Nevada Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you presently in a situation where you require documents for both professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable versions is challenging.

US Legal Forms offers a vast selection of form templates, including the Nevada Consumer Loan Application - Personal Loan Agreement, which can be downloaded to meet federal and state standards.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and minimize mistakes.

The service provides professionally created legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can access the Nevada Consumer Loan Application - Personal Loan Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

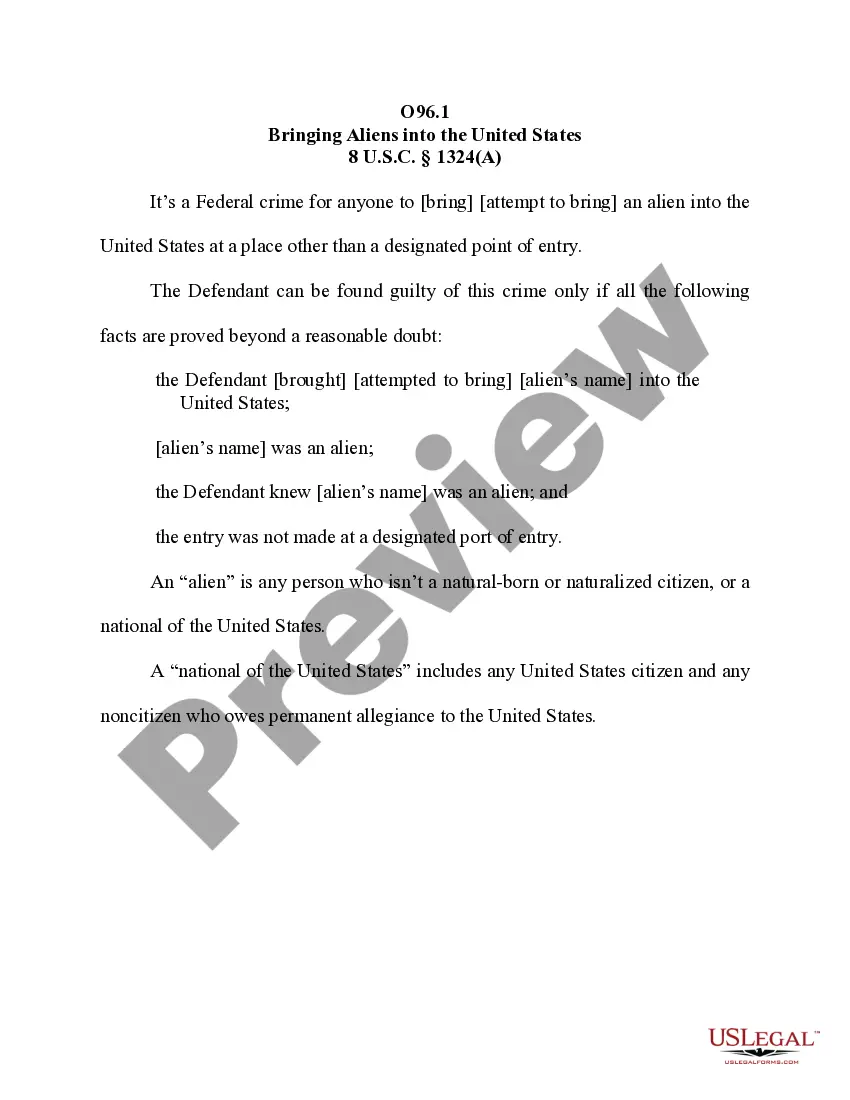

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search feature to locate the form that fits your needs.

- Once you find the appropriate form, click Purchase now.

- Select the payment plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nevada Consumer Loan Application - Personal Loan Agreement at any time, if needed. Just select the required form to download or print the document template.

Form popularity

FAQ

Tribal and out-of-state licensed payday lenders operate under the interpretation that they can export their tribe or state laws into Nevada and are required to adhere to federal lending laws but not Nevada regulations. Federal laws may be less restrictive and less frequently enforced.

Personal loans usually come in the form of unsecured installment loans, meaning lenders will look at a few of an applicant's financial details when they go through the approval process. But, even if you have bad credit, it is still possible to get approved for a great deal on a personal loan in Nevada.

How Nevada Payday Loans Work. Nevada payday loans act like a cash advance to get you money from your next paycheck sooner rather than later. The Nevada payday loan application is easy and simple to fill out. Fill out the simple application, get approved, and if you're approved, get your money.

The provisions of NRS 675.060 shall apply to any person who seeks to evade its application by any device, subterfuge or pretense whatever, including, but not thereby limiting the generality of the foregoing: 1.

You can borrow as much as a lender will let you. This includes getting multiple personal loans. When applying for more debt, though, it's important to consider your own finances and goals. Try to avoid getting too many loans, and make sure that you're comfortable with the monthly payments before taking on anything new.

There are no restrictions to the amount of loan (other than 25% of gross monthly income), the number of outstanding loans, and there are no actual limits for fees and interest rates as well. This makes Nevada a place to be a payday lender and also a bad place to be a borrower.

The maximum loan amount will be determined on an individual basis based on your income and other factors. Loan balances, including fees, cannot exceed 25% of your gross monthly income.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.