. When using a Nevada Invoice Template for Consultant, ensure that your invoice accurately reflects the services you provide and follows legal guidelines. This practice can help you keep track of your expenses and revenue for tax purposes. Just remember to document all transactions clearly.

To create an invoice for consulting services, you can start by selecting a Nevada Invoice Template for Consultant. Fill in your business details, the client's information, a clear description of the services provided, and the amount due. Be sure to include payment terms and any applicable taxes to ensure clarity. Using templates can save you time and make your invoices look professional.

Writing a simple invoice template like the Nevada Invoice Template for Consultant is easy. Start with a header that includes your business information and the client's details. Follow this with a breakdown of services, costs, and payment terms. Ensure everything is organized, making it easy for your client to read and respond.

To write an invoice for consulting services with the Nevada Invoice Template for Consultant, begin by placing your contact information and the client's details at the top. Describe the services you have provided with a focus on clarity and precision. Specify the rates for each service included and summarize the total at the bottom. This structure helps your clients understand their expenses without confusion.

Filling out a contractor invoice using the Nevada Invoice Template for Consultant is straightforward. Include your personal and business information, then the client's name and contact details. List the services performed along with any materials used, presenting the costs clearly. Finish with payment instructions to ensure prompt settlement.

For beginners using the Nevada Invoice Template for Consultant, it’s essential to keep things simple. Start by writing down your name and business details, then add the client’s information. Clearly outline the services you provided and their respective prices, and make sure to communicate payment terms. You can find user-friendly templates on platforms like uslegalforms to help guide you.

The correct format for the Nevada Invoice Template for Consultant includes a header with your business name, contact information, and the invoice title. Follow this with the client's information, the date, and a unique invoice number. List the services with descriptions, rates, and totals in a clear manner, followed by your payment information.

Filling out the Nevada Invoice Template for Consultant requires attention to detail. Begin with your business information and the client’s info. Write a detailed list of services provided along with their associated costs. Don't forget to include the invoice number and payment methods accepted to make transactions smooth.

To fill in the Nevada Invoice Template for Consultant, start by entering your name and contact information at the top. Next, include the client's details and the date of the invoice. Then, add a clear description of the services rendered, the corresponding fees, and any payment terms. Finally, ensure the total amount is prominently displayed.