Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

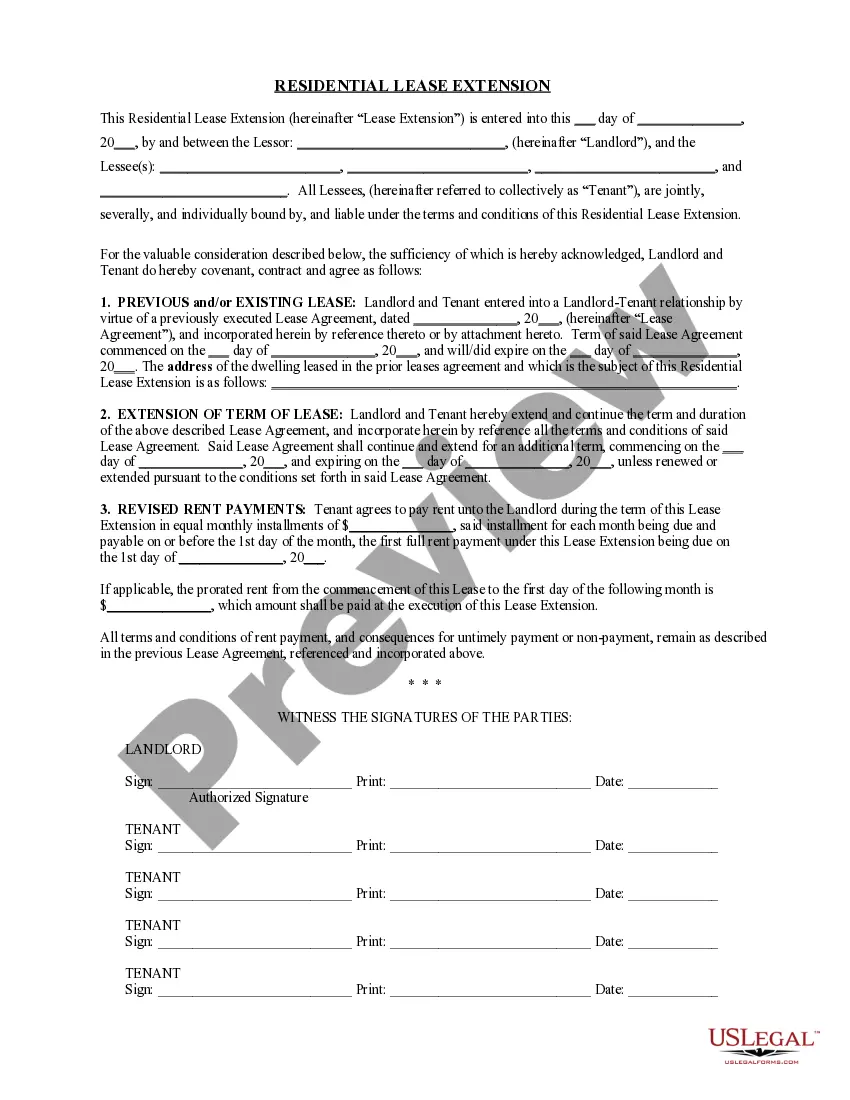

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now option. Choose your preferred pricing strategy and enter your details to register for an account.

Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to quickly find the Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- You can also access forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, adhere to the steps listed below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form’s content. Always take the time to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Chapter 372 of the Nevada Administrative Code governs sales and use tax in the state. This regulation is significant because it includes stipulations that may affect your Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax. Understanding these rules can help you identify tax implications related to leasing equipment. For clearer insights and compliance details, refer to resources available on uslegalforms.

Setting up a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax is straightforward. First, identify the equipment you want to lease and ensure it meets your business needs. Next, create a lease agreement that outlines terms, payment schedules, and duration. To simplify this process, consider using uslegalforms, where you can find templates and guidance tailored to Nevada's legal requirements.

Leased equipment is categorized distinctly based on the type of lease agreement. In an operating lease, the equipment appears as an expense, whereas in a capital lease, it may be treated as an asset that can be depreciated. Exploring a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax helps ensure you understand how these classifications affect your tax obligations and benefits.

Leased equipment is commonly recognized as an expense, particularly under operating leases. These payments can be recorded as operating expenses, thus reducing taxable income. For better financial planning, utilizing a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax can clarify how these expenses fit into your overall tax strategy.

Yes, leasing equipment can be tax-deductible, depending on the type of lease. Operating leases generally allow you to deduct the full lease payments as business expenses. However, in capital leases, different tax treatments can apply, so having a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax can guide you in making the most of your deductions.

toown agreement can be considered a capital lease, allowing the lessee to deduct the interest and depreciation on the leased asset. When you structure this type of contract as a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax, you can leverage tax benefits effectively. Tax structures can be complex, so it's wise to consult with a tax professional to maximize your advantages.

Leases are generally classified as either operating leases or capital leases for tax purposes. An operating lease allows the lessee to use the equipment without transferring ownership. In contrast, a capital lease typically means that the lessee can claim depreciation on the leased equipment. Understanding these classifications is essential, especially in the context of a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax.

Calculating sales tax on a lease involves knowing the total lease payment and the applicable tax rate in Nevada. Generally, the sales tax is calculated on the total lease amount over the lease term. To find the total tax, simply multiply the total lease payments by the sales tax rate. It's important to ensure that your Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax complies with local tax regulations, so consider using uslegalforms to streamline the process.

Income from equipment rental should be reported on your federal tax return, typically on Schedule C for sole proprietors or as business income on corporate returns. If you utilize a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax, track your rental income accurately to ensure compliant reporting. For detailed guidance, consider consulting tax professionals familiar with Nevada’s tax code.

Indeed, equipment rentals are taxable in Nevada under current state tax laws. This taxation covers leases and rental agreements, requiring businesses to collect and remit sales tax. Depending on your leasing agreement, especially a Nevada Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding these tax implications can help streamline your financial planning.