This notice is not from a debt collector but from the party to whom the debt is owed.

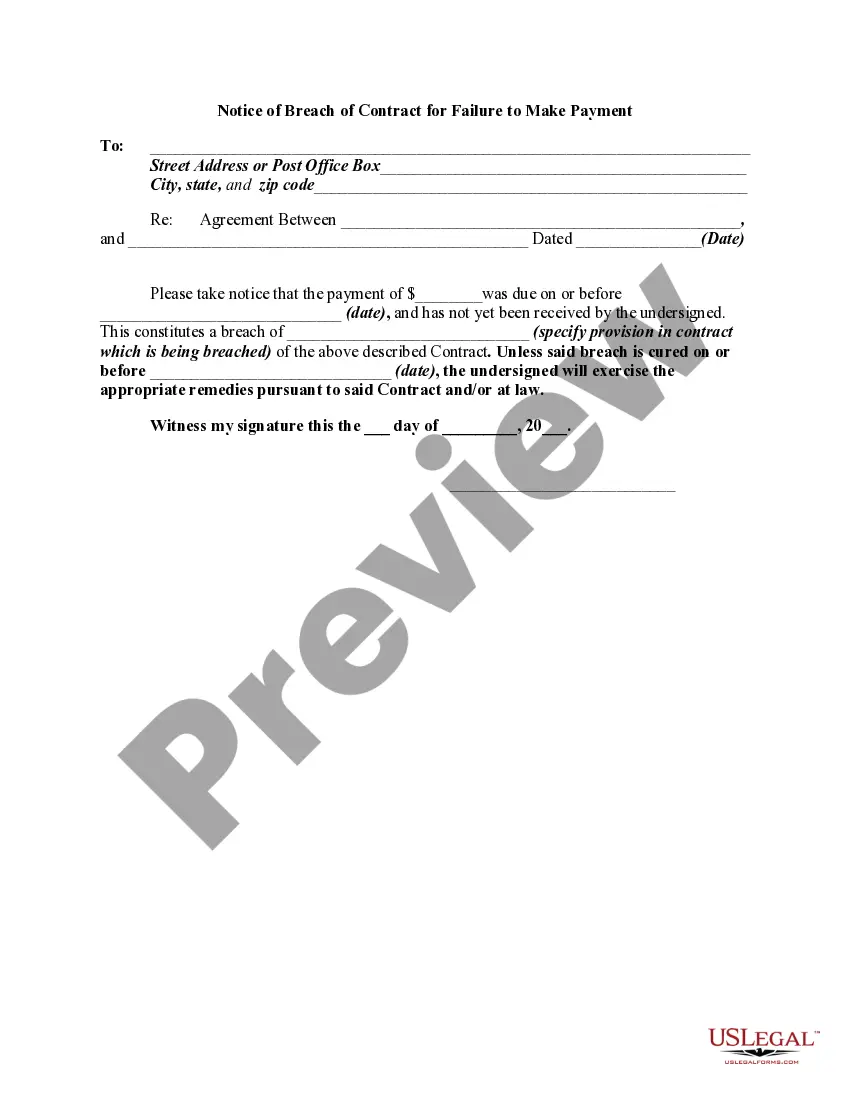

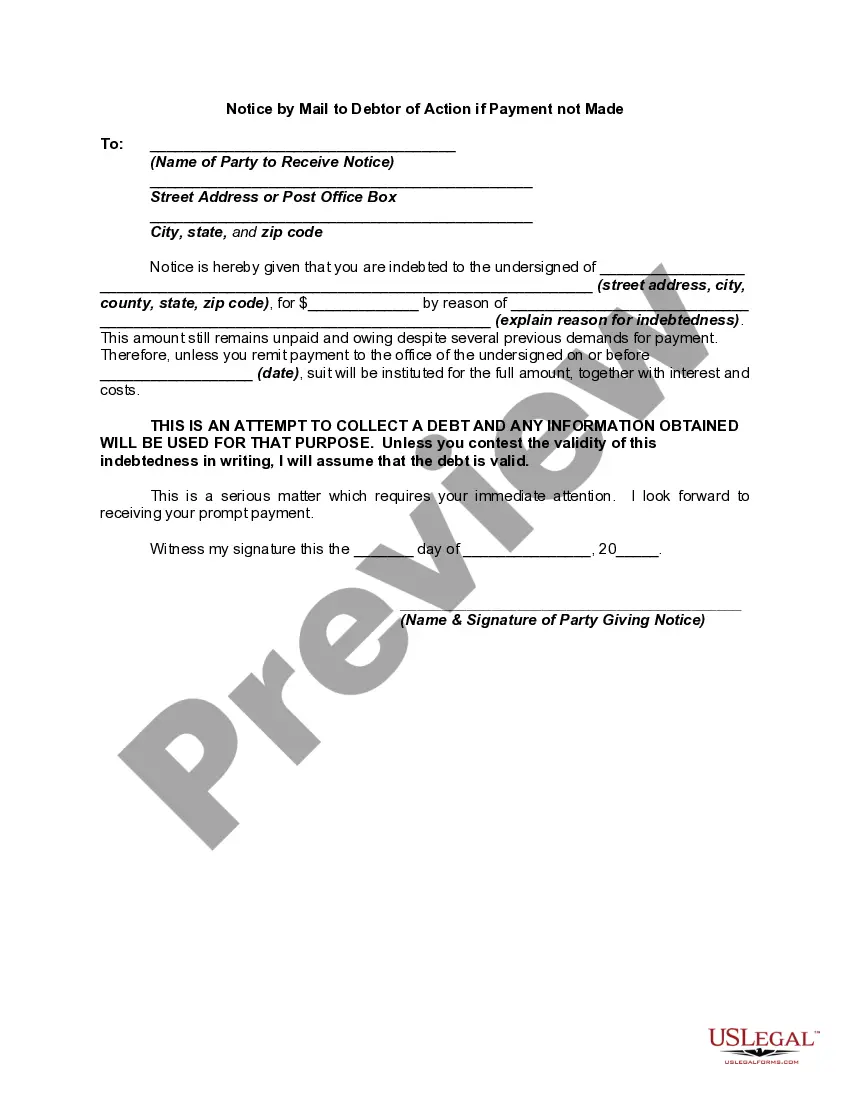

Nevada Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

Choosing the right lawful record template can be quite a battle. Naturally, there are a lot of templates available online, but how would you get the lawful type you will need? Use the US Legal Forms internet site. The support provides 1000s of templates, including the Nevada Notice by Mail to Debtor of Action if Payment not Made, which can be used for business and private demands. Every one of the kinds are checked by specialists and fulfill state and federal demands.

When you are currently authorized, log in to the profile and then click the Acquire button to get the Nevada Notice by Mail to Debtor of Action if Payment not Made. Use your profile to search through the lawful kinds you may have acquired previously. Proceed to the My Forms tab of your respective profile and get another version in the record you will need.

When you are a whole new user of US Legal Forms, listed here are easy directions that you should adhere to:

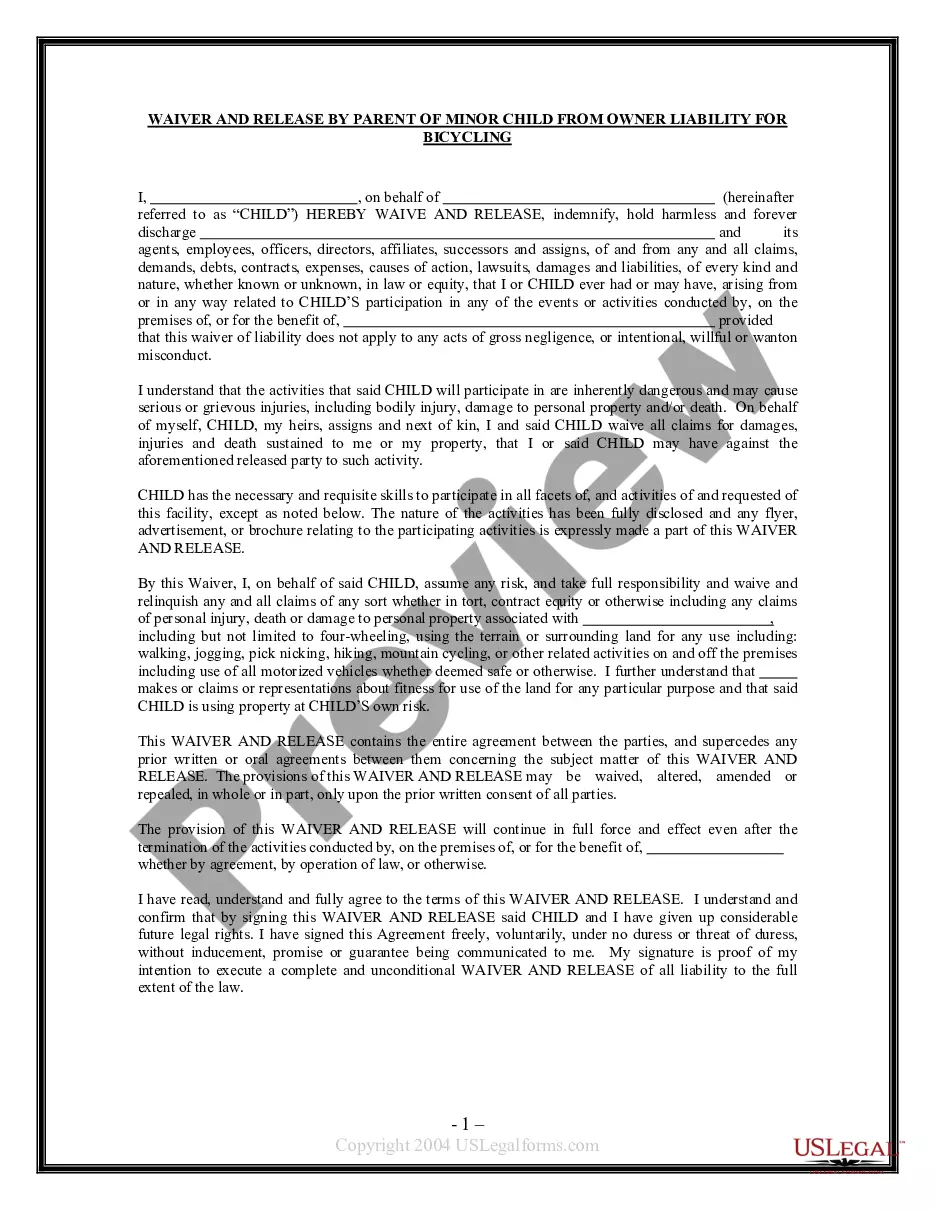

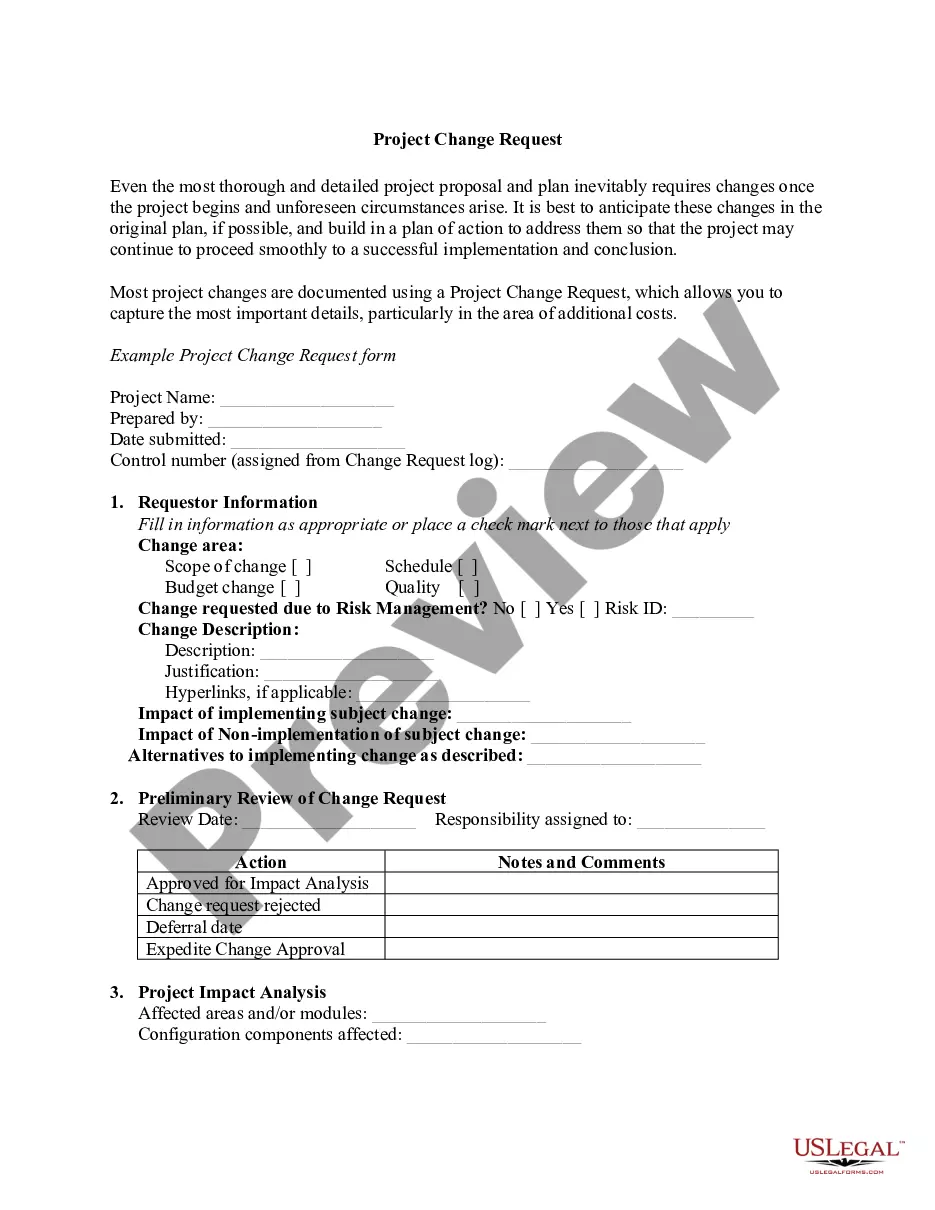

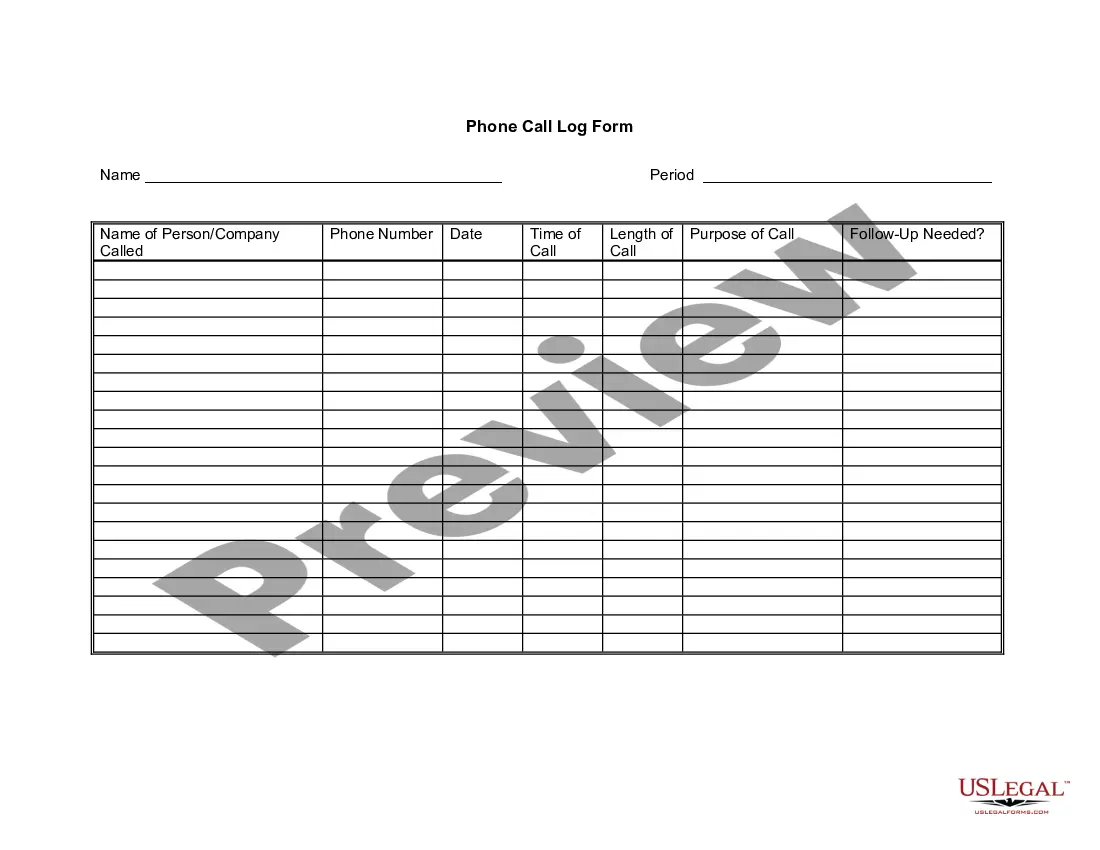

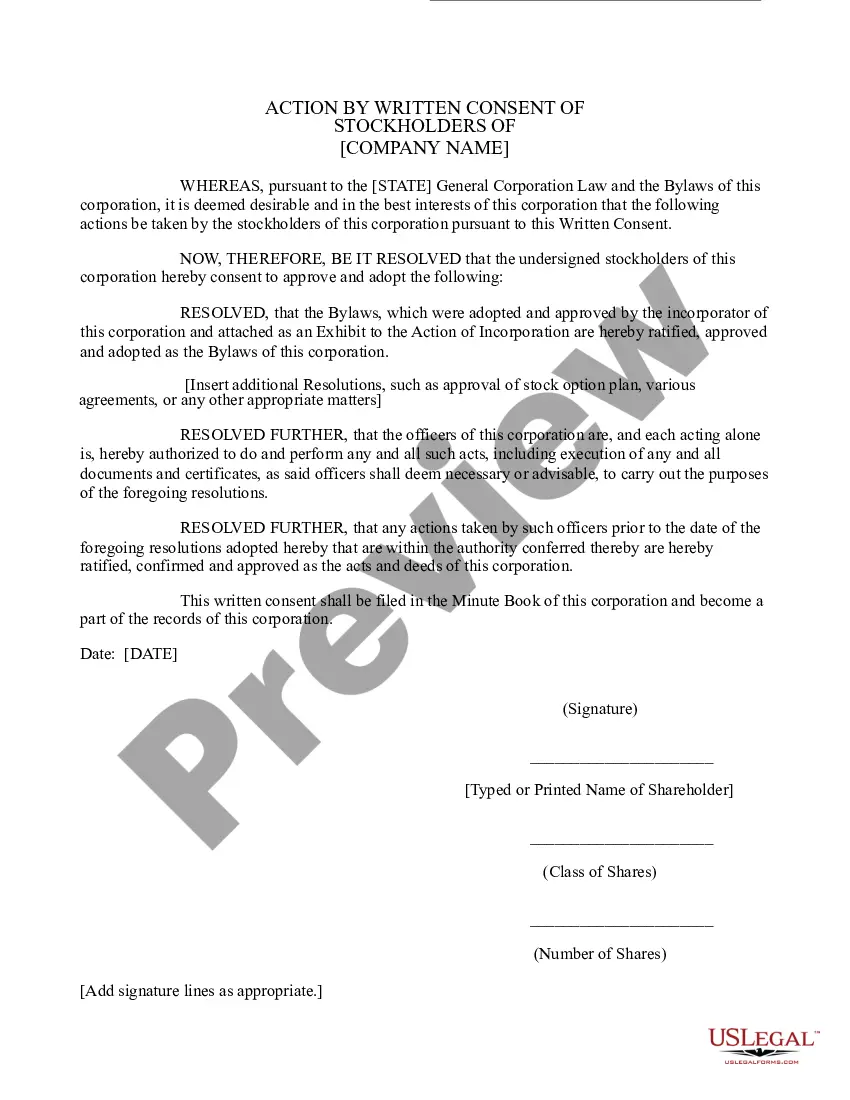

- First, make certain you have chosen the correct type for the area/state. You are able to examine the shape while using Preview button and study the shape outline to ensure this is the right one for you.

- In case the type will not fulfill your needs, use the Seach field to obtain the proper type.

- Once you are certain that the shape is suitable, select the Buy now button to get the type.

- Opt for the pricing prepare you desire and enter in the needed details. Create your profile and buy your order utilizing your PayPal profile or credit card.

- Opt for the document formatting and obtain the lawful record template to the system.

- Total, revise and produce and signal the received Nevada Notice by Mail to Debtor of Action if Payment not Made.

US Legal Forms is the greatest collection of lawful kinds that you can find various record templates. Use the company to obtain skillfully-created papers that adhere to express demands.

Form popularity

FAQ

A judgment remains in effect in Nevada for six years, and can be renewed forever. Executing a judgment allows a creditor to garnish your wages or attach your bank account or other property. How much can a creditor garnish? Only disposable earnings can be garnished.

Creditors of the estate must file their claims, due or to become due, with the clerk, within 60 days after the mailing to the creditors for those required to be mailed, or 60 days after the first publication of the notice to creditors pursuant to NRS 155.020, and within 15 days thereafter the personal representative ...

If you already have a judgment, then Nevada law provides legal remedies to obtain assets from a debtor who is unwilling to voluntarily pay. These remedies include bank and wage garnishments. You can also obtain a court order for the judgment debtor to appear for an examination under oath to list assets.

How does a creditor go about getting a judgment lien in Nevada? To attach the lien, the creditor files the judgment with the county recorder in any Nevada county where the debtor has property now or may have property in the future.

A judgment creditor can execute upon a judgment debtor's wages, real property, bank account, or cash box. There are a series of forms that the judgment creditor must prepare, file with the court clerk, and give to the constable or sheriff in order to execute a judgment.

The Statute of limitations for debts based on verbal agreements in Nevada is four years, compared to six years for written contracts. The statute of limitations on open-ended accounts and accounts with revolving balances, such as credit cards, is four years.

Under Nevada Revised Statute (NRS), a judgment creditor can seize goods, chattels, money, and other personal and real property. This means that a judgment may allow a creditor to garnish personal property, levy bank accounts, put liens on real property, and even initiate wage garnishment.

The Fair Debt Collections Practices Act regulates debt collection agencies, seeking to stop abusive collection practices and promote fair collection practices. Consumers are granted rights, including a legal way to dispute and validate debts.