The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

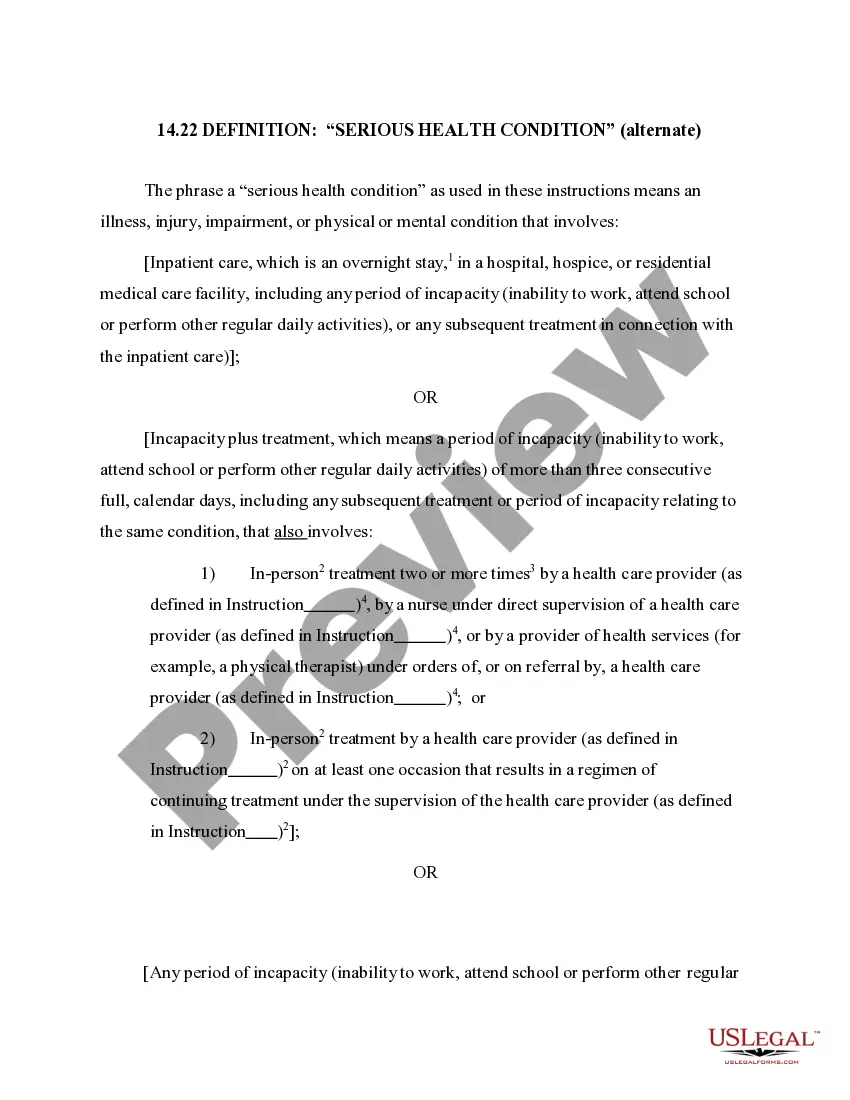

Description

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account in a matter of seconds.

Click the Preview button to review the content of the form.

Examine the form details to ensure you have selected the correct one.

- If you already have a subscription plan, Log In to download the Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account from the US Legal Forms collection.

- The Obtain button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your area/region.

Form popularity

FAQ

Certain assets may not be suitable for inclusion in a Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Typically, personal assets that you may want to retain control over, like your primary residence or vehicles, should remain outside the trust. Moreover, assets that have significant tax implications if transferred—such as certain retirement accounts or IRAs—should be approached cautiously. Consulting with a legal expert can help determine the best strategy for your specific situation.

Yes, you can include your retirement account in a Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. This arrangement can provide various benefits, such as protecting the assets from creditors and ensuring controlled distribution to your beneficiaries. However, it’s important to consult with a legal expert to navigate the complexities involved in this process. The proper setup is crucial to maximize the advantages.

To fill out a beneficiary designation, begin by carefully reading the form's instructions. Clearly write the names of your beneficiaries, ensuring that you include any necessary details such as their relationship to you. If you opt for a Nevada Irrevocable Trust as your designated beneficiary, be sure to list its complete title and tax ID number. Finally, review your entries for accuracy before submitting the form.

An example of beneficiary designation can be naming your spouse as the primary beneficiary of your IRA, while naming your children as contingent beneficiaries. Alternatively, you might choose a Nevada Irrevocable Trust as a designated beneficiary to manage the distribution of funds on behalf of your heirs, particularly if they are minors or not financially savvy. This arrangement helps safeguard your assets and provide for your loved ones effectively.

Filling out a beneficiary designation form is straightforward. Start by gathering necessary details about your beneficiaries, including full names and contact information. If you wish to name a Nevada Irrevocable Trust as the designated beneficiary, include its legal name, along with the trust's tax identification number. Follow the instructions on the form carefully to ensure all sections are completed accurately.

Yes, naming a trust, such as a Nevada Irrevocable Trust, as the designated beneficiary for your retirement accounts can be a wise decision. This option often provides enhanced control over the distribution of your assets, ensuring they align with your long-term goals. It can also offer certain tax benefits and protect the inherited assets from creditors.

You should avoid naming minors or individuals who may not handle financial matters responsibly as beneficiaries. Naming a Nevada Irrevocable Trust as a designated beneficiary can provide a structured way to distribute assets, preventing potential issues with incompetent or unprepared beneficiaries. Additionally, steer clear of naming individuals in active bankruptcy, as it could complicate the inheritance.

The beneficiary of an individual retirement account (IRA) is the person or entity designated to receive the funds upon your passing. When you set up your IRA, you can appoint a Nevada Irrevocable Trust as the designated beneficiary. This allows you to ensure that your retirement assets are distributed according to your wishes while providing control over the management of those assets.

A trust can indeed be classified as an eligible designated beneficiary under certain conditions, allowing it to receive distributions from a retirement account. For the trust to qualify, it must meet specific IRS criteria. Employing a Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can provide your beneficiaries with structured financial support while navigating tax implications effectively.

Yes, an irrevocable trust can act as the designated beneficiary of an IRA. This arrangement allows the trust to receive the retirement funds directly, which can help with estate planning and asset protection. When establishing a Nevada Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you ensure a smoother transfer of wealth to your beneficiaries, adhering to tax regulations.