Nevada Subcontractor Agreement for Professional Services

Description

How to fill out Subcontractor Agreement For Professional Services?

Have you encountered a scenario where you frequently require documents for either business or personal use almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of template options, including the Nevada Subcontractor Agreement for Professional Services, designed to meet state and federal regulations.

Once you find the appropriate form, simply click Purchase now.

Choose your pricing plan, enter the necessary information to process your payment, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess a user account, simply Log In.

- Afterward, you can download the Nevada Subcontractor Agreement for Professional Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Select the form you need and verify it is for the correct city/state.

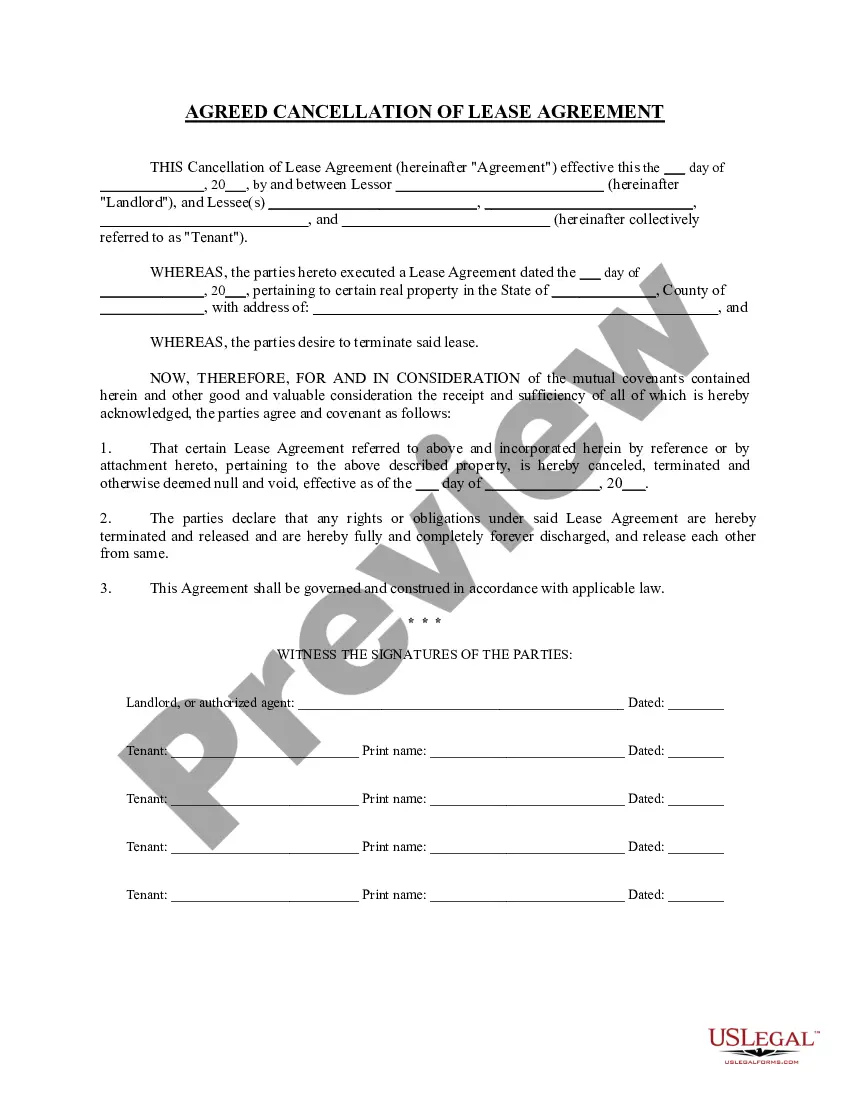

- Utilize the Preview button to view the document.

- Review the details to ensure you have selected the right form.

- If the form does not meet your requirements, use the Lookup section to find a type that suits your needs.

Form popularity

FAQ

Completing an agreement involves ensuring all sections are properly filled out and reviewed. With a Nevada Subcontractor Agreement for Professional Services, check that all parties understand and agree to the terms before signing. Once all signatures are in place, it’s crucial to distribute copies to all parties for their records.

Subcontractors need to fill out their personal information, work scope, payment rates, and any specific terms relevant to the project. Using a Nevada Subcontractor Agreement for Professional Services can streamline this process, ensuring that all critical information is captured effectively. Always review the agreement with the primary contractor to confirm mutual understanding.

Writing an agreement starts with defining the purpose and scope clearly. For a Nevada Subcontractor Agreement for Professional Services, list all crucial details such as the work to be completed, payment terms, and deliverables. Once drafted, review the agreement for completeness and clarity, ensuring that it meets the needs of both parties involved.

A professional services agreement is a contract that outlines the terms under which a service provider offers their expertise. In the context of a Nevada Subcontractor Agreement for Professional Services, it details project specifications, deliverables, and timelines to ensure all parties have clear expectations. This protects both the client and the subcontractor during the business relationship.

Filling an agreement form requires clarity and completeness. Begin by outlining the essential terms such as the roles of each party and the services to be performed under the Nevada Subcontractor Agreement for Professional Services. After completing all sections, carefully proofread for accuracy, then ensure all signatures are obtained.

To fill out a Nevada Subcontractor Agreement for Professional Services, start by entering the details of both parties involved, including names and addresses. Next, describe the scope of work along with timelines and payment terms. Be sure to include any necessary clauses that protect both parties, and finally, have both parties review and sign the agreement.

Most independent contractors in Nevada must obtain a business license to operate legally. This requirement primarily helps ensure compliance with state taxes and regulatory standards. To simplify the process, consider using resources like uslegalforms, which can help you draft a comprehensive Nevada Subcontractor Agreement for Professional Services that adheres to all legal necessities.

Yes, as an independent contractor in Nevada, you usually need a business license if your work exceeds the state's established income limits. This ensures that your business is legally recognized and operating within state guidelines. When you utilize a Nevada Subcontractor Agreement for Professional Services, it is important to include provisions that reflect compliance with local licensing requirements.

Typically, a 1099 employee is considered an independent contractor, and whether they need a business license in Nevada depends on the nature of their work and income level. If their activities fall under certain thresholds or types of work, they may not need a license. Therefore, understanding your situation is crucial when preparing a Nevada Subcontractor Agreement for Professional Services.

In Nevada, certain professionals may be exempt from requiring a business license, including government employees and certain nonprofit organizations. Additionally, limited businesses that do not exceed specific revenue thresholds may also escape this requirement. Knowing the exemption criteria is vital for those drafting a Nevada Subcontractor Agreement for Professional Services to ensure compliance with state regulations.