Nevada Notice of Default under Security Agreement in Purchase of Mobile Home

Description

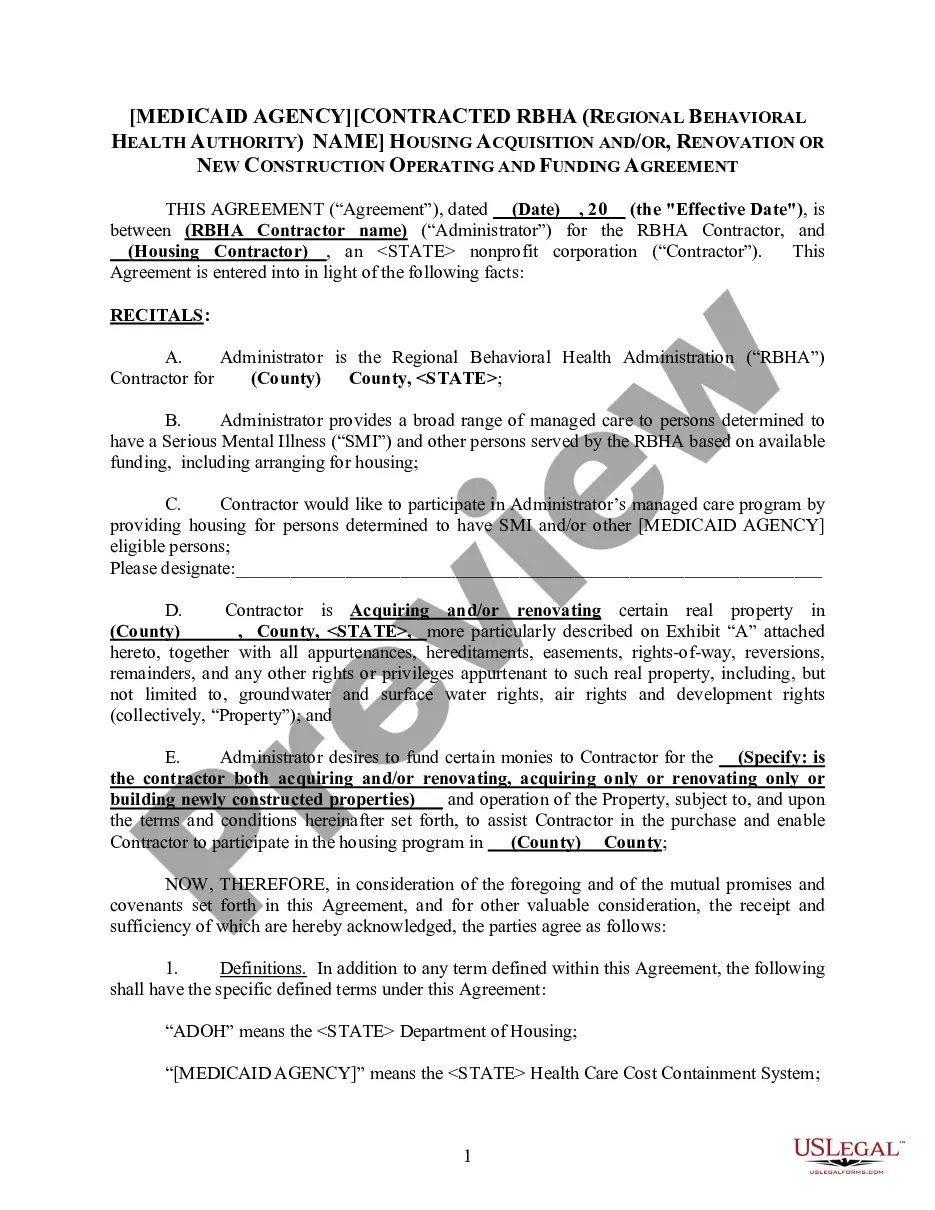

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

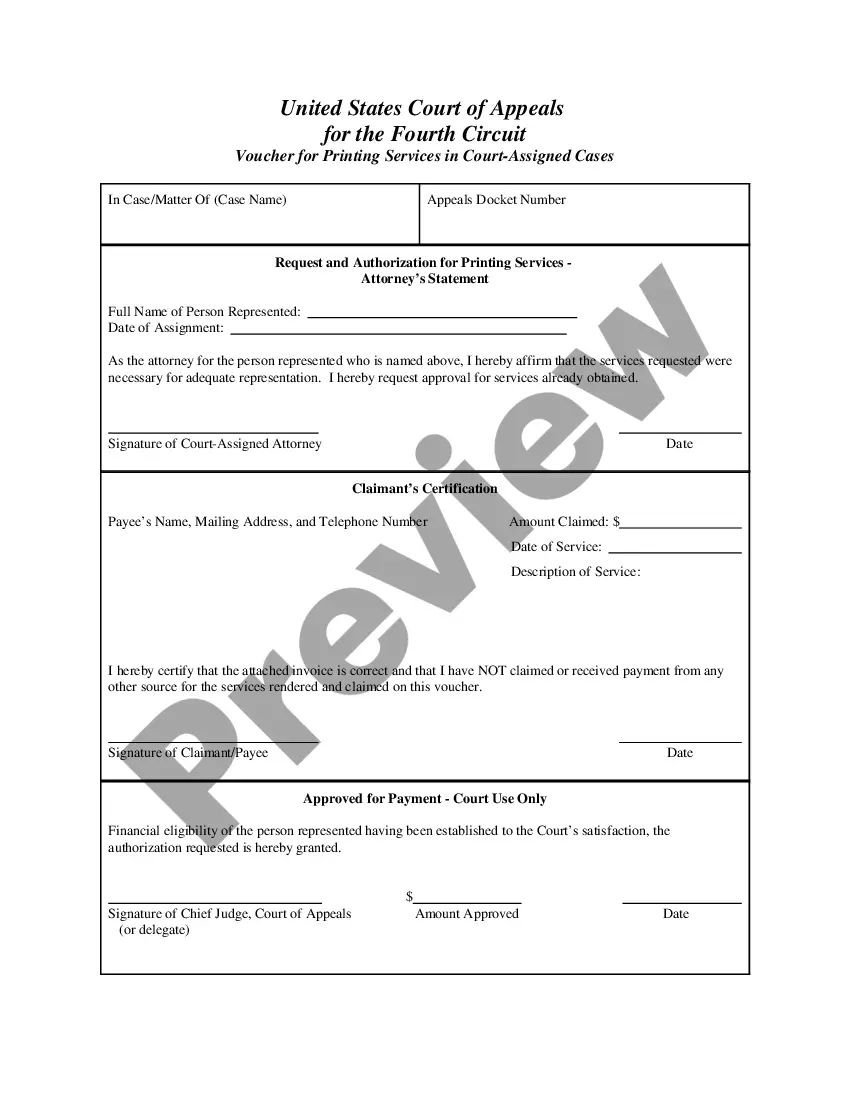

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords.

You can access the latest forms such as the Nevada Notice of Default under Security Agreement in Purchase of Mobile Home within seconds.

Examine the form description to confirm that you have chosen the right document.

If the form does not meet your needs, utilize the Search bar at the top of the page to find a suitable one.

- If you currently hold a monthly subscription, sign in to obtain the Nevada Notice of Default under Security Agreement in Purchase of Mobile Home from the US Legal Forms library.

- The Download button will appear on every form you access.

- You can view all previously acquired forms in the My documents section of your account.

- For first-time users of US Legal Forms, here are simple steps to get started.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

Form popularity

FAQ

Receiving a notice of default in Nevada means that you are at risk of losing your mobile home due to missed payments. This document serves as an official warning, prompting you to address the missed payments or risk facing foreclosure. It’s advisable to act quickly by contacting your lender or seeking assistance from a platform like US Legal Forms, which can help guide you through the necessary steps to potentially resolve your situation.

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

Often, secured parties use UCC-1 financing statement forms to achieve perfection of security interest outlined in a security agreement. Prepared and signed by both parties, this form includes the following information: The debtor's name (either the name of an organization or an individual taking on debt).

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

While the financing statement should include the names of the secured party and the debtor (along with some indication of the collateral), it need not be authenticated or signed. The financing statement lacks several of the requirements attached to a security agreement, so it cannot serve as a valid substitute.

A security interest in a manufactured home that is or becomes a fixture (defined in UCC § 9-102 as goods that have become so related to particular real property that an interest in them arises under real property law) is perfected by one of three methods: making a fixture filing, noting the secured party's lien on

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

Debtor's rights in collateral. In such cases, the business will sign a conditional sales contract, which is also considered a security agreement, and which, under UCC sales rules, will give the business the necessary rights in the purchased items to use them as collateral.

If two parties have a security interest in the same property, the party who filed first takes first. If the competing security interests are both unperfected, the party who was first to attach the property as collateral has priority. Other creditors of a debtor may have the first claim on secured property.

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.