Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

Are you in a situation where you need documentation for either business or individual reasons nearly every time? There are numerous legitimate document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed, that are created to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed template.

- Locate the form you need and ensure it is for the correct city/state.

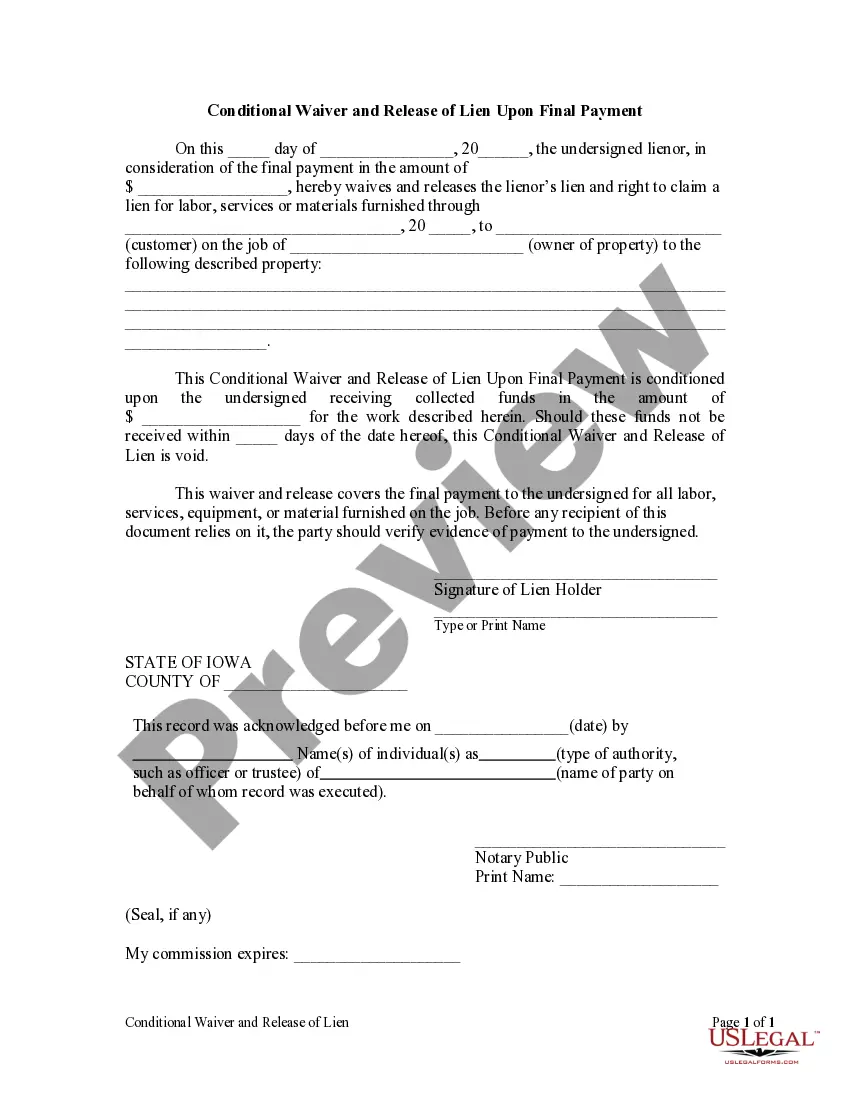

- Use the Review button to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search box to find the form that fits you and your requirements.

- Once you find the correct form, click Acquire now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

While an LLC is not mandatory for starting consulting in Nevada Business Management Consulting, it offers several advantages. Forming an LLC protects your personal assets from business liabilities. It also enhances your credibility in the eyes of clients. If you decide to proceed as a sole proprietor, consider implementing a Consultant Services Agreement - Self-Employed to manage legal risks.

A consulting agreement is a legal document that outlines the relationship between a consultant and a client. In Nevada Business Management Consulting, this agreement specifies deliverables, timelines, and compensation. Having a well-structured agreement ensures that both parties understand their roles and responsibilities. It serves as a crucial element in establishing professional trust.

Consultants should utilize a Consultant Services Agreement - Self-Employed tailored to their specific needs. This contract should clearly define the scope of work, payment terms, and confidentiality clauses. Crafting a detailed agreement can prevent misunderstandings and protect your interests. Platforms like uslegalforms provide templates for easy customization.

To protect yourself as a consultant in Nevada Business Management Consulting, it's vital to have a solid contract. A comprehensive Consultant Services Agreement - Self-Employed outlines your responsibilities and limits your liability. Additionally, consider professional insurance to safeguard against unforeseen issues. Always keep record-keeping and communication clear with your clients.

To write a simple contract agreement, first state the parties involved and the purpose of the agreement. Clearly outline the terms, payment, and duration, while ensuring both parties understand their responsibilities. Effective Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed ensures clarity and protects both consultants and clients.

Yes, an independent contractor can also act as a consultant. Many professionals provide consulting services while working independently on projects. If you are looking to establish your consulting practices, consider a Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed to formalize your client relationships.

An independent contractor typically provides specific services under a contract, while an independent consultant usually offers expert advice and strategic guidance. Although their roles can overlap, consultants focus more on consulting rather than executing tasks. When establishing your role in Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed, clarify these distinctions.

Writing a simple consulting contract involves stating the parties' names, outlining the services provided, and specifying payment terms. Also, include start and end dates, along with any confidentiality agreements. A clear and straightforward Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed ensures both parties understand their commitments.

A consultancy contract should include essential elements such as the scope of work, payment details, timelines, and responsibilities of each party. Additionally, it should address confidentiality and conflict resolution procedures. Crafting a comprehensive agreement helps ensure a successful partnership in Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed.

Yes, a business consultant is typically self-employed, operating independently to provide expert advice to clients. This self-employment status allows consultants to manage their own schedules and choose the clients they want to work with. Consider utilizing a Nevada Business Management Consulting or Consultant Services Agreement - Self-Employed to formalize your work arrangement.