Nevada Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a wide range of legal form templates that you can download or print.

By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords. You can quickly access the latest versions of forms such as the Nevada Agreement to Settle Debt by Returning Secured Assets.

If you already have an account, Log In to download the Nevada Agreement to Settle Debt by Returning Secured Assets from the US Legal Forms database. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Choose the file format and download the form to your device.

Make changes. Fill out, edit, and print and sign the downloaded Nevada Agreement to Settle Debt by Returning Secured Assets.

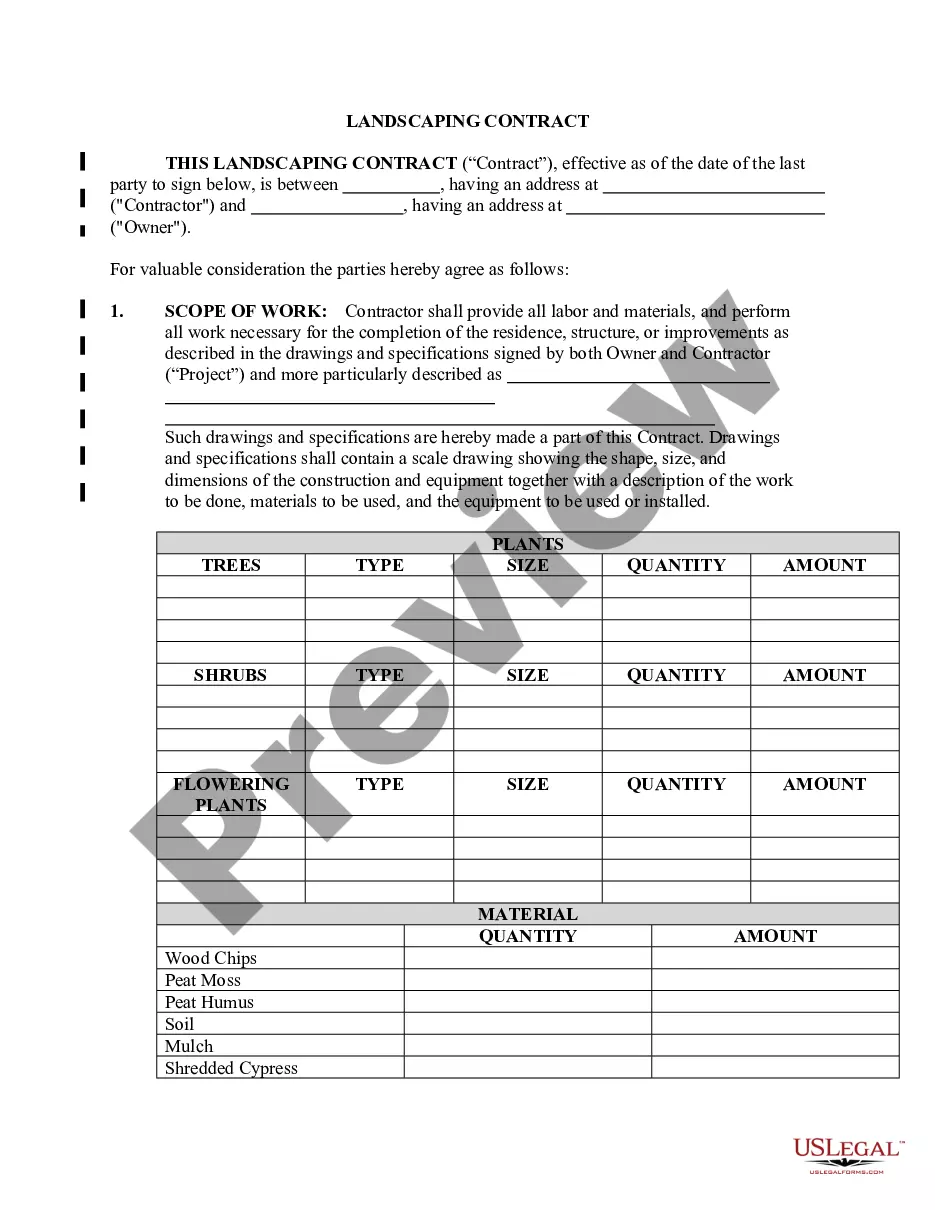

- Ensure you select the correct form for your city/state. Choose the Preview button to review the form’s content.

- Examine the form description to confirm you have chosen the right form.

- If the form does not meet your needs, utilize the Search area at the top of the page to find a suitable one.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, select your desired payment plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

To effectively write a debt agreement, start by stating the names of the involved parties and the specifics of the debt, including the total amount and payment terms. It is also essential to document the consequences if terms are not met, ensuring both parties have mutual understanding. If applicable, reference the Nevada Agreement to Compromise Debt by Returning Secured Property as a way to outline your intent and proposed terms clearly. This methodical approach helps in establishing clearly defined communication.

The 777 rule refers to a guideline where debt collectors must follow certain procedures for debts that patients owe to healthcare providers. Specifically, this rule allows for the collection of debts only under specific conditions, ensuring consumer protection. When navigating these collections, consider utilizing the Nevada Agreement to Compromise Debt by Returning Secured Property as a strategic option to settle your outstanding debts effectively. Following this rule can offer valuable insights into your rights.

Writing a debt settlement agreement involves drafting a document that specifies the details of the debt reduction and repayment terms. Clearly state the total amount owed, the reduced amount you're offering, and the reasons for settlement. You should also include information about the Nevada Agreement to Compromise Debt by Returning Secured Property, if relevant, as it can add structure to the negotiation process. This ensures both parties remain committed to the agreement.

In Nevada, debt collectors can pursue old debt for up to six years. This time frame starts on the date of the last payment made or when the debt was acknowledged. Being aware of this limitation is important when considering how to handle your debts, such as through a Nevada Agreement to Compromise Debt by Returning Secured Property. Understanding your rights can empower you to make informed financial decisions.

To write a debt agreement, start by clearly outlining the terms under which the debt will be settled. Include the amount owed, the repayment schedule, and any interest rates or fees involved. You may also want to specify how the Nevada Agreement to Compromise Debt by Returning Secured Property will work in your specific case. This clarity can help both parties understand their responsibilities and expectations.

A debt generally becomes uncollectible when the statute of limitations runs out, which is usually six years in Nevada. After this period, creditors lose their legal right to collect the debt, although the debt itself may still exist. Engaging with the Nevada Agreement to Compromise Debt by Returning Secured Property can be a constructive way to negotiate and settle debts well within this timeframe. Utilizing this option helps you take control of your financial situation and reduce the stresses associated with debt.

In Nevada, the statute of limitations for debt collection typically spans six years. This period applies to most types of debt, including credit cards and personal loans. Once this time frame expires, creditors can no longer pursue legal action to collect the debt. You may want to consider a Nevada Agreement to Compromise Debt by Returning Secured Property as a proactive step to resolve your obligations before the statute expires.

Typically, offers to settle a debt range from 30% to 70% of the total owed, depending on your financial situation and the creditor's willingness to negotiate. It's advisable to start lower and be prepared for counteroffers. When considering these percentages, keep in mind how a Nevada Agreement to Compromise Debt by Returning Secured Property can aid in reaching an amicable solution. This approach allows for more flexibility in negotiations.

A good debt settlement letter should clearly state your intent to settle the debt and propose a specific amount. Be concise, provide relevant details about the debt, and express your willingness to negotiate. When drafting such a letter, aim to align your message with a Nevada Agreement to Compromise Debt by Returning Secured Property. This alignment can encourage acceptance of your proposal.

Nevada state law regulates debt collection practices to protect consumers from harassment. Collectors must adhere to specific guidelines regarding communication and cannot use deceptive practices. Understanding these laws is important when entering into a Nevada Agreement to Compromise Debt by Returning Secured Property, as it helps you recognize your rights and responsibilities in the negotiation process.