Nevada Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

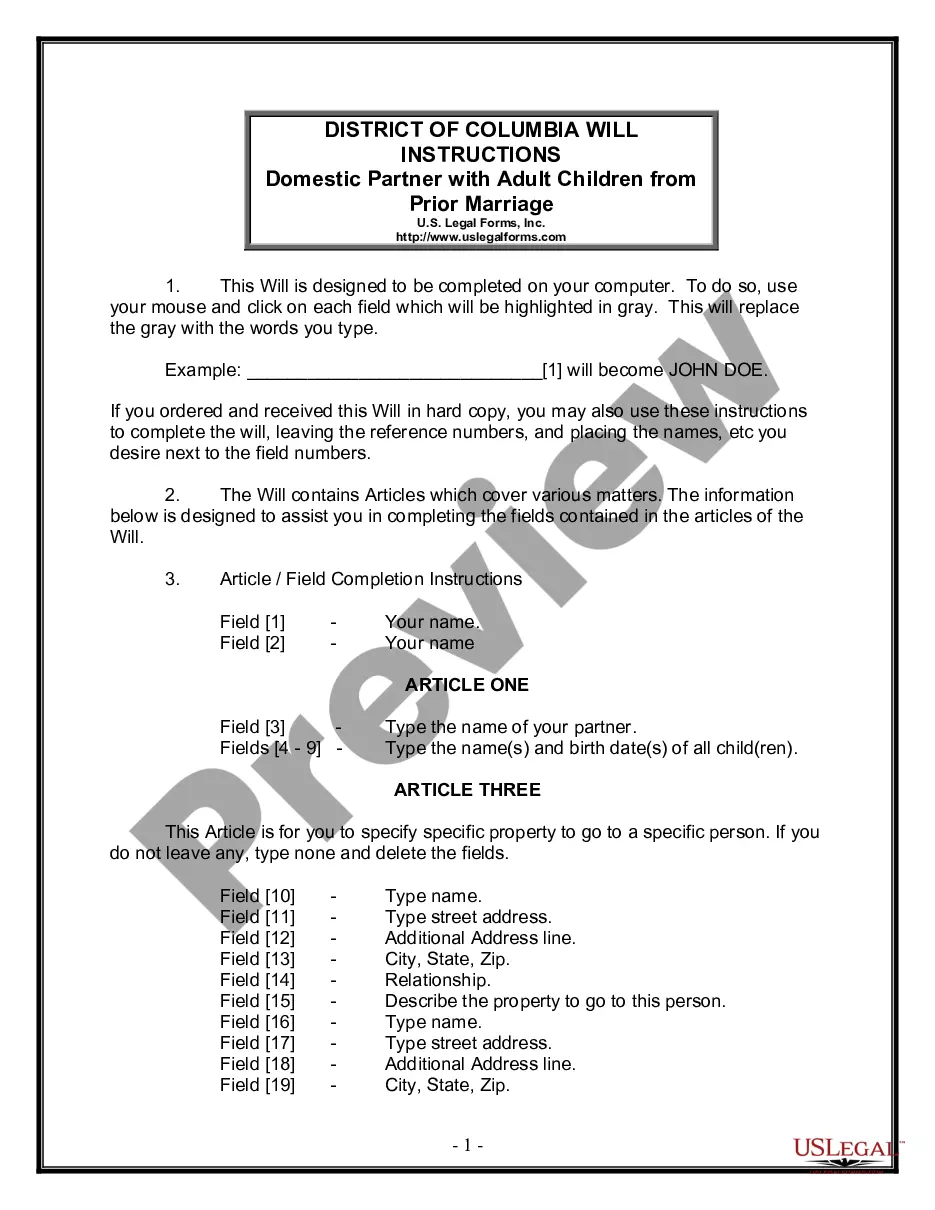

Are you in a circumstance where you need documentation for either professional or personal purposes nearly every day? There are numerous valid document templates available online, but finding versions you can trust isn’t easy. US Legal Forms provides a vast array of form templates, such as the Nevada Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate, which can be printed to meet state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Nevada Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/state. Utilize the Review button to evaluate the document. Read the description to confirm you have selected the appropriate form. If the form isn’t what you are looking for, use the Lookup section to find the form that suits your needs and requirements. When you locate the right form, click Purchase now. Choose the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Find all of the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Nevada Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate at any time if needed. Just click on the needed form to download or print the document template.

The service offers expertly crafted legal document templates that can be utilized for various purposes.

Create an account on US Legal Forms and start simplifying your life.

- Utilize US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid mistakes.

- The service offers expertly crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and begin simplifying your life.

- Ensure you have the right document for your situation.

- Review the chosen form thoroughly before proceeding.

- Make sure to use the search function if the initial form does not meet your requirements.

- Download or print the form as needed.

Form popularity

FAQ

Any person over the age of 18 can be named an executor of a will, provided that the person has not been convicted of a felony. Often, a family member or close friend is chosen to serve.

Finally, an executor has the power to distribute what remains of the estate to the beneficiaries. However, the executor cannot independently decide how the estate is distributed. They must follow the instructions in the will or the succession laws of the relevant jurisdiction.

The executor is an individual who is responsible for distributing the assets and liabilities of the estate to the beneficiaries. Unless they are appointed as a trustee or guardian, the executor must be a resident of Nevada. They must also be 18 years old or older and can serve as executors.

As an executor, you cannot: Do anything to carry out the will before the testator passes away. ... Sign an unsigned will on behalf of the deceased. ... Take action to manage the estate prior to being appointed as executor. ... Sell assets for less than fair market value without agreement of the beneficiaries.

First steps for an executor Find the will, secure it, and file it with probate court. Petition to open probate, validate the will, and obtain letters testamentary. Start gathering and securing all your loved one's assets. Figure out if you will need full probate and/or a lawyer.

General Fee Schedule for the Payment of Executors in Nevada For the first $15,000 of the estate value, the executor should receive payment at the rate of 4 percent. For the next $85,000 of the estate value, the executor should receive payment at the rate of 3 percent.

If the estate must go through probate, the probate court will legally confirm your appointment as executor with what are called letters testamentary (sometimes called surrogate certificates).

A petition must be filed with the court within eight months of the death, naming an executor and claiming that no other petitions for the appointment of a personal representative are currently pending in any jurisdiction. An NV law office can help answer questions regarding the decedent assets.